This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Gift of Entire Interest in Literary Property

Description

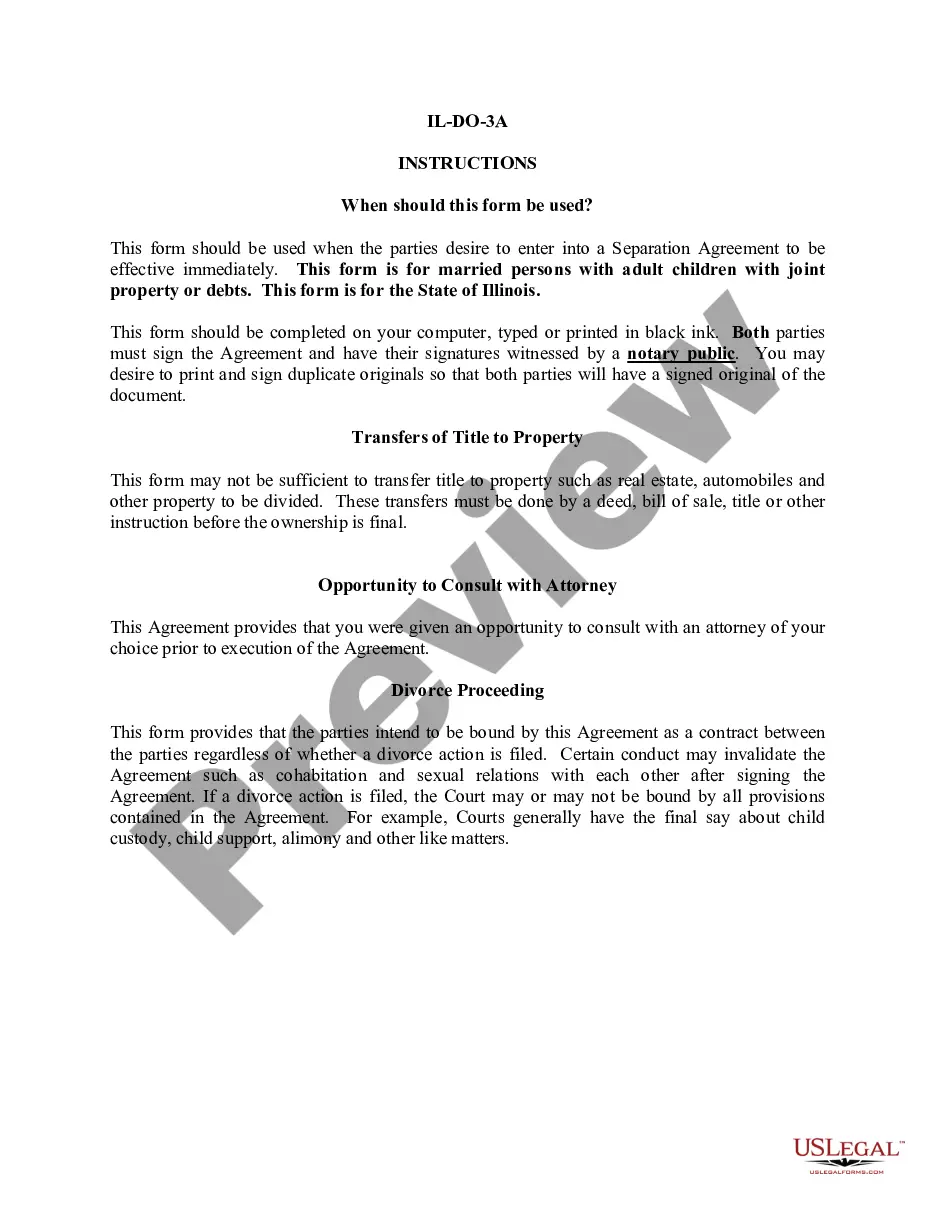

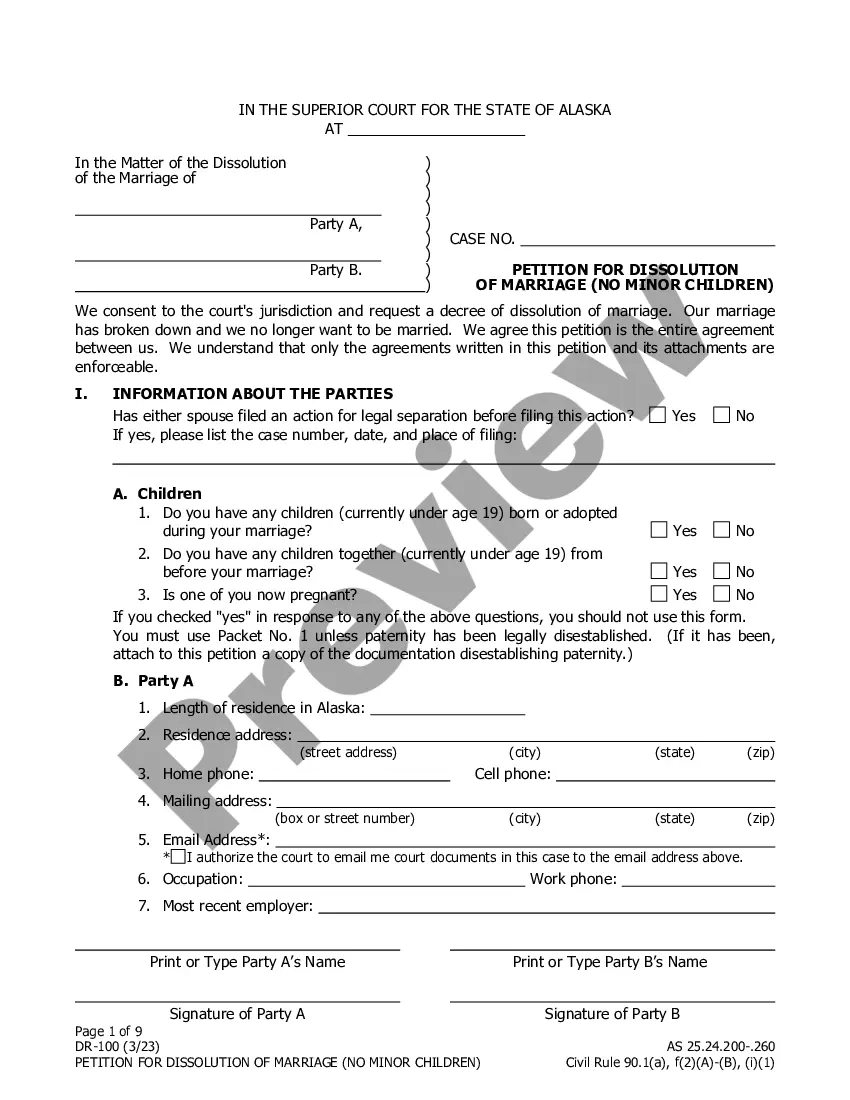

How to fill out Gift Of Entire Interest In Literary Property?

If you need to fill out, obtain, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s simple and efficient search to locate the documents you require.

Various templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the Georgia Gift of Entire Interest in Literary Property with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to obtain the Georgia Gift of Entire Interest in Literary Property.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct state/region.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you aren’t satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

To document a Georgia Gift of Entire Interest in Literary Property for the IRS, create a clear, written record that includes the date, description, and value of the gift. It’s also wise to include any correspondence between you and the donor. Utilizing platforms like uslegalforms can simplify the documentation process, ensuring you meet all IRS requirements efficiently.

The third element necessary for a transfer to be considered a gift, especially regarding a Georgia Gift of Entire Interest in Literary Property, is intent. The donor must have the intention to make a present transfer without expecting anything in return. This intention distinguishes a gift from a sale, reinforcing the nature of the transfer as a gift.

The annual exclusion for present interest gifts, including a Georgia Gift of Entire Interest in Literary Property, allows a donor to give a certain amount without incurring gift tax. As of 2023, this exclusion amount is $17,000 per recipient. This means that if your gift remains within this limit, you can transfer property without triggering tax implications for the donor.

Declaring a Georgia Gift of Entire Interest in Literary Property on taxes primarily falls on the donor, who must report gifts that exceed the annual exclusion amount. As the recipient, you generally do not need to declare the gift on your tax return. However, understanding the donor's obligations can help you both navigate any potential tax responsibilities associated with the gift.

