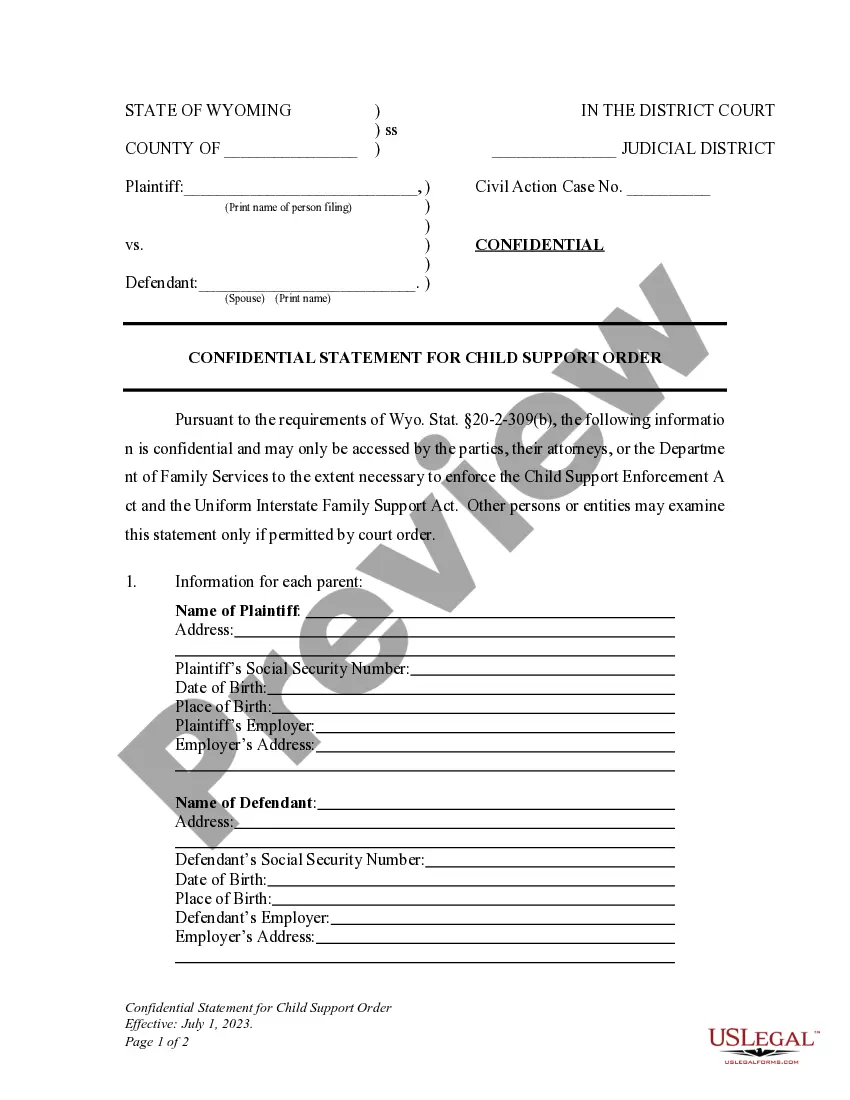

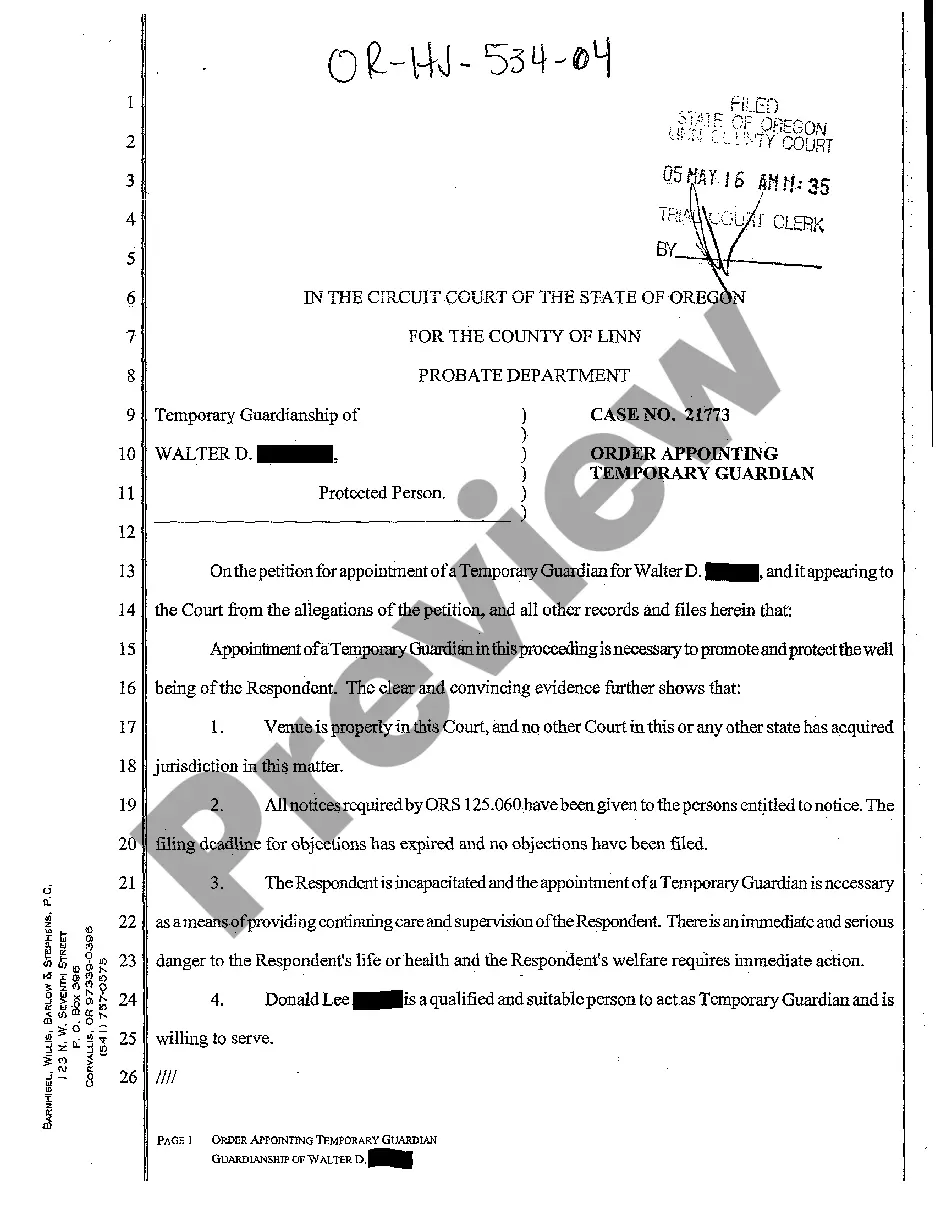

This form is used when Assignor, pursuant to the terms and conditions of a Purchase and Sale Agreement, sells, assigns, transfers, conveys, and delivers to Assignee all of Assignor's rights, title, and interests in and to the within described property and interests (collectively, the Assets )

Florida Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form

Description

How to fill out Assignment, Conveyance, And Bill Of Sale Of All Interest In Described Assets Long Form?

Choosing the right legitimate file design can be quite a have a problem. Naturally, there are a lot of themes available on the Internet, but how can you discover the legitimate develop you will need? Use the US Legal Forms site. The service provides thousands of themes, like the Florida Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form, which can be used for enterprise and private requirements. All the varieties are inspected by experts and meet up with state and federal needs.

Should you be previously authorized, log in for your account and click on the Download switch to find the Florida Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form. Make use of your account to appear with the legitimate varieties you have acquired in the past. Go to the My Forms tab of your respective account and acquire an additional version in the file you will need.

Should you be a fresh consumer of US Legal Forms, here are simple directions that you can stick to:

- Very first, make certain you have selected the correct develop to your area/region. You can look through the form utilizing the Review switch and read the form outline to make sure it will be the best for you.

- In case the develop fails to meet up with your expectations, utilize the Seach industry to find the correct develop.

- Once you are sure that the form is proper, go through the Buy now switch to find the develop.

- Choose the costs plan you desire and enter the essential details. Design your account and pay for an order making use of your PayPal account or credit card.

- Select the document structure and down load the legitimate file design for your system.

