A limited partnership is a modified partnership. It has characteristics of both a corporation and a general partnership. In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership

Description

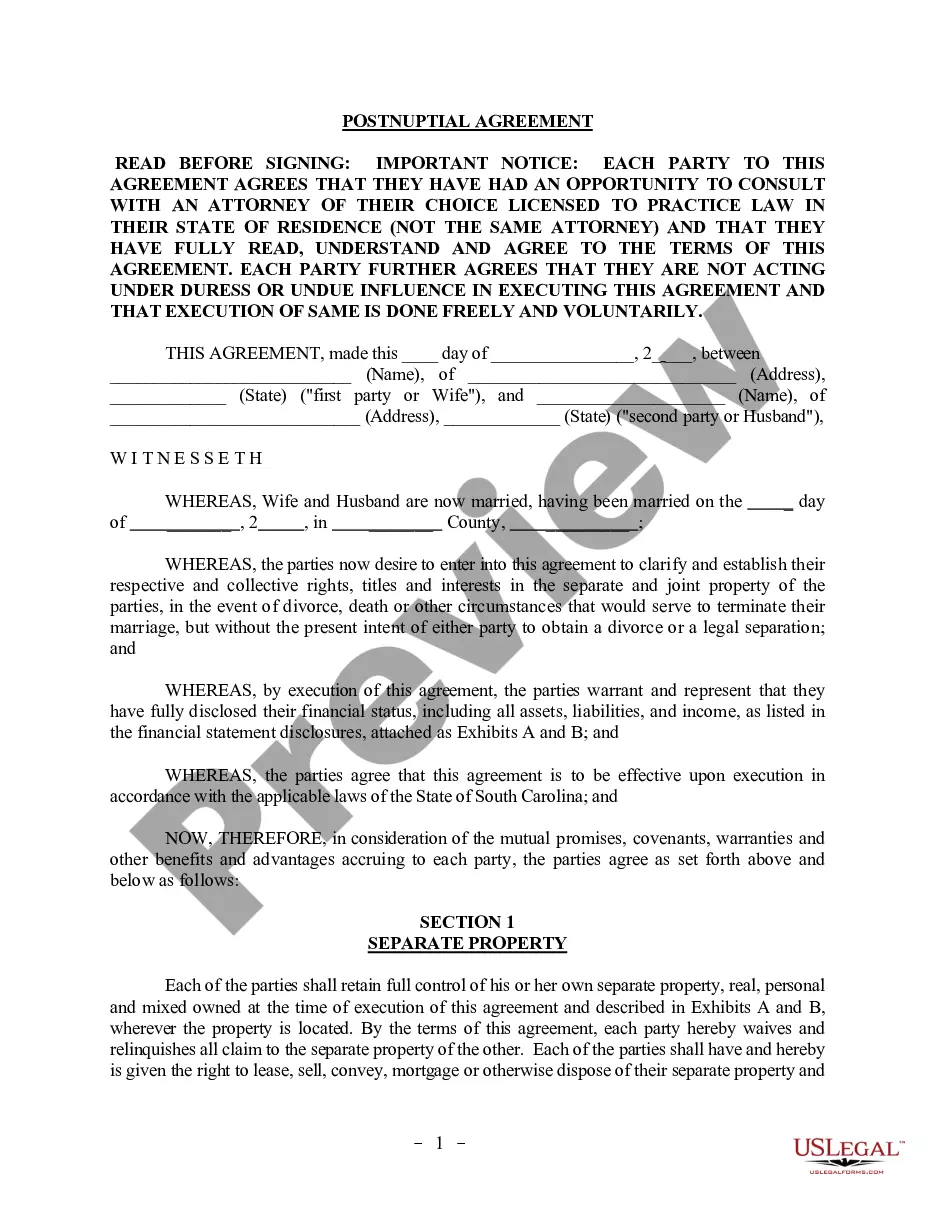

How to fill out Guaranty Of Payment By Limited Partners Of Notes Made By General Partner On Behalf Of Limited Partnership?

You can spend countless hours online trying to locate the sanctioned document template that fulfills the local and national requirements you need.

US Legal Forms offers a wide array of legal documents that are vetted by professionals.

You can conveniently access or print the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership through our services.

First, make sure that you have selected the correct document template for the region/city you choose. Review the form description to ensure you have chosen the right template. If available, use the Preview button to browse through the document format as well.

- If you possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

- Each legal document template you purchase is yours permanently.

- To get an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

In a general limited partnership, there are both general partners, who manage the business risk, and limited partners, who have limited liability. Conversely, a limited liability partnership protects all partners from personal liability while allowing them to actively manage the business. This knowledge is vital when navigating the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, ensuring you choose the right structure for your needs.

A general partnership features partners managing the business with shared liability, whereas a limited partnership includes general partners with unlimited liability and limited partners with restricted liability. Meanwhile, an LLP provides all partners with limited liability protection and shared management. Each structure has unique traits, and understanding these can enhance your approach to the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

The primary difference is that limited partnerships have both general and limited partners, while limited liability partnerships consist of partners who share management responsibilities with limited personal liability. This distinction is crucial when considering the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership. Leveraging the right partnership structure can optimize your business outcomes and legal protections.

A Limited Liability Partnership (LLP) protects partners from personal liability for certain debts and obligations, while a general partnership does not offer this protection. In a general partnership, each partner shares liability equally. When considering the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, understanding these distinctions can help you assess risk and liability in your business ventures.

In the context of partnerships, a General Partner (GP) generally manages the business and has unlimited liability, while a Limited Partner (LP) invests capital but has limited liability. This structure is essential in understanding the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, as it outlines the responsibilities of each party. Knowing these differences can help you make informed decisions about your investments and partnerships.

In a limited partnership, the general partner has unlimited liability, meaning they can be personally responsible for the debts and obligations of the partnership. This contrasts sharply with limited partners, who enjoy limited liability based on their investment. Knowing the implications of the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership helps clarify the risks and responsibilities for both types of partners, ensuring informed business decisions.

A general partnership involves all partners sharing equal responsibility and liability for the business’s debts and obligations. In contrast, a limited partnership has both general partners and limited partners, where the general partners manage the business while limited partners typically invest capital without taking on personal liability for business debts. Understanding the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership is crucial, as it affects the financial responsibilities of all partners involved.

A general partner in funds is the individual or entity that has control over fund operations and typically makes all key investment decisions. This partner also bears unlimited liability for the fund's debts, differing fundamentally from limited partners. Understanding this role is crucial when assessing the implications of the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

Yes, the general partner bears full liability for any debts or liabilities incurred by the partnership. This key responsibility shapes the risk profile of the partnership and requires careful consideration by those entering into the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership. Awareness of this risk is vital for effective partnership management.

Limited partners typically enjoy limited liability for partnership debts, protecting their personal assets. In contrast, general partners face unlimited liability, making it crucial to understand each partner's role and responsibility. This differentiation is especially relevant in relation to the Georgia Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.