Florida Campaign Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Campaign Worker Agreement - Self-Employed Independent Contractor?

If you want to compile, download, or create authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site's user-friendly and efficient search feature to find the documents you need.

Various templates for business and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to obtain the Florida Campaign Worker Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, then print the Florida Campaign Worker Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to get the Florida Campaign Worker Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions in the legal form format.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, print, or sign the Florida Campaign Worker Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

In Florida, independent contractors are generally not required to carry workers' compensation insurance. However, if you are a self-employed independent contractor working under a Florida Campaign Worker Agreement, it is essential to understand your specific circumstances. Depending on your contract and the nature of your work, you may still want to consider obtaining coverage to protect yourself against potential risks. For more tailored guidance, US Legal Forms offers resources to help you navigate your obligations and opportunities as a Florida Campaign Worker.

In Florida, an independent contractor is typically a self-employed individual who provides services under a contract. The contractor usually maintains control over how tasks are performed while delivering specific results. Understanding these qualifications is essential when setting up a Florida Campaign Worker Agreement - Self-Employed Independent Contractor to ensure compliance with state laws.

To receive a 1099 form, an independent contractor in Florida must earn at least $600 in a calendar year from a single client. This income threshold ensures that both the contractor and the hiring party understand their tax responsibilities. It's crucial to maintain accurate records when working under a Florida Campaign Worker Agreement - Self-Employed Independent Contractor.

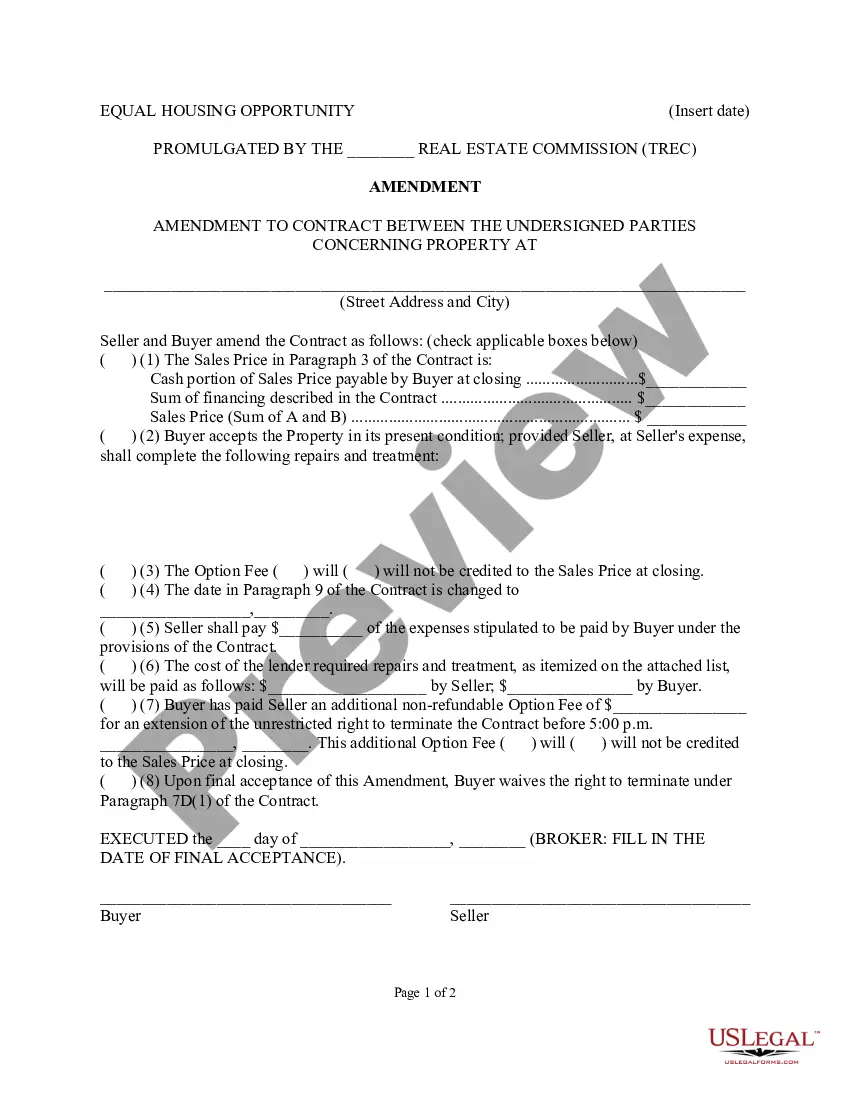

The independent contractor agreement in Florida is a formal document that delineates the working terms for self-employed individuals. It helps both parties understand their obligations and rights, outlining payment structures and deliverables. Utilizing this agreement effectively promotes transparency and trust when executing a Florida Campaign Worker Agreement - Self-Employed Independent Contractor.

