Florida Letter of Transmittal to Accompany Certificates of Common Stock

Description

How to fill out Letter Of Transmittal To Accompany Certificates Of Common Stock?

You can invest time on the Internet searching for the legitimate record design which fits the federal and state needs you need. US Legal Forms provides 1000s of legitimate forms which can be analyzed by specialists. You can actually download or printing the Florida Letter of Transmittal to Accompany Certificates of Common Stock from the assistance.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Down load button. Next, it is possible to complete, revise, printing, or indicator the Florida Letter of Transmittal to Accompany Certificates of Common Stock. Every single legitimate record design you buy is the one you have forever. To obtain yet another backup of any bought kind, go to the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms website the first time, stick to the basic recommendations below:

- Very first, make sure that you have selected the right record design for that state/area that you pick. Look at the kind information to ensure you have selected the appropriate kind. If available, utilize the Review button to look with the record design at the same time.

- If you would like discover yet another variation from the kind, utilize the Lookup discipline to find the design that fits your needs and needs.

- When you have discovered the design you want, just click Acquire now to carry on.

- Choose the costs prepare you want, type in your credentials, and sign up for your account on US Legal Forms.

- Full the deal. You may use your credit card or PayPal bank account to pay for the legitimate kind.

- Choose the file format from the record and download it to your system.

- Make changes to your record if necessary. You can complete, revise and indicator and printing Florida Letter of Transmittal to Accompany Certificates of Common Stock.

Down load and printing 1000s of record themes using the US Legal Forms Internet site, which offers the most important variety of legitimate forms. Use expert and express-distinct themes to take on your organization or specific needs.

