Florida NQO Agreement

Description

How to fill out NQO Agreement?

Have you been within a position in which you need to have files for either business or person uses almost every day time? There are tons of authorized file web templates available on the net, but getting versions you can rely on is not simple. US Legal Forms provides a large number of type web templates, like the Florida NQO Agreement, that are composed to satisfy state and federal needs.

Should you be presently acquainted with US Legal Forms web site and possess a free account, basically log in. Following that, you are able to download the Florida NQO Agreement template.

Should you not provide an profile and want to start using US Legal Forms, adopt these measures:

- Discover the type you will need and ensure it is for the right metropolis/region.

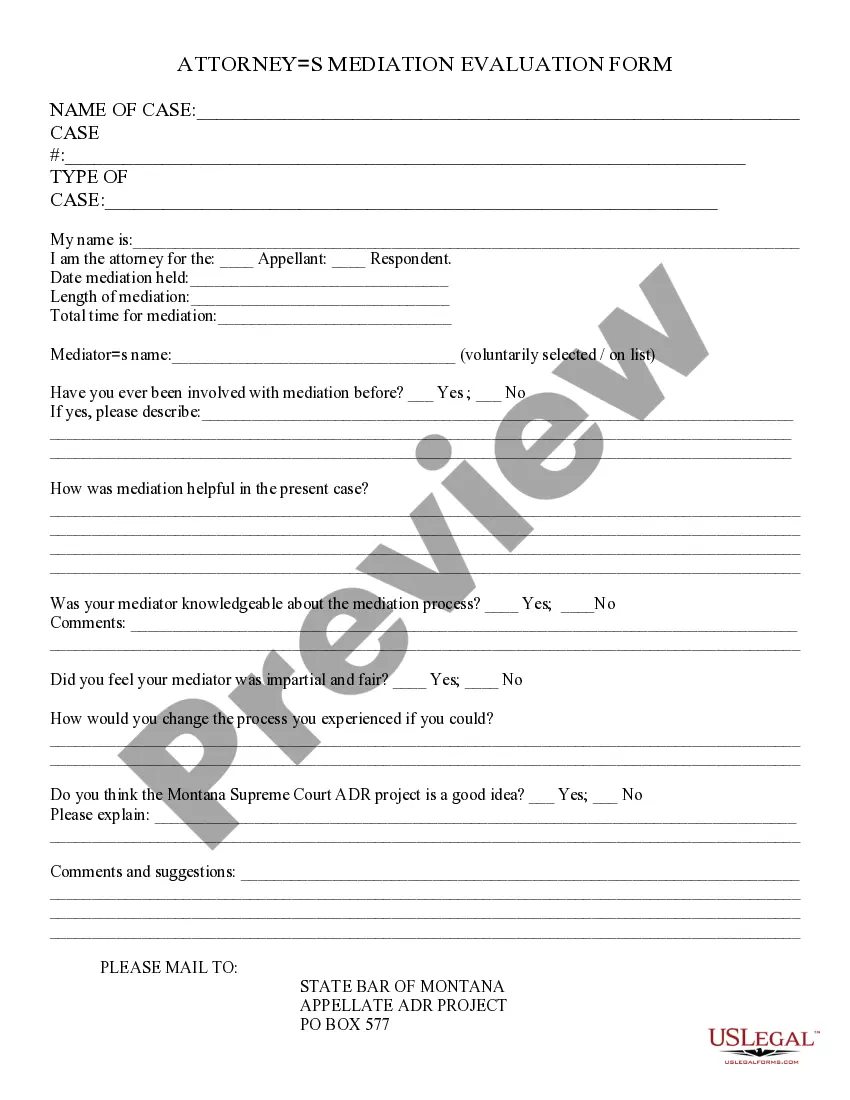

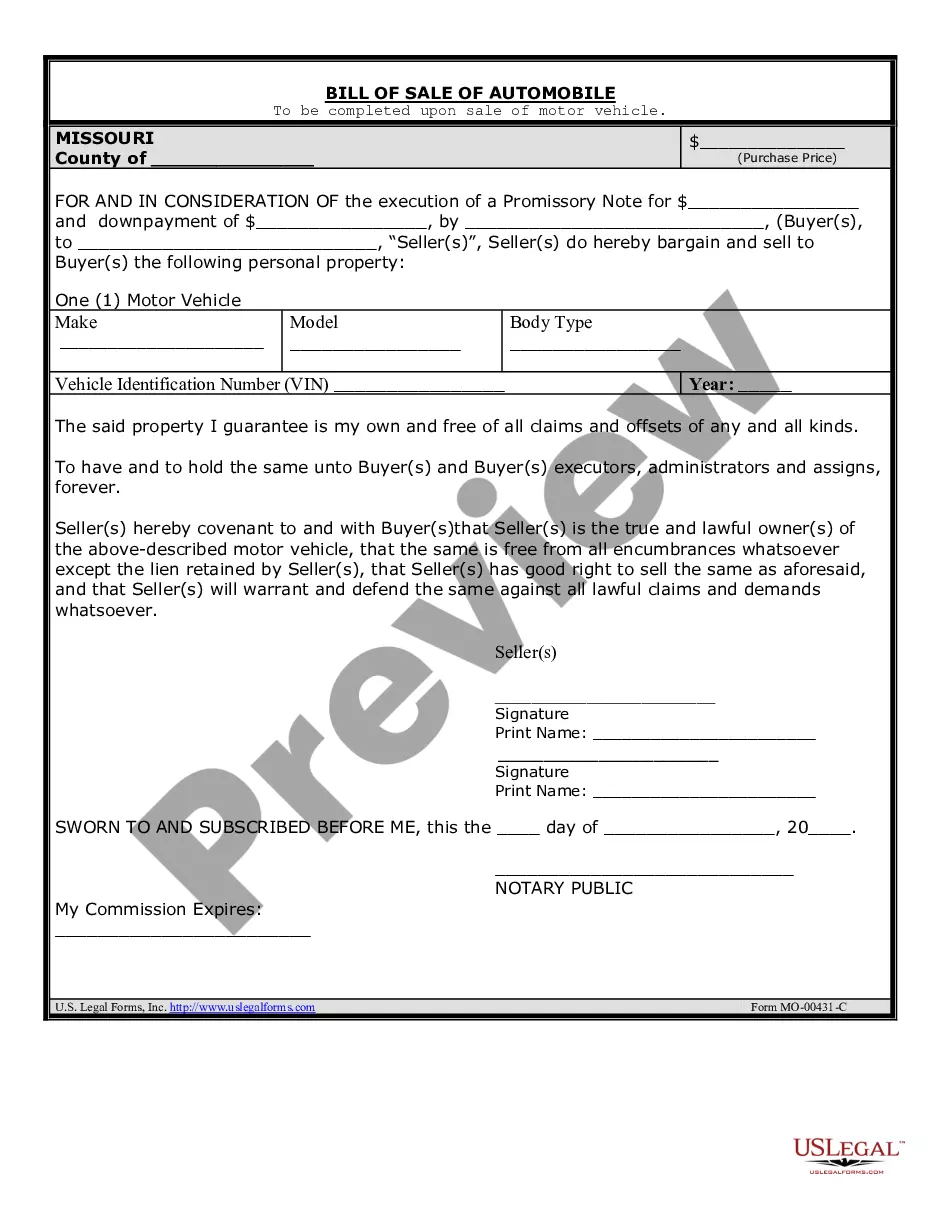

- Use the Preview switch to examine the form.

- Read the description to ensure that you have selected the right type.

- In case the type is not what you`re seeking, use the Lookup area to get the type that suits you and needs.

- Once you obtain the right type, click on Acquire now.

- Choose the prices plan you want, complete the necessary information to generate your bank account, and pay for an order utilizing your PayPal or credit card.

- Select a convenient document file format and download your backup.

Get each of the file web templates you may have bought in the My Forms menus. You can get a further backup of Florida NQO Agreement whenever, if possible. Just click on the necessary type to download or print out the file template.

Use US Legal Forms, the most substantial selection of authorized forms, in order to save some time and steer clear of faults. The support provides expertly produced authorized file web templates which you can use for a range of uses. Generate a free account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

While Florida non-solicitation contracts are generally valid and enforceable if they meet several requirements, the burden of proof for enforcing these agreements rests on the party seeking enforcement?typically the employer. Under Florida law, this means an employer must show the following.

