Florida Self-Employed Technician Services Contract

Description

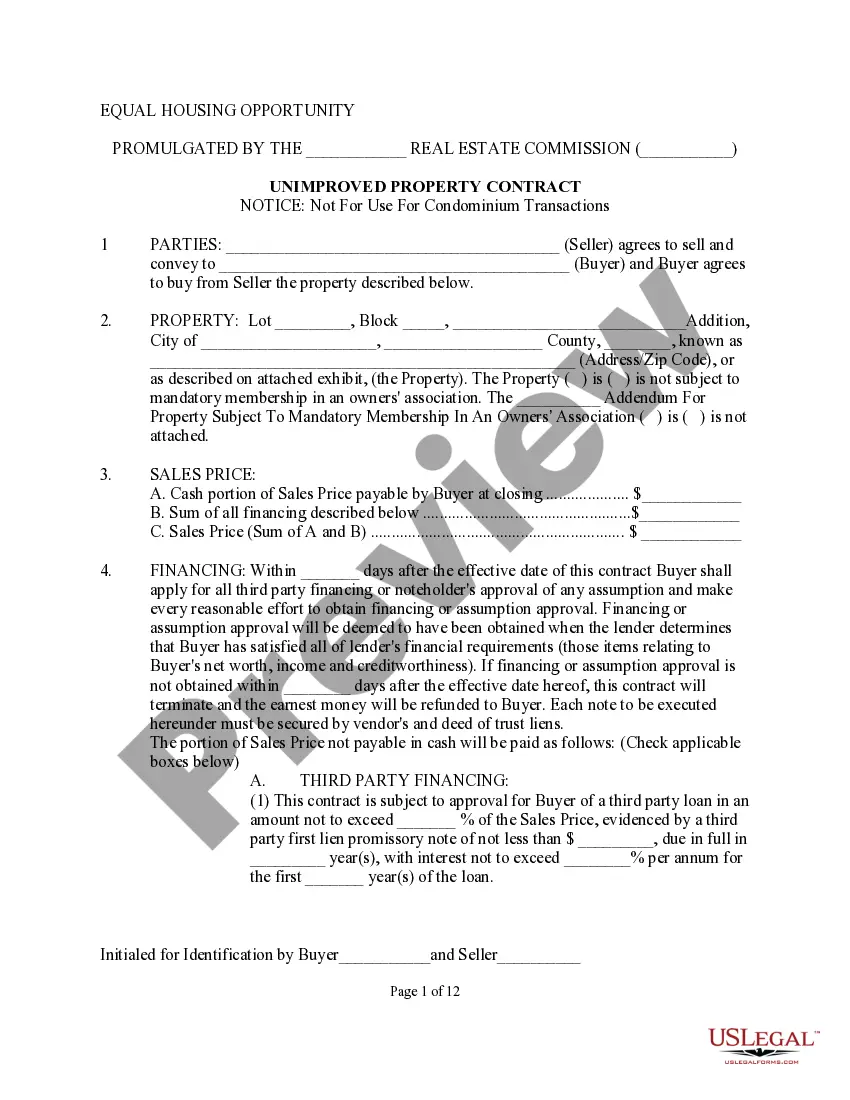

How to fill out Self-Employed Technician Services Contract?

You might spend numerous hours online attempting to locate the legal document template that satisfies the federal and state requirements you require.

US Legal Forms offers thousands of legal documents that have been evaluated by experts.

It is easy to obtain or print the Florida Self-Employed Technician Services Contract from my service.

If available, utilize the Preview button to view the document template as well. To find another version of the form, use the Search field to locate the template that fulfills your needs and specifications. Once you have identified the template you want, click Get now to proceed. Select the pricing plan you desire, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the file format of the document and download it to your device. Make changes to your document if necessary. You may complete, modify, sign, and print the Florida Self-Employed Technician Services Contract. Access and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal documents. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Florida Self-Employed Technician Services Contract.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred region/area.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

Yes, registering your business as an independent contractor is often a crucial step. In Florida, this registration helps you stay compliant with local laws and tax requirements. Having a Florida Self-Employed Technician Services Contract can support your business structure by defining your services and terms clearly. Utilizing platforms like uslegalforms can simplify the registration process and provide you with essential documents.

To be authorized as an independent contractor in the US, you must first understand your state's regulations. In Florida, obtaining the necessary licenses or permits is essential for compliance. You can also benefit from securing a Florida Self-Employed Technician Services Contract, which outlines your responsibilities and rights. This contract can help you navigate the requirements more easily and establish a professional relationship with your clients.

Being employed without a contract can lead to uncertainty regarding your rights and obligations. Without a formal agreement, you may struggle to enforce payment or project terms. It's wise to establish a Florida Self-Employed Technician Services Contract to protect your interests and clarify expectations.

Yes, having a contract is essential when you are self-employed. It establishes the terms of your work, payment, and responsibilities, helping to avoid disputes. A well-crafted Florida Self-Employed Technician Services Contract can serve as a valuable tool for ensuring clarity and professionalism in your business dealings.

Yes, it is legal to work without a signed contract, but it introduces risks for both parties. Without a formal agreement, you may face challenges regarding payment, project scope, and responsibilities. A Florida Self-Employed Technician Services Contract can mitigate these risks and provide a clear framework for your work.

In Florida, the amount of work you can do without a contractor license depends on the specific type of service you offer. Many skilled trades require licensing, while others may not. Always check local regulations to ensure compliance, especially when creating a Florida Self-Employed Technician Services Contract.

While it is possible to freelance without a contract, it is not advisable. A written agreement, like a Florida Self-Employed Technician Services Contract, protects both parties by outlining the scope of work and payment terms. This clarity helps prevent misunderstandings in the future.

The new independent contractor law in Florida clarifies the criteria for classifying workers as independent contractors. This legislation aims to protect both workers and employers, ensuring fair treatment. If you are considering a Florida Self-Employed Technician Services Contract, it’s crucial to stay informed about these legal changes.

In Florida, an independent contractor is someone who provides services under a contract but retains control over how those services are performed. They usually work for multiple clients and set their own schedules. Understanding this classification is essential, especially when drafting a Florida Self-Employed Technician Services Contract.

When writing a contract for a 1099 employee, specify the services they will provide, payment structure, and deadlines. It is important to clarify that they are an independent contractor, not an employee. To ensure compliance with tax regulations and state laws, using a Florida Self-Employed Technician Services Contract template from US Legal Forms can simplify the process.