Florida Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

US Legal Forms - one of many largest libraries of legal varieties in the States - offers a wide range of legal record layouts it is possible to down load or print. Making use of the internet site, you may get thousands of varieties for business and individual functions, sorted by types, claims, or keywords and phrases.You can get the most up-to-date models of varieties like the Florida Stock Option Grants and Exercises and Fiscal Year-End Values within minutes.

If you have a subscription, log in and down load Florida Stock Option Grants and Exercises and Fiscal Year-End Values in the US Legal Forms catalogue. The Down load key will appear on each kind you see. You gain access to all earlier downloaded varieties in the My Forms tab of the bank account.

If you want to use US Legal Forms for the first time, listed here are straightforward guidelines to help you started:

- Be sure you have selected the best kind for your personal metropolis/county. Click the Review key to check the form`s information. Browse the kind outline to actually have chosen the appropriate kind.

- If the kind doesn`t match your specifications, use the Look for discipline at the top of the display screen to get the one who does.

- Should you be pleased with the shape, affirm your choice by simply clicking the Get now key. Then, pick the pricing prepare you prefer and supply your qualifications to sign up for the bank account.

- Procedure the purchase. Make use of your bank card or PayPal bank account to accomplish the purchase.

- Choose the format and down load the shape on your own system.

- Make adjustments. Complete, change and print and indication the downloaded Florida Stock Option Grants and Exercises and Fiscal Year-End Values.

Every single web template you included with your bank account does not have an expiry particular date and it is yours permanently. So, if you want to down load or print yet another version, just visit the My Forms section and click on in the kind you want.

Obtain access to the Florida Stock Option Grants and Exercises and Fiscal Year-End Values with US Legal Forms, by far the most considerable catalogue of legal record layouts. Use thousands of professional and condition-specific layouts that satisfy your small business or individual needs and specifications.

Form popularity

FAQ

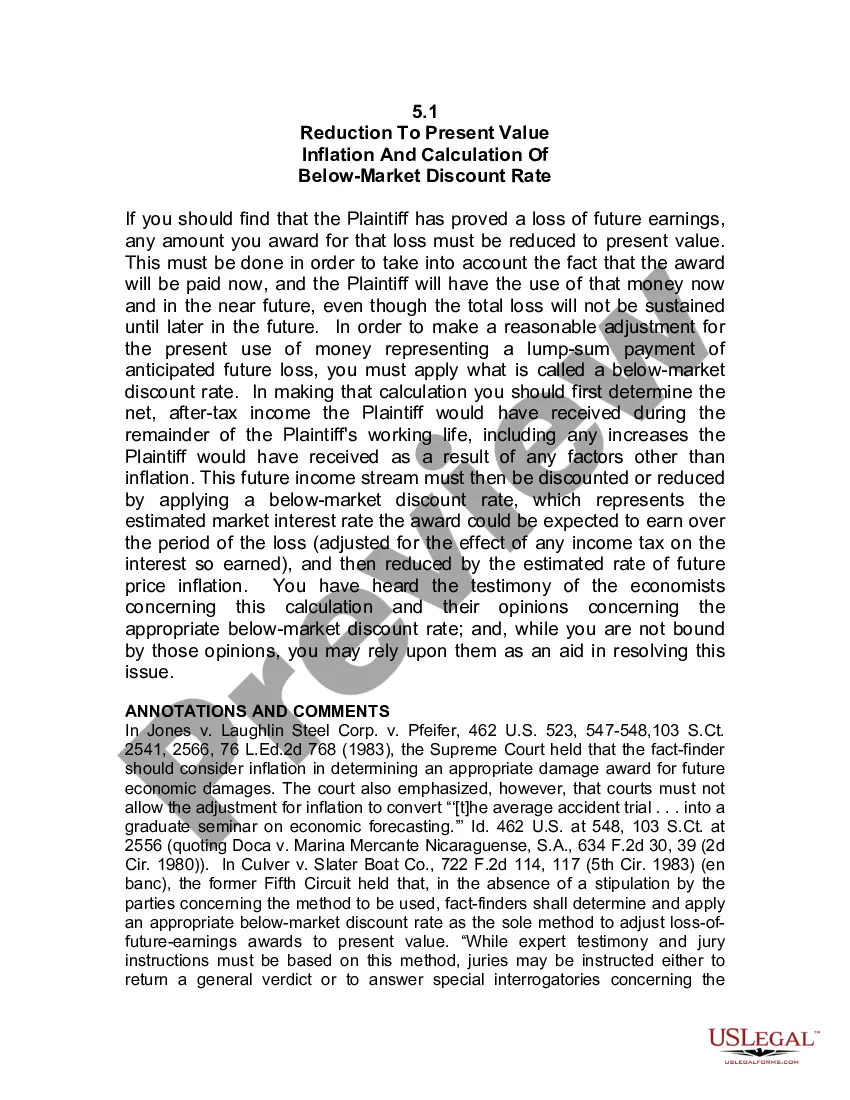

Total stock compensation expense is calculated by taking the number of stock options granted and multiplying by the fair market value on the grant date.

The grant price is the price at which you can purchase shares, and the grant date is the day the stock options are given to you. Vesting is the process of fulfilling the grant (promise). The vesting schedule determines the vesting date - the date when you can begin purchasing stock and using your options.

You have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

Many equity grants range from 0.5% to 3% for first hires. Often, employee stock grants are awarded on a vesting schedule. This is typically where a percentage of the stocks are awarded regularly over a set period of time.

Every stock option has an exercise price, also called the strike price, which is the price at which a share can be bought. In the US, the exercise price is typically set at the fair market value of the underlying stock as of the date the option is granted, in order to comply with certain requirements under US tax law.

FMV influences the price employees, contractors, and other common stock option recipients must pay to purchase their stock options (also known as the strike price). The strike price must be greater than or equal to the FMV stated in the 409A valuation.

Option grants are a type of employee compensation that allows employees to purchase company stock at a discounted price. While option grants have many benefits for employers and employees, they also come with risks and tax implications that should be carefully considered.

You can't exercise your options before the vesting date or after the expiration date. Here's a summary of the terminology you will see in your employee stock option plan: Grant price/exercise price/strike price: The specified price at which your employee stock option plan says you can purchase the stock.