Voiding a non-compete contract is possible in certain circumstances such as proving you never signed it or the contract is against the public interest. How to Find Loopholes in a Non-Compete Contract - UpCounsel upcounsel.com ? voiding-a-non-compete-co... upcounsel.com ? voiding-a-non-compete-co...

During the course of your employment, You agree not to work for or provide any services to any competitor of the Company. Neither shall you engage in any competitive activity with respect to the Company. Sample Non-Compete and Non-Solicitation Agreement.doc Zywave ? DownloadAsset Zywave ? DownloadAsset DOC

Non-compete agreements are recognized and enforceable under Florida law. Florida Statute 542.335 provides standards for enforceable non-compete agreements. The standards are generally more favorable to the enforcing party (usually the employer) than in many other states.

(1) Notwithstanding s. 542.18 and subsection (2), enforcement of contracts that restrict or prohibit competition during or after the term of restrictive covenants, so long as such contracts are reasonable in time, area, and line of business, is not prohibited.

Make sure it is really narrow and truly does protect your client's interests. Limit the non-compete terms to the actual job duties of the employee, and limit activity restraints to customers with whom the employee actually interacted. Otherwise, you'll just be drafting something that your client can't enforce! Eight Tips for Drafting & Negotiating Compliant Non-Compete Agreements lawline.com ? eight-tips-for-drafting-negotiat... lawline.com ? eight-tips-for-drafting-negotiat...

How should I write a Noncompete Agreement? Duration. How long the agreement lasts. Usually, the terms are six months to a few years. ... Geography. If the business is local, you may define a specific area that is restricted. ... Scope. This part of the agreement should be specific to stand up in court.

Non-compete agreements are automatically void as a matter of law in California, except for a small set of specific situations expressly authorized by statute. They were outlawed by the original California Civil Code in 1872 (Civ. Code, former § 1673). Non-compete clause - Wikipedia wikipedia.org ? wiki ? Non-compete_clause wikipedia.org ? wiki ? Non-compete_clause