Georgia Checklist for Business Loans Secured by Real Estate

Description

How to fill out Checklist For Business Loans Secured By Real Estate?

Finding the right lawful document format might be a battle. Of course, there are a variety of templates available online, but how do you find the lawful form you require? Make use of the US Legal Forms web site. The support provides a large number of templates, like the Georgia Checklist for Business Loans Secured by Real Estate, that you can use for enterprise and private requirements. All the varieties are inspected by pros and fulfill state and federal specifications.

Should you be currently authorized, log in in your accounts and then click the Acquire key to find the Georgia Checklist for Business Loans Secured by Real Estate. Use your accounts to check with the lawful varieties you possess bought in the past. Proceed to the My Forms tab of your own accounts and get an additional duplicate of the document you require.

Should you be a new end user of US Legal Forms, here are basic guidelines that you should adhere to:

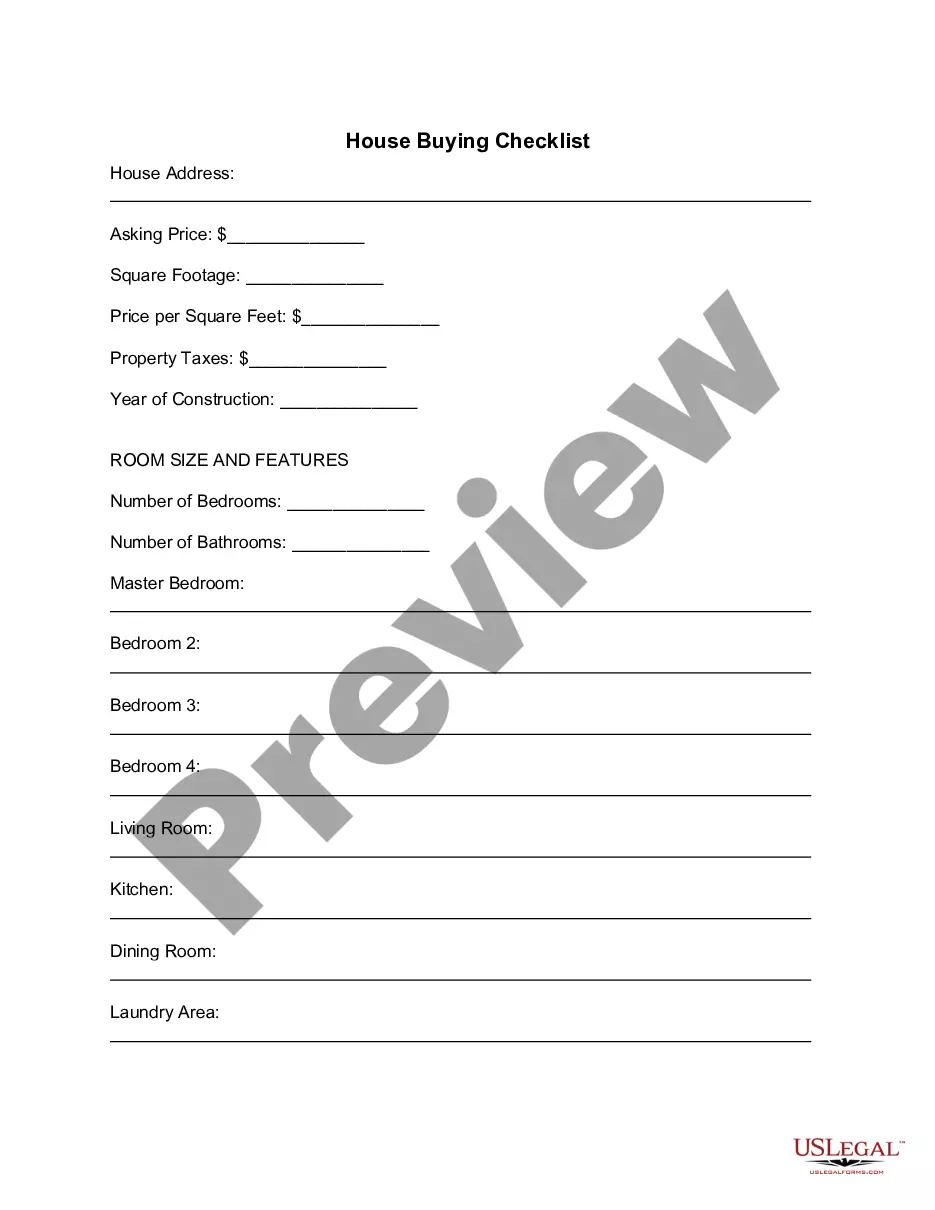

- First, be sure you have chosen the proper form for your area/area. You can examine the shape while using Preview key and study the shape outline to ensure this is the best for you.

- If the form fails to fulfill your expectations, make use of the Seach area to discover the correct form.

- Once you are positive that the shape would work, select the Get now key to find the form.

- Pick the rates program you desire and type in the essential details. Make your accounts and pay for the order making use of your PayPal accounts or credit card.

- Select the data file file format and acquire the lawful document format in your gadget.

- Total, modify and printing and indicator the attained Georgia Checklist for Business Loans Secured by Real Estate.

US Legal Forms is the largest library of lawful varieties in which you can see various document templates. Make use of the company to acquire skillfully-made documents that adhere to condition specifications.

Form popularity

FAQ

Also known as seller financing, a purchase-money mortgage is a loan the property seller provides to the home buyer. This type of mortgage is common in situations when the buyer doesn't qualify for standard bank financing, much like other nonconforming loans.

A purchase-money mortgage is a mortgage issued to the borrower by the seller of a home as part of the purchase transaction. Also known as a seller or owner financing, this is usually done in situations where the buyer cannot qualify for a mortgage through traditional lending channels.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Purchase money mortgages usually have priority over subsequently recorded liens on the property. Purchase money mortgages also have a super priority status above prior and subsequent judgment liens and certain other types of liens.

The security is held by a neutral third party known as the trustee. With a deed of trust, the mortgagor (borrower) is called the trustor and the mortgagee (lender) is called the beneficiary. The correct answer is: The trustee. What is the disadvantage to a lender if the lender accepts a "deed in lieu of foreclosure?"

Cons Usually charges a higher interest rate compared to a traditional mortgage. Typically required a balloon payment at the end of the loan term. Sellers may not agree to this arrangement if the buyer has poor credit. A due-on-sale clause may prevent the seller from entering this type of arrangement.

As a type of specialty home financing, a land contract is similar to a mortgage. However, rather than borrowing money from a lender or bank to buy real estate, the buyer makes payments to the real estate owner, or seller, until the purchase price is paid in full.

A business purpose loan is used to purchase an investment property or a cash out refinance where the funds are used for any business purpose. The property collateralized can be non-owner occupied if the funds are used for business.