Georgia Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

You can spend hours online searching for the legal document format that fulfills the state and federal standards you require.

US Legal Forms offers a vast collection of legal documents that are assessed by experts.

You can easily obtain or print the Georgia Agreement to Settle Debt by Returning Secured Property with my help.

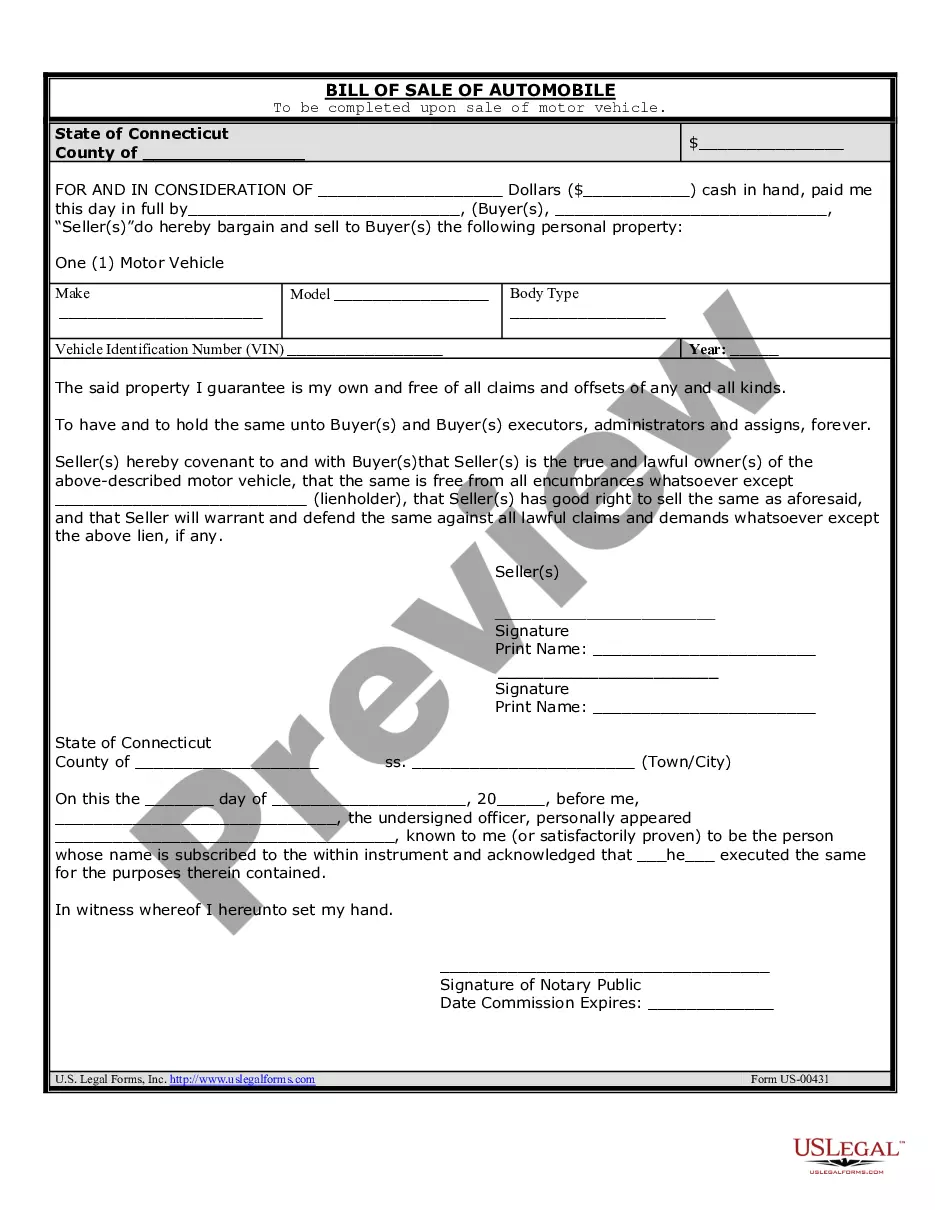

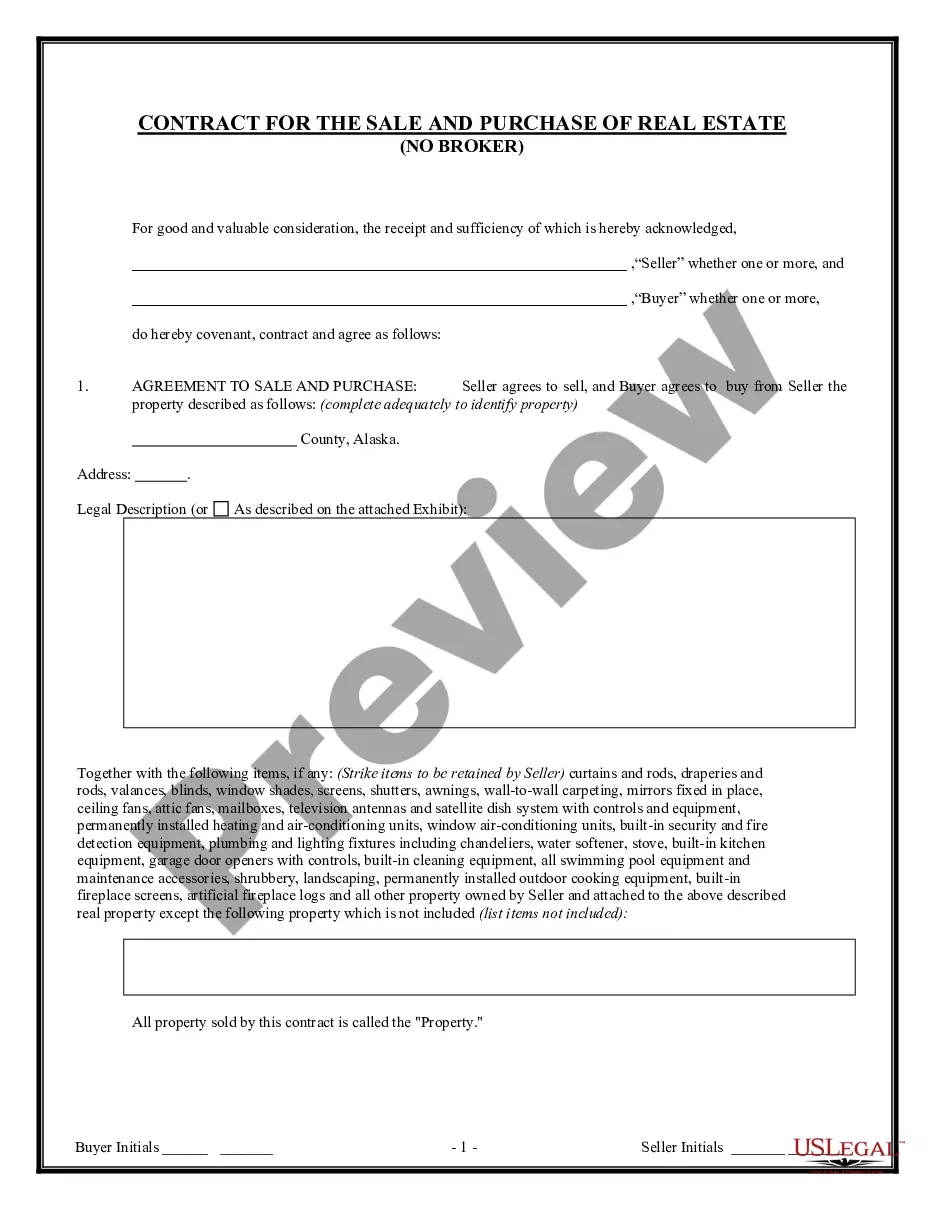

If available, use the Preview button to review the document format simultaneously.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can complete, modify, print, or sign the Georgia Agreement to Settle Debt by Returning Secured Property.

- Each legal document format you purchase is yours indefinitely.

- To acquire an additional copy of any purchased document, navigate to the My documents section and click on the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the state/city of your preference.

- Check the form description to confirm you have selected the appropriate document.

Form popularity

FAQ

The type of deed used when property serves as security for a debt in Georgia is specifically a deed to secure debt. This legal document is crucial as it protects the lender's interest in the property should the borrower fail to meet their repayment obligations. This knowledge is particularly important when considering a Georgia Agreement to Compromise Debt by Returning Secured Property.

In Georgia, a deed to secure debt is commonly used to reflect borrowing situations. This deed acts similarly to a mortgage, allowing property to act as security for the obligation. If you are looking into a Georgia Agreement to Compromise Debt by Returning Secured Property, knowing the right deed type will aid in navigating this process effectively.

Code 44 14 64 in Georgia refers to the statutory provisions regulating deeds to secure debt. It outlines the legal framework and stipulations for such transactions, ensuring clarity and protection for both lenders and borrowers. Familiarizing yourself with this code is essential if you are considering a Georgia Agreement to Compromise Debt by Returning Secured Property.

To win a Georgia Agreement to Compromise Debt by Returning Secured Property, start by making a thorough case for your financial situation. Gather all necessary documentation to prove your hardship, and present a realistic offer to your creditor. Using platforms like USLegalForms can simplify the process by providing resources and templates that ensure you are prepared and organized.

