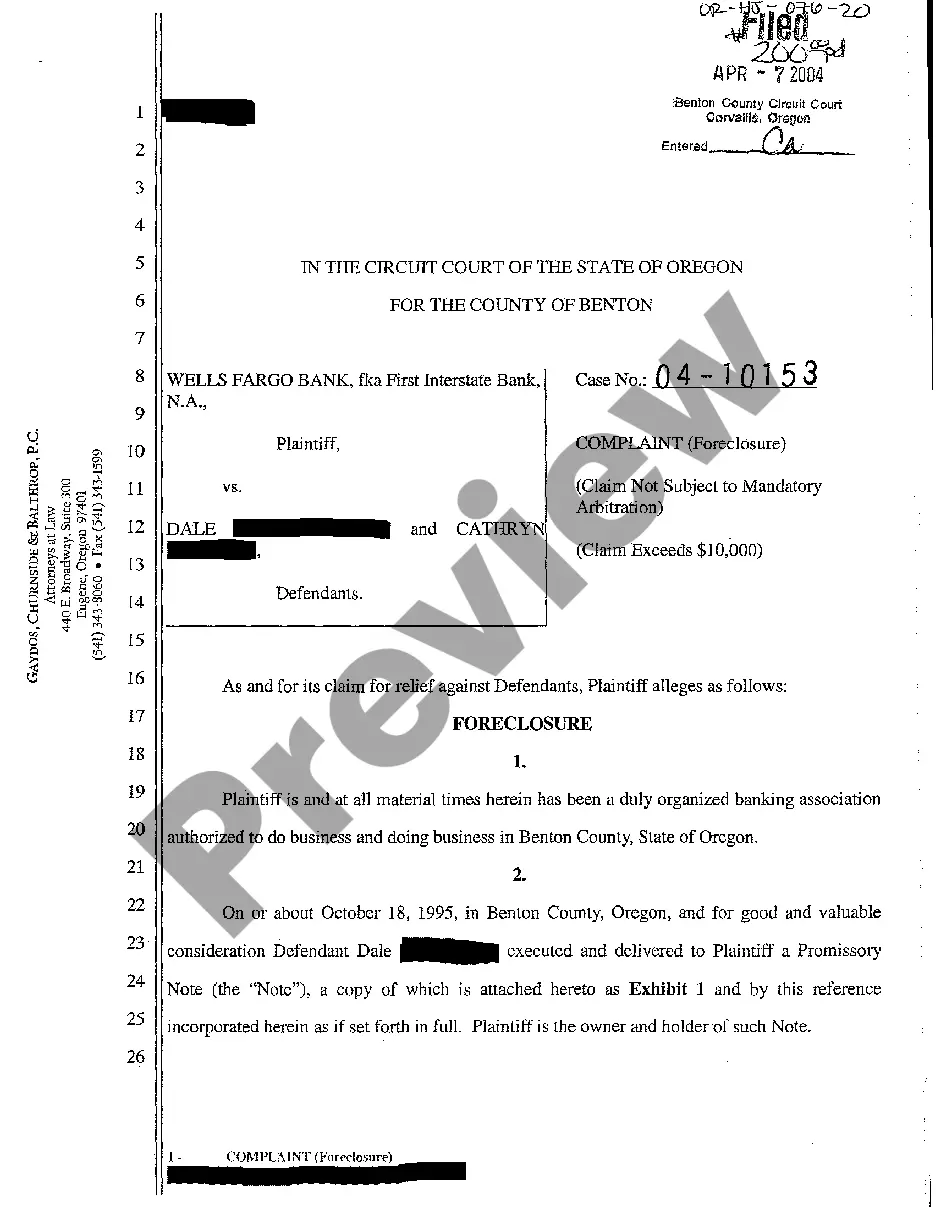

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Florida Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a broad selection of legal document designs that you can download or print.

By using the site, you will acquire thousands of templates for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of templates similar to the Florida Notice to Debt Collector - Falsely Representing a Document as Legal Process in just a few minutes.

Check the form outline to confirm that you have chosen the correct document.

If the form does not meet your needs, use the Search box at the top of the page to find the one that does.

- If you possess an active monthly subscription, Log In to download the Florida Notice to Debt Collector - Falsely Representing a Document as Legal Process from your US Legal Forms library.

- The Obtain button will appear on each form you view.

- All previously downloaded templates can be accessed from the My documents section of your personalized account.

- If you are new to US Legal Forms, here are simple instructions to get started.

- Ensure you have selected the appropriate form for your city/region.

- Click the Preview button to review the form's details.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.