Florida has recently updated its independent contractor laws to clarify the classification of workers. These changes help protect the rights of both employees and contractors while ensuring compliance. It’s important to familiarize yourself with these regulations to maintain a valid Florida Campaign Worker Agreement - Self-Employed Independent Contractor.

The Florida Campaign Worker Agreement - Self-Employed Independent Contractor establishes clear terms between the contractor and hiring party. This agreement outlines responsibilities, compensation, and specific expectations for the role. By having a written document, both parties can avoid misunderstandings, thus ensuring a smooth working relationship.

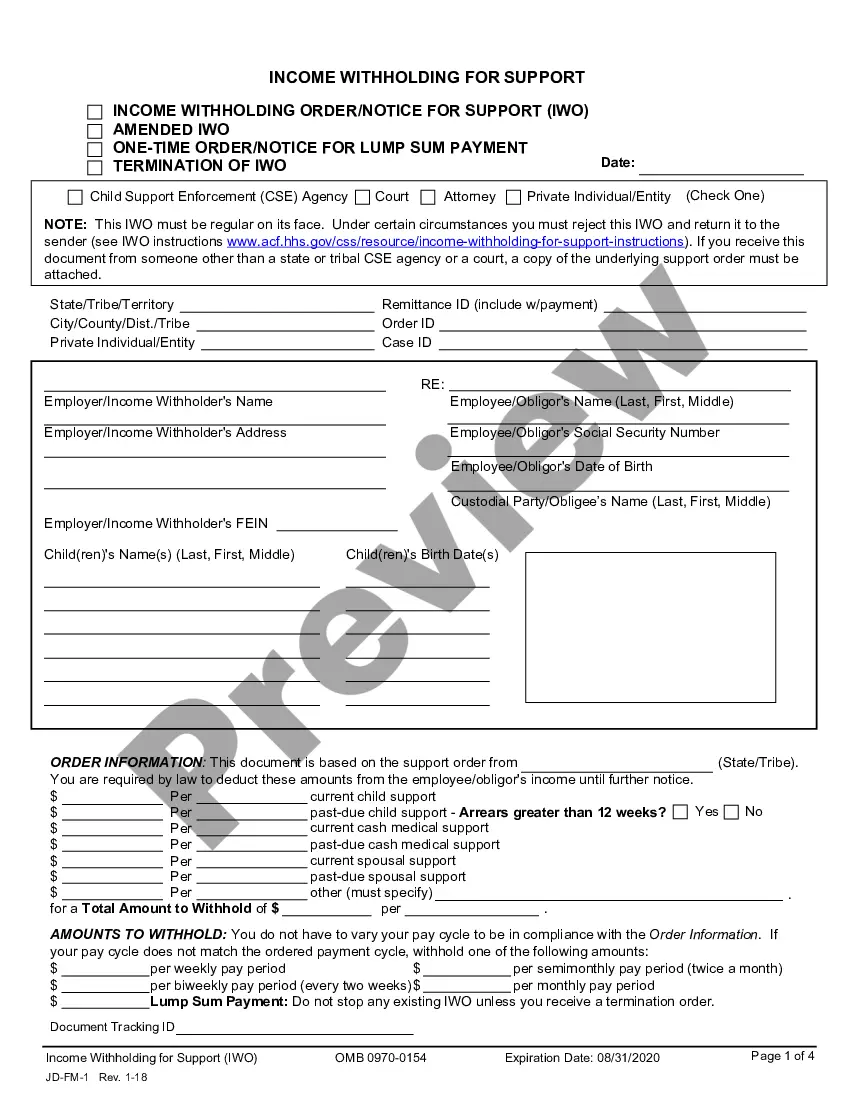

To complete an independent contractor form, start by providing your personal information and the details of the contracting party. Include specifics about the scope of work and compensation amount to ensure clarity. It's crucial to document any relevant agreements, especially in a Florida Campaign Worker Agreement - Self-Employed Independent Contractor. Using uslegalforms can help you navigate this with ease, making sure you include every necessary component.

Filling out an independent contractor agreement begins with understanding the roles and responsibilities involved. Clearly state the services the contractor will provide, while also including payment terms and deadlines. Additionally, consider emphasizing the independent nature of this relationship, such as in the Florida Campaign Worker Agreement - Self-Employed Independent Contractor. Utilizing platforms like uslegalforms can simplify this process by offering templates and guidance tailored for your needs.