Once your Georgia Agreement to Compromise Debt by Returning Secured Property is accepted, you will need to fulfill the terms of the compromise. This often requires returning the secured property or making payment arrangements as specified in the agreement. Following the agreement is crucial, as non-compliance may lead to the reinstatement of your debt.

A cancellation of a deed to secure debt is a legal process that removes the lender's claim to the property once the debt is settled. This cancellation allows you to regain full ownership of your property without the burden of outstanding debt. If you consider a Georgia Agreement to Compromise Debt by Returning Secured Property, this process should be clearly outlined to ensure a smooth transition and complete resolution.

A debt trust deed serves as a means to secure loans without needing to go through traditional mortgage routes. This type of deed allows the borrower to put up property as collateral for securing debt and may apply when negotiating a Georgia Agreement to Compromise Debt by Returning Secured Property. Understanding debt trust deeds can empower you to make informed financial decisions.

When considering whether it's better to be on the deed or title, it’s important to understand how each term operates. Being on the deed typically means you hold a legal interest in the property, which is crucial when involved in a Georgia Agreement to Compromise Debt by Returning Secured Property. Meanwhile, the title represents ownership, and being on the title gives you rights associated with property ownership. Each situation is unique, so assessing your needs is key.

A released tax execution occurs when the state formally acknowledges that a tax lien has been satisfied or resolved. This release is crucial as it clears your property title from the outstanding tax debt. If you've successfully navigated a compromise, utilizing the Georgia Agreement to Compromise Debt by Returning Secured Property can help you attain a released tax execution efficiently.

An offer of compromise in Georgia is a formal request to settle your tax liabilities for less than the full amount owed. It serves as a valuable alternative for individuals facing overwhelming tax debt. Utilizing the Georgia Agreement to Compromise Debt by Returning Secured Property can greatly assist in crafting an effective compromise proposal that meets your financial realities.