Florida Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

Choosing the right legitimate file template can be quite a battle. Of course, there are tons of layouts available on the Internet, but how can you obtain the legitimate form you will need? Take advantage of the US Legal Forms internet site. The services provides a large number of layouts, like the Florida Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor, that you can use for company and private needs. Every one of the kinds are checked out by professionals and meet state and federal specifications.

In case you are already registered, log in to your profile and click the Acquire key to get the Florida Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor. Make use of your profile to check throughout the legitimate kinds you might have acquired formerly. Proceed to the My Forms tab of your respective profile and get yet another version of your file you will need.

In case you are a new customer of US Legal Forms, listed below are straightforward directions that you should follow:

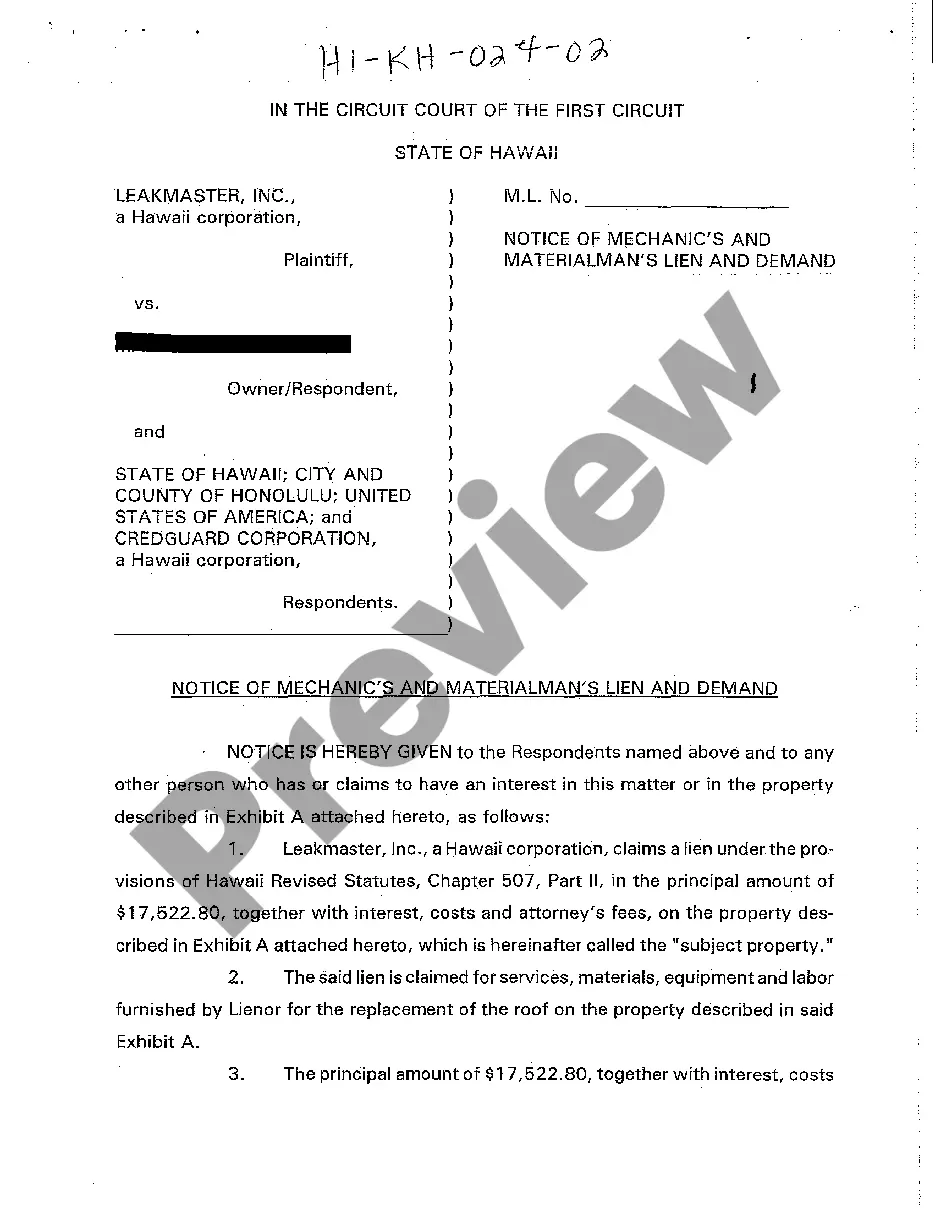

- Initially, make certain you have selected the proper form to your area/county. It is possible to look over the form making use of the Review key and look at the form explanation to make certain it will be the best for you.

- When the form fails to meet your expectations, use the Seach discipline to get the proper form.

- When you are certain the form would work, go through the Acquire now key to get the form.

- Pick the costs plan you want and enter in the essential info. Design your profile and pay for the order with your PayPal profile or charge card.

- Pick the file file format and down load the legitimate file template to your product.

- Full, change and print out and indicator the attained Florida Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor.

US Legal Forms is definitely the largest local library of legitimate kinds in which you can see a variety of file layouts. Take advantage of the service to down load skillfully-created files that follow status specifications.

Form popularity

FAQ

A release of a portion of commercial real property in Florida from the lien of a mortgage. Lenders in Florida customarily use a partial release of mortgage to discharge a mortgage lien against some, but not all, of the borrower's commercial real property.

In Florida, a Deed is required to transfer ownership of a piece of property, regardless of whether that property consists of buildings or vacant land. Contrary to popular opinion, the title to the property is not conveyed by the Mortgage in Florida (the Mortgage creates a lien on the property).

Notes: Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Florida is a lien state and mortgages are the security instrument used to encumber real property.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.