Form popularity

FAQ

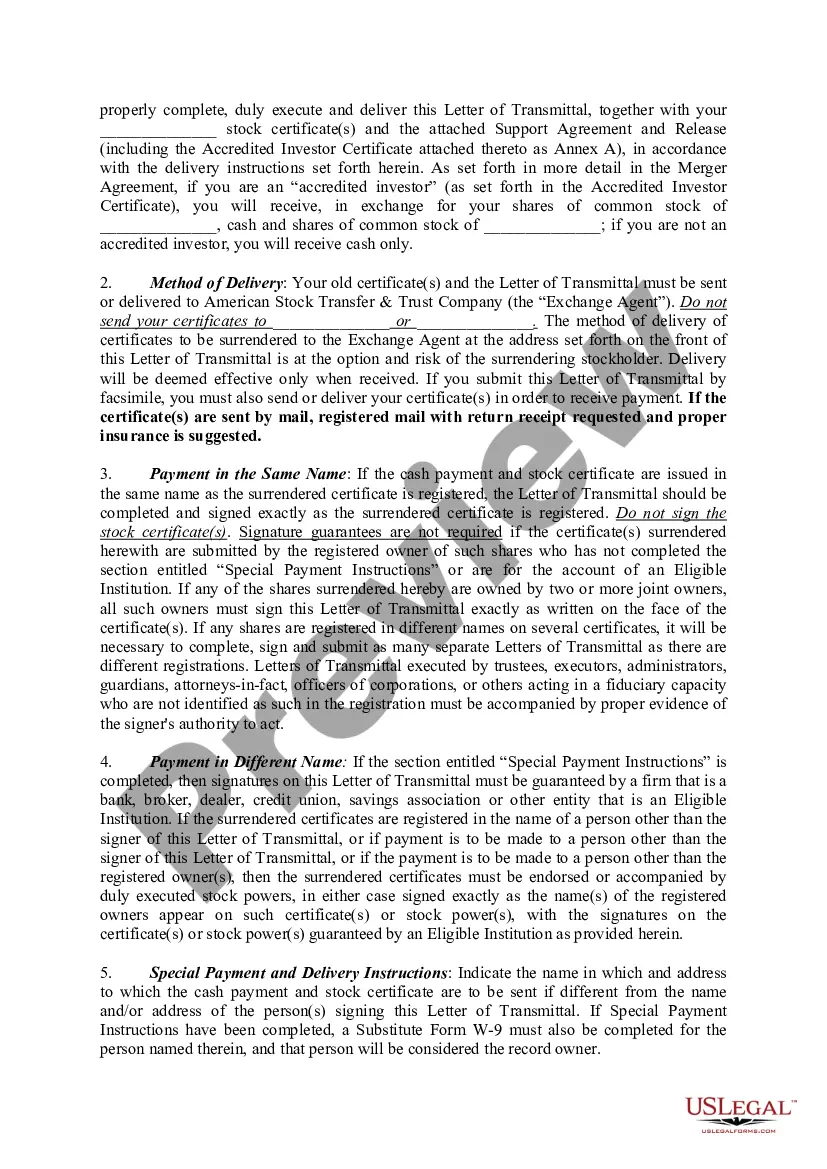

As you draft your letter of transmittal, adhere to these guidelines: Follow proper business letter. Maintain a professional tone. Clarify the purpose of the letter (to notify the recipient that the report is enclosed) Offer any specific details necessary for the reader to understand why the report was written.