To document a Georgia Gift of Entire Interest in Literary Property for tax purposes, you should gather all related documents, such as a written agreement or a deed of gift. It's essential to provide detailed descriptions of the property and its value at the time of the transfer. Keeping these records organized will help both the donor and recipient stay compliant with tax regulations.

When you receive a Georgia Gift of Entire Interest in Literary Property, you typically do not have to report it to the IRS. However, if the value exceeds the annual exclusion limit, the donor must file a gift tax return. This means you should stay informed about the donor's actions, as their actions may have tax implications for both parties.

Yes, you can gift a house in Georgia by using a deed of gift. This legal process outlines the transfer of property ownership as a gift. When naming such a gift as a Georgia Gift of Entire Interest in Literary Property, it is essential to follow proper legal protocols to ensure the transfer is valid and recognized by law.

The purpose of a deed of gift is to formalize the transfer of ownership of property from one party to another without payment. It serves to protect the rights of both the giver and receiver. In the context of a Georgia Gift of Entire Interest in Literary Property, it enables an author or creator to pass on their literary works securely and legally.

The legal term for a gift of real property is typically referred to as a 'donative transfer.' This involves conveying ownership without monetary compensation. In cases involving a Georgia Gift of Entire Interest in Literary Property, understanding this term is vital, as it clarifies the nature of the transfer and its implications for both parties.

A deed of gift in Georgia is a specific legal document used to transfer ownership of property as a gift. This deed must be signed by the giver and accepted by the receiver to be legally binding. When it pertains to a Georgia Gift of Entire Interest in Literary Property, it effectively assigns all rights related to literary works from one person to another.