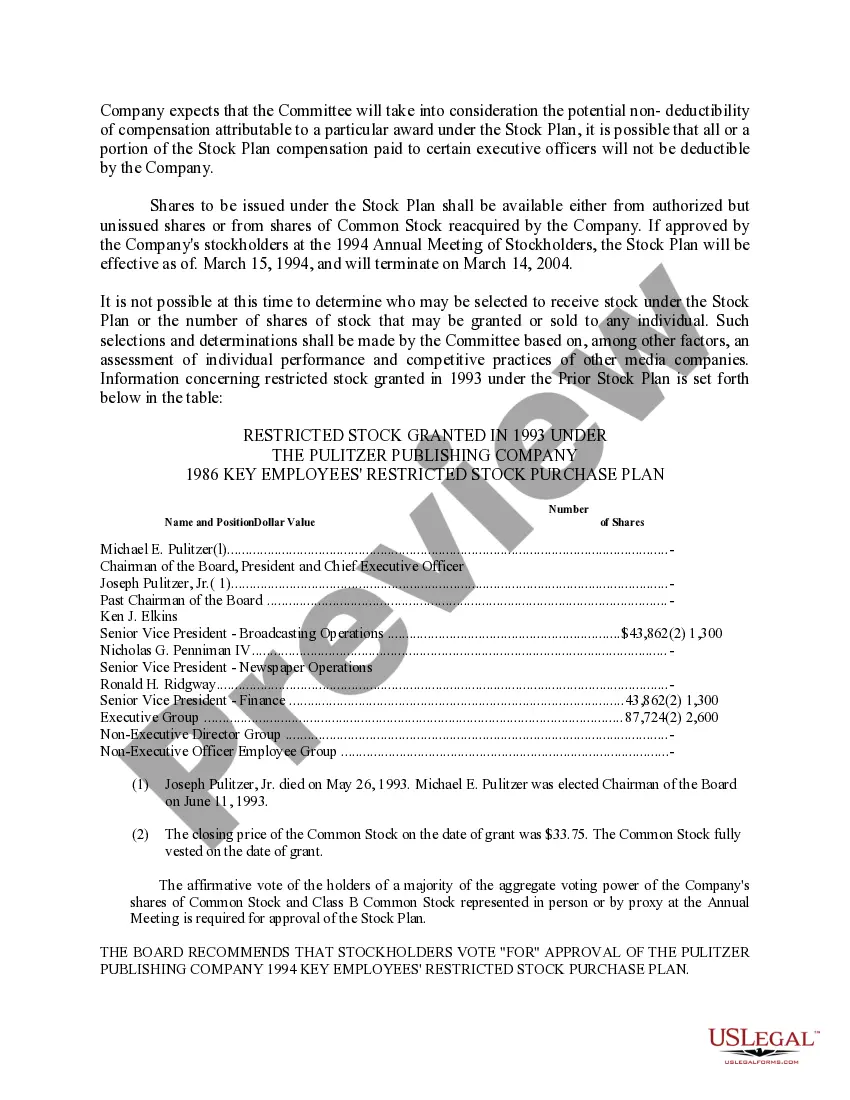

Florida Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co.

Description

How to fill out Approval Of Key Employees' Restricted Stock Purchase Plan Of The Pulitzer Publishing Co.?

US Legal Forms - one of the most significant libraries of lawful kinds in the United States - gives an array of lawful papers themes you are able to obtain or print. Making use of the web site, you can find 1000s of kinds for organization and individual reasons, sorted by types, says, or search phrases.You can find the newest types of kinds just like the Florida Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. within minutes.

If you currently have a membership, log in and obtain Florida Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. from the US Legal Forms library. The Download option will show up on each and every form you look at. You have accessibility to all previously delivered electronically kinds from the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, listed here are easy recommendations to help you get began:

- Be sure to have chosen the proper form for your personal town/state. Click the Preview option to review the form`s articles. Read the form outline to actually have selected the right form.

- When the form doesn`t match your needs, utilize the Lookup industry on top of the display screen to discover the one who does.

- In case you are content with the shape, verify your choice by visiting the Purchase now option. Then, pick the prices program you favor and give your references to register to have an accounts.

- Approach the purchase. Utilize your charge card or PayPal accounts to finish the purchase.

- Find the structure and obtain the shape on the system.

- Make adjustments. Fill out, change and print and sign the delivered electronically Florida Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co..

Each and every design you put into your money does not have an expiry date and it is your own property forever. So, if you want to obtain or print an additional version, just check out the My Forms portion and click on in the form you will need.

Obtain access to the Florida Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. with US Legal Forms, probably the most considerable library of lawful papers themes. Use 1000s of specialist and status-certain themes that meet your business or individual demands and needs.

Form popularity

FAQ

Employee Stock Purchase Plan: Qualified or Non-qualified Now, we can have a look at the key difference between the two types. An ESPP qualified plan is designed and operates ing to Internal Revenue Section (IRS) 423 regulations, whereas a non-qualified ESPP does not meet those criteria.

Can I Sell ESPP Stock Right Away? Yes, you can sell stock purchased through your ESPP plan immediately if you want to guarantee that you profit from your discount. Otherwise, the value of the stock may go up, which increases your profit, or it may go down, causing you to lose money.

Under a § 423 employee stock purchase plan, you have taxable income or a deductible loss when you sell the stock. Your income or loss is the difference between the amount you paid for the stock (the purchase price) and the amount you receive when you sell it.

In this situation, you sell your ESPP shares more than one year after purchasing them, but less than two years after the offering date. This is a disqualifying disposition because you sold the stock less than two years after the offering (grant) date.

ESPP Eligibility Cannot participate in an ESPP if an employee owns more than 5% of the company's stock. Must be employed with the company for a specific period of time. (e.g., 1 to 2 years). ESPPs are a benefit.

An ESPP must be approved by the stockholders of the sponsoring corporation within the period commencing 12 months before and ending 12 months after the ESPP is adopted by the sponsoring corporation's board of directors.