Georgia Invoice Template for Secretary

Description

How to fill out Invoice Template For Secretary?

It is feasible to dedicate numerous hours online trying to locate the legal document template that aligns with the federal and state requirements you necessitate.

US Legal Forms provides thousands of legal documents that can be examined by professionals.

You can actually download or print the Georgia Invoice Template for Secretary from my service.

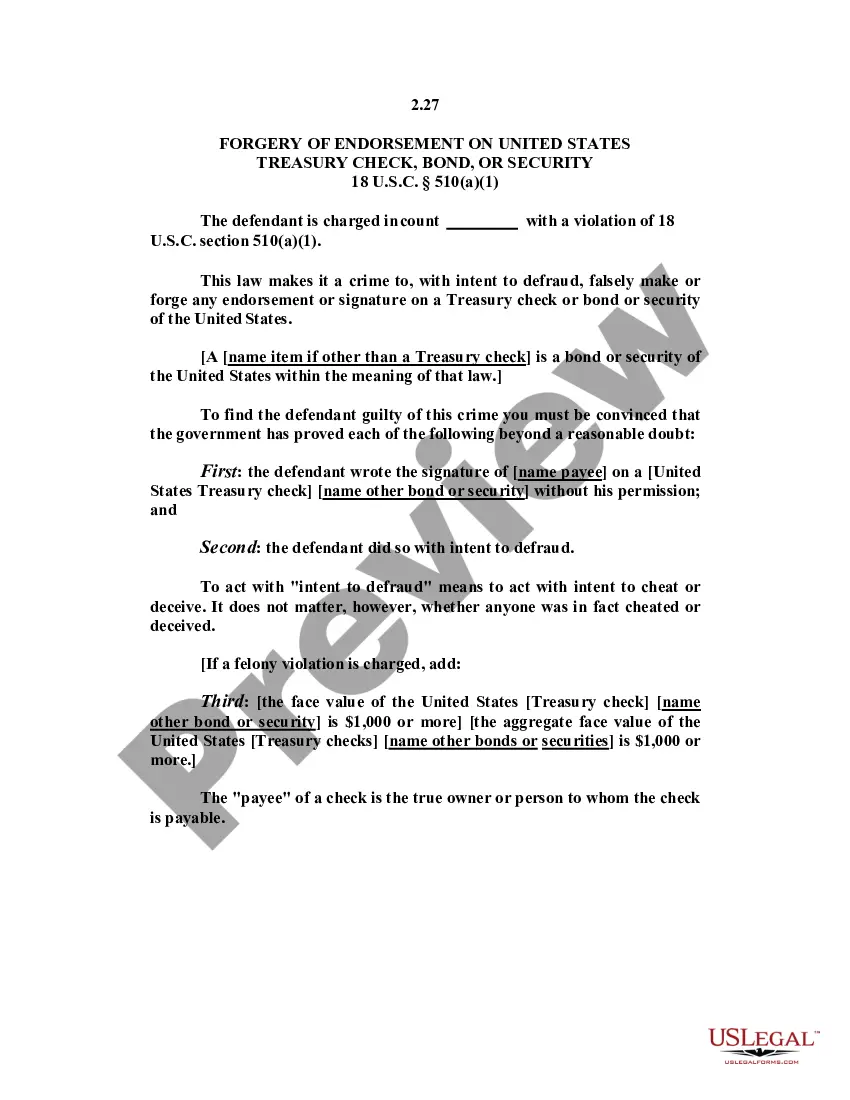

If available, utilize the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- Afterwards, you can complete, alter, print, or sign the Georgia Invoice Template for Secretary.

- Every legal document template you purchase is yours forever.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choosing.

- Read the form description to confirm you have chosen the correct document.

Form popularity

FAQ

To file your LLC in Georgia, you need to complete the Articles of Organization and submit them to the Secretary of State. You can do this online or by mail. A Georgia Invoice Template for Secretary is an efficient tool to help you document all necessary expenses and processes as you establish your business.

Typically, LLC owners do not file their LLC taxes together with personal taxes since LLCs are pass-through entities. Instead, any business income is reported on the owner's personal tax return. A Georgia Invoice Template for Secretary can assist you in keeping both sets of records organized, making it easier when tax season rolls around.

To change officers on the Secretary of State in Georgia, you will need to fill out the appropriate form and submit it online or by mail. Ensure that the information is accurate and reflects the current officers of your LLC. Using a Georgia Invoice Template for Secretary helps you record changes and maintain accurate business records for this process.

In Georgia, LLCs are generally classified as pass-through entities by default, meaning income is taxed at the individual member level. However, an LLC can also opt to be taxed as a corporation if that benefits its members. Utilizing a Georgia Invoice Template for Secretary can help streamline your income tracking and tax calculations for easier reporting.

To file LLC taxes in Georgia, start by determining the tax classification of your LLC. Depending on whether it is treated as a sole proprietorship, partnership, or corporation, the filing process may differ. Use the Georgia Invoice Template for Secretary to organize your financial documents and ensure you have all necessary information when submitting your taxes.

An annual report is indeed required for LLCs in Georgia. This report allows the state to keep updated records of your business information. To streamline this process, a Georgia Invoice Template for Secretary can be a valuable resource for ensuring timely and accurate filings.

Yes, filing an annual report for your LLC in Georgia is mandatory. This requirement helps maintain your business in good standing with the state. To ease the burden of compliance, consider utilizing a Georgia Invoice Template for Secretary when preparing your report.

Filing Articles of Organization is essential for forming an LLC in Georgia. This document officially establishes your LLC and should be submitted to the Secretary of State. Ensure you use a Georgia Invoice Template for Secretary to facilitate your filing and ensure accuracy.

Yes, Limited Liability Partnerships (LLPs) must register with the Secretary of State in Georgia. This registration is necessary to attain legal recognition and protect your personal assets. Leverage tools like the Georgia Invoice Template for Secretary to assist with the registration process.

Not filing annual registration in Georgia can lead to significant issues for your business. You could incur fines, and your business standing may be jeopardized. Utilizing a Georgia Invoice Template for Secretary can help simplify the filing process and keep your registration on track.