Georgia Contract between General Agent of Insurance Company and Independent Agent

Description

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

US Legal Forms - one of the most prominent collections of legal forms in the United States - provides a vast selection of legal document templates that you can download or print.

Through the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Georgia Contract between General Agent of an Insurance Company and Independent Agent in moments.

Check the form summary to verify that you have selected the correct form.

If the form does not fit your requirements, use the Search field at the top of the screen to find one that does.

- If you have a subscription, sign in and download the Georgia Contract between General Agent of an Insurance Company and Independent Agent from your US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

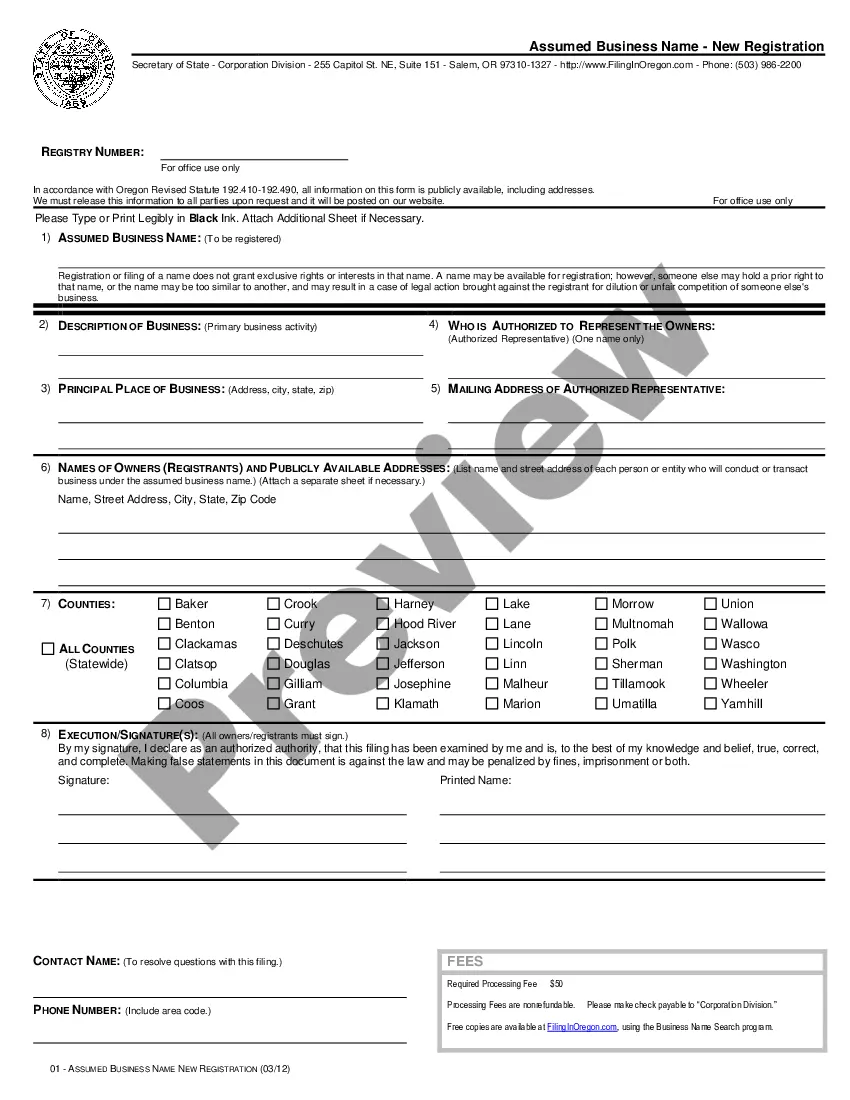

- Click the Preview button to review the form’s contents.

Form popularity

FAQ

An independent insurance agent typically earns between 10% to 20% commission on the policies they sell. This commission can vary based on the type of insurance and the agreements in the Georgia Contract between General Agent of Insurance Company and Independent Agent. Additionally, agents may receive bonuses or residuals for renewing policies, which can significantly increase their earnings over time. By understanding this commission structure, agents can maximize their income potential.

An insurance agent acts as a bridge between the insurance company and the clients, selling policies and providing assistance. Typically, the insurance agent enters into a Georgia Contract between General Agent of Insurance Company and Independent Agent, which outlines their roles and responsibilities. This contract establishes the agent's authority to act on behalf of the company and the compensation structure. Strong communication and a clear understanding of this relationship help foster trust and ensure clients are well-informed about their options.

A general agent represents an insurance company and has the authority to make decisions on its behalf, while a broker operates independently, representing the interests of clients. In the context of the Georgia Contract between General Agent of Insurance Company and Independent Agent, this distinction is crucial. General agents typically focus on marketing the insurance products of a specific company, while brokers can offer multiple options for clients. Understanding this difference helps ensure you choose the right professional for your insurance needs.

Most independent insurance agents in Georgia can earn between $30,000 to $100,000 annually, depending on their experience, clientele, and the commission structure they work under. Successful agents who cultivate strong customer relationships can see their earnings significantly increase over time. Engaging in a Georgia Contract between General Agent of Insurance Company and Independent Agent can provide the necessary support to maximize these earnings.

In Georgia, insurance agent licenses must be renewed every two years. During this period, agents are required to complete continuing education courses to ensure they stay updated on industry trends and regulations. Renewing the license timely helps maintain a valid status to operate in the field. Familiarity with the Georgia Contract between General Agent of Insurance Company and Independent Agent is beneficial for understanding compliance requirements.

A GA general agent is an individual or agency responsible for representing an insurance company on a broader scale, often managing a team of independent agents. They handle various tasks, from introducing new products to guiding agents in sales strategies. GA general agents ensure that sales processes align with the insurance company’s objectives and compliance standards. Their role is typically solidified through a Georgia Contract between General Agent of Insurance Company and Independent Agent.

In the insurance context, GA stands for General Agent. This term denotes an individual or entity that has been authorized by an insurance company to represent them and manage agent relationships. General agents are instrumental in strengthening the insurance provider's presence in the market. Their operations are often guided by a Georgia Contract between General Agent of Insurance Company and Independent Agent.

A general agent refers to a professional who represents an insurance company and manages the interactions with independent agents. This role involves a broad set of responsibilities, including overseeing agent performance and ensuring compliance with state regulations. Essentially, a general agent acts as a pivotal link between the company and its agents. The Georgia Contract between General Agent of Insurance Company and Independent Agent formalizes this relationship.

General agents act as intermediaries between insurance companies and independent agents. They provide essential resources such as training, marketing support, and access to necessary tools. By fostering communication and offering guidance, general agents help independent agents thrive in a competitive market. The Georgia Contract between General Agent of Insurance Company and Independent Agent solidifies these important functions.

A general agent plays a crucial role in connecting an insurance company with independent agents. Their duties often include recruiting, training, and supporting agents to ensure they understand the products and systems in place. Additionally, a general agent manages relationships with agents and oversees their sales activities. This relationship is often defined by a Georgia Contract between General Agent of Insurance Company and Independent Agent.