Assignment is the act of transferring power or rights to another, such as contractual rights. Accounts may be characterized as accounts payable, which is money that is owed to be paid to another, or accounts receivable, which is money owed for products or services to a provider of the same. This generic form is assignment of a particular account receivable.

Georgia Assignment of Particular Account

Description

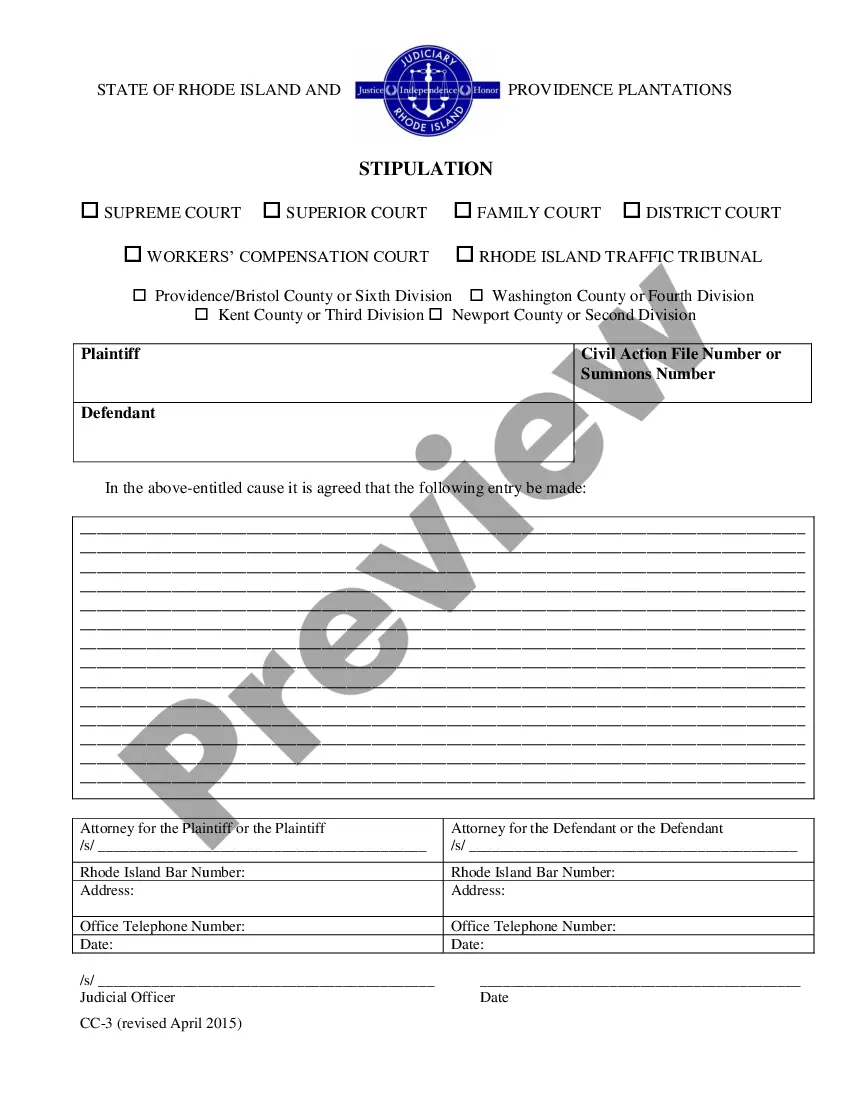

How to fill out Assignment Of Particular Account?

Discovering the right authorized file design might be a battle. Naturally, there are a lot of web templates accessible on the Internet, but how will you get the authorized type you require? Make use of the US Legal Forms website. The services delivers a huge number of web templates, like the Georgia Assignment of Particular Account, that can be used for business and private needs. All the types are checked out by professionals and satisfy federal and state demands.

When you are currently signed up, log in to the account and then click the Download option to obtain the Georgia Assignment of Particular Account. Make use of account to appear throughout the authorized types you may have bought earlier. Visit the My Forms tab of your respective account and get an additional copy of your file you require.

When you are a brand new customer of US Legal Forms, here are simple guidelines so that you can follow:

- Very first, be sure you have chosen the appropriate type for your town/state. You can look over the form while using Preview option and look at the form description to ensure it is the best for you.

- In case the type does not satisfy your expectations, use the Seach industry to obtain the right type.

- When you are certain that the form is proper, select the Buy now option to obtain the type.

- Choose the costs prepare you need and enter the required information and facts. Build your account and pay for the transaction making use of your PayPal account or Visa or Mastercard.

- Opt for the file formatting and download the authorized file design to the device.

- Comprehensive, revise and printing and sign the acquired Georgia Assignment of Particular Account.

US Legal Forms is definitely the largest collection of authorized types in which you can find a variety of file web templates. Make use of the service to download expertly-made papers that follow state demands.

Form popularity

FAQ

This form is a standard assignment agreement, which outlines the transfer of rights, title, interest, and obligation from one party (known as the "Assignor") to another party (known as the "Assignee").

An Assignment, or an assignment of contract, is a document that allows one party to transfer the rights and benefits of a contract to another party.

Assignment of Benefits (AOB) is an agreement that transfers the insurance claims rights or benefits of the policy to a third party. An AOB gives the third party authority to file a claim, make repair decisions, and collect insurance payments without the involvement of the homeowner.

The statute of limitations on open accounts (implied promises or undertakings) is 4 years. O.C.G.A. § 9-3-25. The statute of limitations for auto contracts 4 is years because they fall under the Georgia UCC.

Open Accounts; Breach of Certain Contracts; Implied Promise; Exception. All actions upon open account, or for the breach of any contract not under the hand of the party sought to be charged, or upon any implied promise or undertaking shall be brought within four years after the right of action accrues.

Under Georgia law, an ?assignment? is the ?absolute, unconditional, and completed transfer of all right, title and interest in the property that is the subject of the assignment.? O.C.G.A. § 44-12-24 ? Personal torts, such as trespass, are not assignable!

In order for an assignment and assumption agreement to be valid, the following criteria need to be met: The initial contract must provide for the possibility of assignment by one of the initial contracting parties. The assignor must agree to assign their rights and duties under the contract to the assignee.

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.