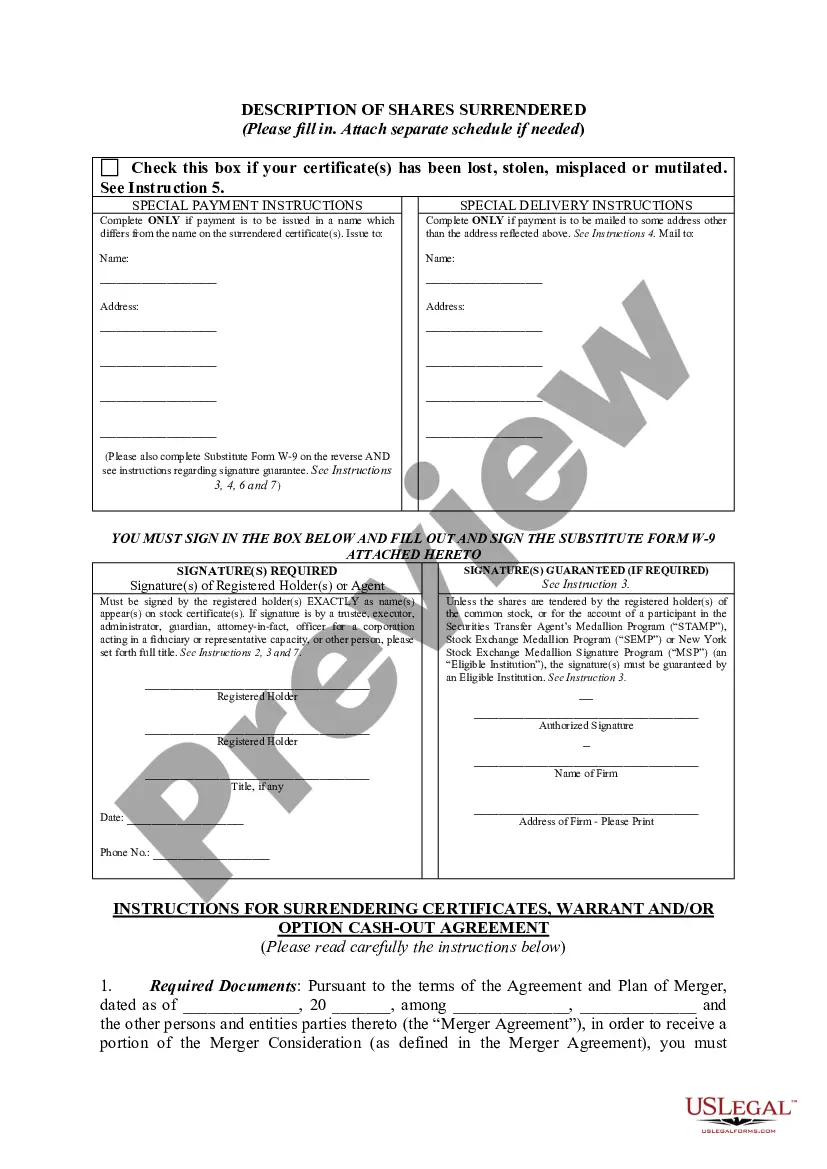

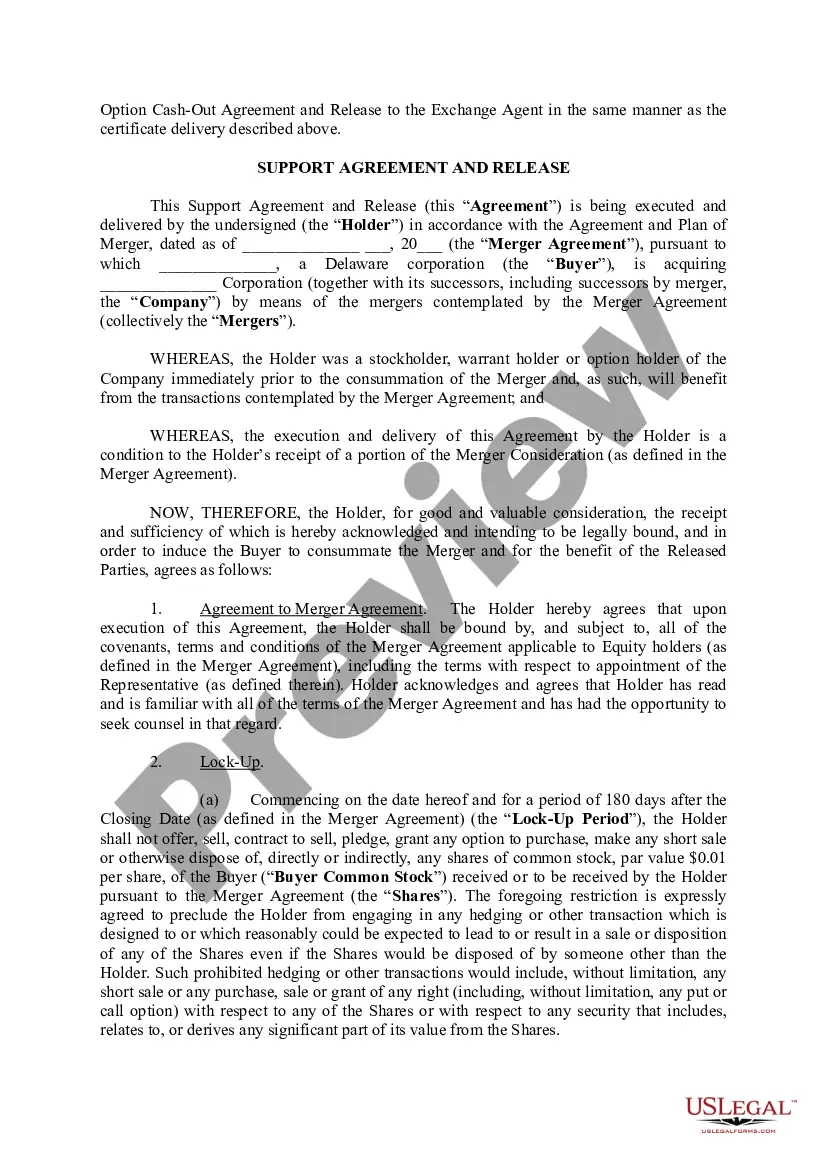

In finance, a letter of transmittal is a type of cover letter that accompanies a document, such as a financial report or security certificate. Within financial markets it is used by a security holder to accompany certificates surrendered in an exchange or corporate action.

