Florida Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title

Description

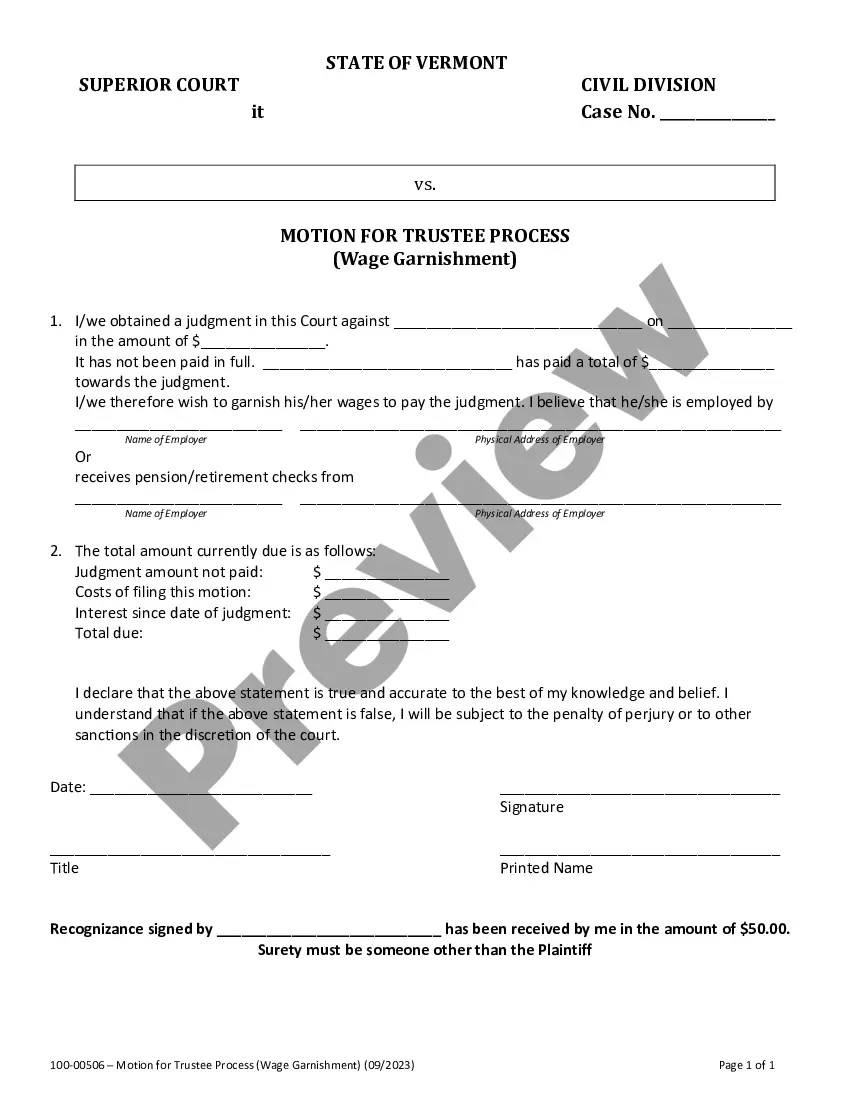

How to fill out Deed Of Trust, Mortgage, Security Agreement, Assignment Of Production, And Financing Statement Of Oil And Gas Properties Including After - Acquired Title?

Are you currently inside a place where you need documents for both business or personal reasons almost every day time? There are a lot of authorized file themes accessible on the Internet, but finding versions you can rely on is not straightforward. US Legal Forms delivers 1000s of develop themes, much like the Florida Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title, that happen to be created to meet state and federal specifications.

If you are currently informed about US Legal Forms site and have your account, basically log in. After that, it is possible to down load the Florida Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title web template.

Unless you provide an account and wish to begin using US Legal Forms, adopt these measures:

- Discover the develop you need and ensure it is to the proper area/region.

- Use the Review option to examine the form.

- See the explanation to ensure that you have selected the right develop.

- If the develop is not what you are looking for, use the Research industry to get the develop that meets your requirements and specifications.

- If you find the proper develop, click Purchase now.

- Opt for the prices program you would like, complete the required info to create your money, and purchase an order using your PayPal or charge card.

- Select a convenient file formatting and down load your backup.

Find every one of the file themes you may have bought in the My Forms food selection. You may get a further backup of Florida Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title anytime, if required. Just click the necessary develop to down load or print out the file web template.

Use US Legal Forms, the most extensive collection of authorized varieties, to save some time and avoid errors. The service delivers skillfully produced authorized file themes which can be used for a selection of reasons. Create your account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

What is the Difference Between a Deed and a Deed of Trust? The primary difference between a deed and a deed of trust is the purpose of each document. A deed transfers ownership of a property from one party to another, while a deed of trust secures a loan on a property.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A deed of trust, or security deed, as it is known in some jurisdictions, is a form of mortgage. A borrower of money signs a promissory note demonstrating the debt owed to the lender. The promissory note will generally recite the purpose of the loan and indicate that it is secured by real property.

A security interest exists when a borrower enters into a contract that allows the lender or secured party to take collateral that the borrower owns in the event that the borrower cannot pay back the loan. The term security interest is often used interchangeably with the term lien in the United States.

Mortgage and security interest are two similar terms, both referring to a collateral created in order to secure a debt by one party to the other. They operate similarly, both give preferential rights to the secured party in the disposition of assets in question.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third party?such as a bank, escrow company, or title company?to hold until the borrower repays their debt to the lender.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.