Florida Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

It is possible to spend hrs online attempting to find the legitimate papers template which fits the state and federal specifications you want. US Legal Forms provides a huge number of legitimate types which can be reviewed by experts. You can easily download or printing the Florida Gift Deed of Nonparticipating Royalty Interest with No Warranty from my support.

If you already possess a US Legal Forms profile, you are able to log in and then click the Download button. Afterward, you are able to full, change, printing, or indication the Florida Gift Deed of Nonparticipating Royalty Interest with No Warranty. Every single legitimate papers template you buy is your own property eternally. To acquire one more backup associated with a acquired develop, check out the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site initially, stick to the simple guidelines beneath:

- Initial, be sure that you have chosen the correct papers template for the region/metropolis of your choosing. Look at the develop explanation to make sure you have selected the proper develop. If offered, use the Review button to look throughout the papers template also.

- In order to get one more variation of the develop, use the Look for industry to get the template that fits your needs and specifications.

- When you have discovered the template you desire, just click Acquire now to continue.

- Pick the costs prepare you desire, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your bank card or PayPal profile to purchase the legitimate develop.

- Pick the structure of the papers and download it to the system.

- Make adjustments to the papers if possible. It is possible to full, change and indication and printing Florida Gift Deed of Nonparticipating Royalty Interest with No Warranty.

Download and printing a huge number of papers layouts while using US Legal Forms site, which provides the greatest variety of legitimate types. Use skilled and condition-particular layouts to take on your small business or personal demands.

Form popularity

FAQ

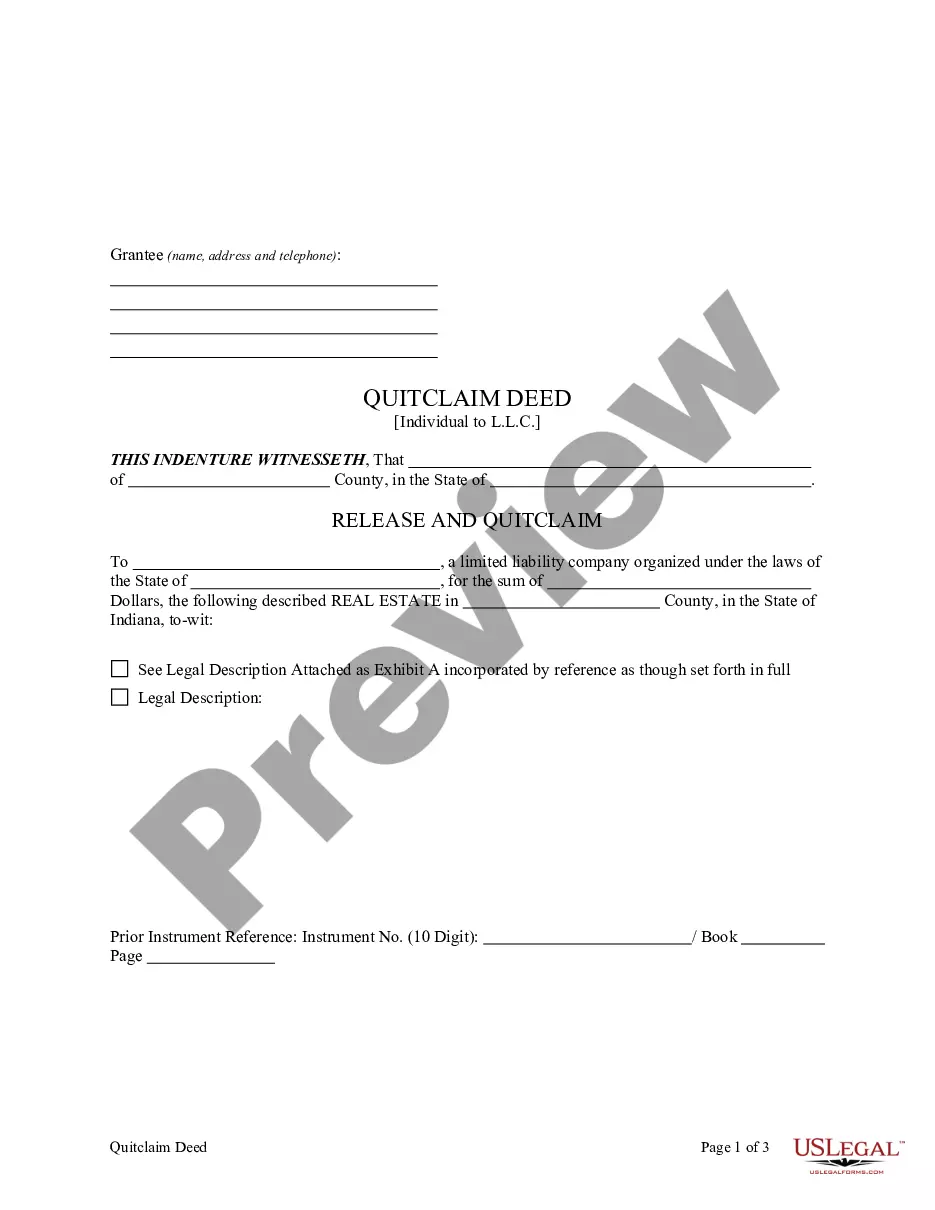

A quitclaim deed is the simplest way to add a name to an existing deed in Florida. The quitclaim deed transfers a property interest to another person without making guarantees of title. No title search is involved.

Each grantor must sign the deed in the presence of a notary public for a valid transfer. In Florida, certain counties may require a recording cover sheet and/or a Declaration of Domicile. Contact the appropriate county clerk and recorder to verify additional requirements before recording.

Real Estate Conveyance Fees $0.70 per $100 of consideration or fraction thereof on deed or other instrument conveying an interest in Real Estate. A minimum of . 70 cents doc stamps must be affixed to deeds which have a consideration of $100 or less.

Florida does not have a gift tax. However, you may trigger a gift tax at the federal level depending on the value of the gifts you provide, but you won't owe a gift tax until you breach your lifetime gift and estate tax exemption. The Tax Cuts and Jobs Act signed by President Trump raised that threshold.

The state of Florida does not require you to use an attorney to file a quitclaim deed. You simply can download the form, sign and notarize it, then file it with the county clerk all on your own.