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

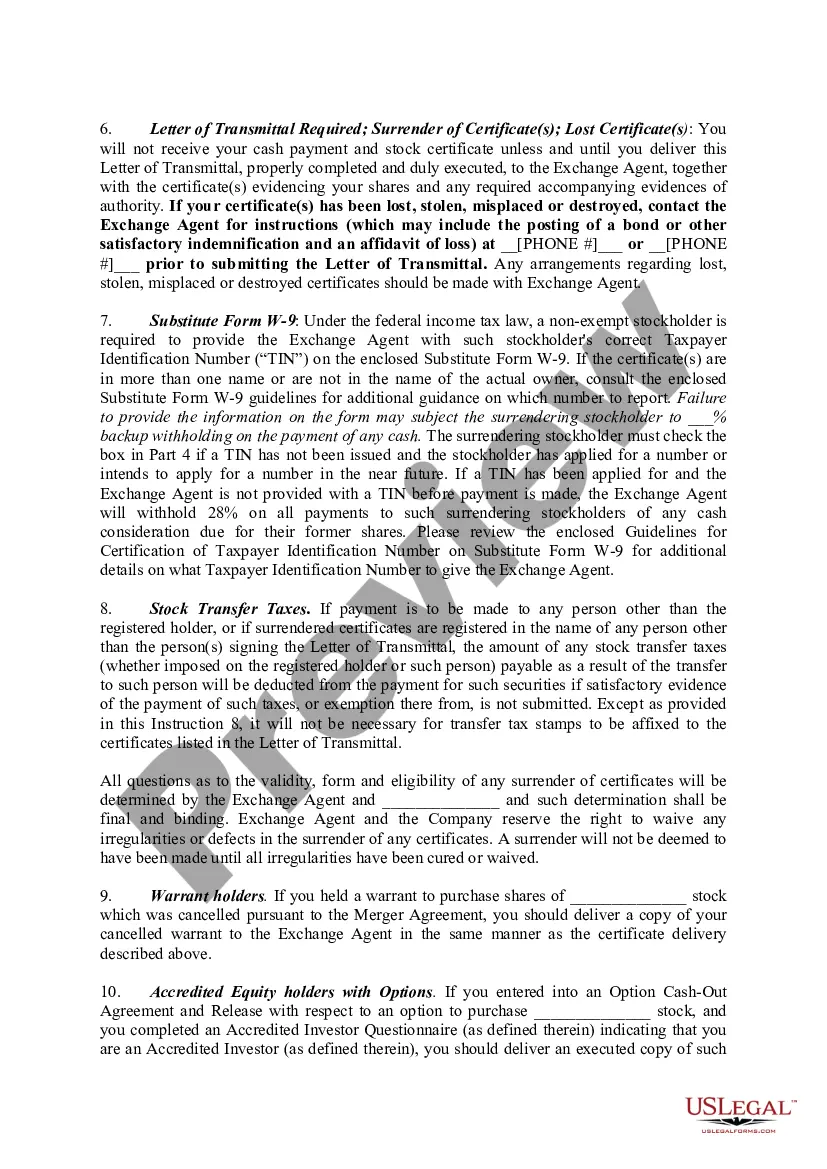

In order to cash in the stock, you need to fill out the transfer form on the back of the certificate and have it notarized. Once complete, send the notarized certificate to the transfer agent, who will register the stock to you as owner.

A transmittal or cover letter accompanies a larger item, usually a document. The transmittal letter provides the recipient with a specific context in which to place the larger document and simultaneously gives the sender a permanent record of having sent the material. Transmittal letters are usually brief.

What is a Letter of Transmittal? A Letter of Transmittal is a form generally used for an exchange of stock and/or cash payment.

Letters of transmittal are usually brief, often with three paragraphs, each one devoted to a specific purpose: review the purpose of the report, offer a brief overview of main ideas in the report, and offer to provide fuller information as needed, along with a ?thank you? and contact information.

You can find out who your company's transfer agent is by contacting its investor relations department. Then, the transfer agent will have you send in any paper stock certificates you have, along with a letter of instruction to instruct it on how to change the ownership of the stock.