- Full, modify and printing and signal the acquired Florida Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form.

US Legal Forms may be the biggest library of legitimate varieties where you will find different file themes. Use the company to down load skillfully-created documents that stick to status needs.

Form popularity

FAQ

Documentary Transfer Tax is computed when the consideration or value of the interest or property conveyed (exclusive of the value of any lien or encumbrance remaining thereon at the time of sale) exceeds one hundred dollars ($100), at the rate of fifty-five cents ($0.55) for each five hundred dollars ($500), or ...

This form is for nonregistered taxpayers reporting documentary stamp tax on unrecorded documents. Each DR-228 form contains a unique, identifying number that enables the Department to process your return accurately and efficiently.

$0.70 per $100 of consideration or fraction thereof on deed or other instrument conveying an interest in Real Estate. A minimum of . 70 cents doc stamps must be affixed to deeds which have a consideration of $100 or less.

Sellers are typically responsible for paying the Florida Documentary Stamp Tax on the deed, while buyers who are financing usually foot the stamp tax bill on the mortgage itself.

Section 201.08(1)(b), F.S., imposes documentary stamp tax on any document filed or recorded in Florida that evidences an obligation to pay money (for example, mortgages).

Documentary stamp tax is payable by any of the parties to a taxable transaction. If one party is exempt, the tax is required of the nonexempt party. United States government agencies; Florida government agencies; and Florida's counties, municipalities, and political subdivisions are exempt from documentary stamp tax.

Tax is due on a document that contains a promise to pay a specific amount of money and is signed, executed, or delivered in Florida. The maximum amount of documentary stamp tax due on unsecured notes or other written obligations to pay money is $2,450. Examples include: Demand notes.

Tax is generally not due if the property is not mortgaged or if the marital home is transferred due to a divorce. Documentary stamp tax is due on the original issuance of bonds in Florida.