Florida Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp.

Description

How to fill out Stock Option And Dividend Equivalent Plan With Exhibits Of UGI Corp.?

Finding the right legal document template can be quite a have difficulties. Needless to say, there are a lot of web templates available on the net, but how can you get the legal kind you require? Use the US Legal Forms internet site. The assistance gives thousands of web templates, like the Florida Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp., which can be used for business and personal requirements. All the varieties are checked by specialists and meet state and federal demands.

When you are already listed, log in in your bank account and click on the Down load key to have the Florida Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp.. Make use of bank account to appear through the legal varieties you might have ordered formerly. Proceed to the My Forms tab of your own bank account and acquire another duplicate from the document you require.

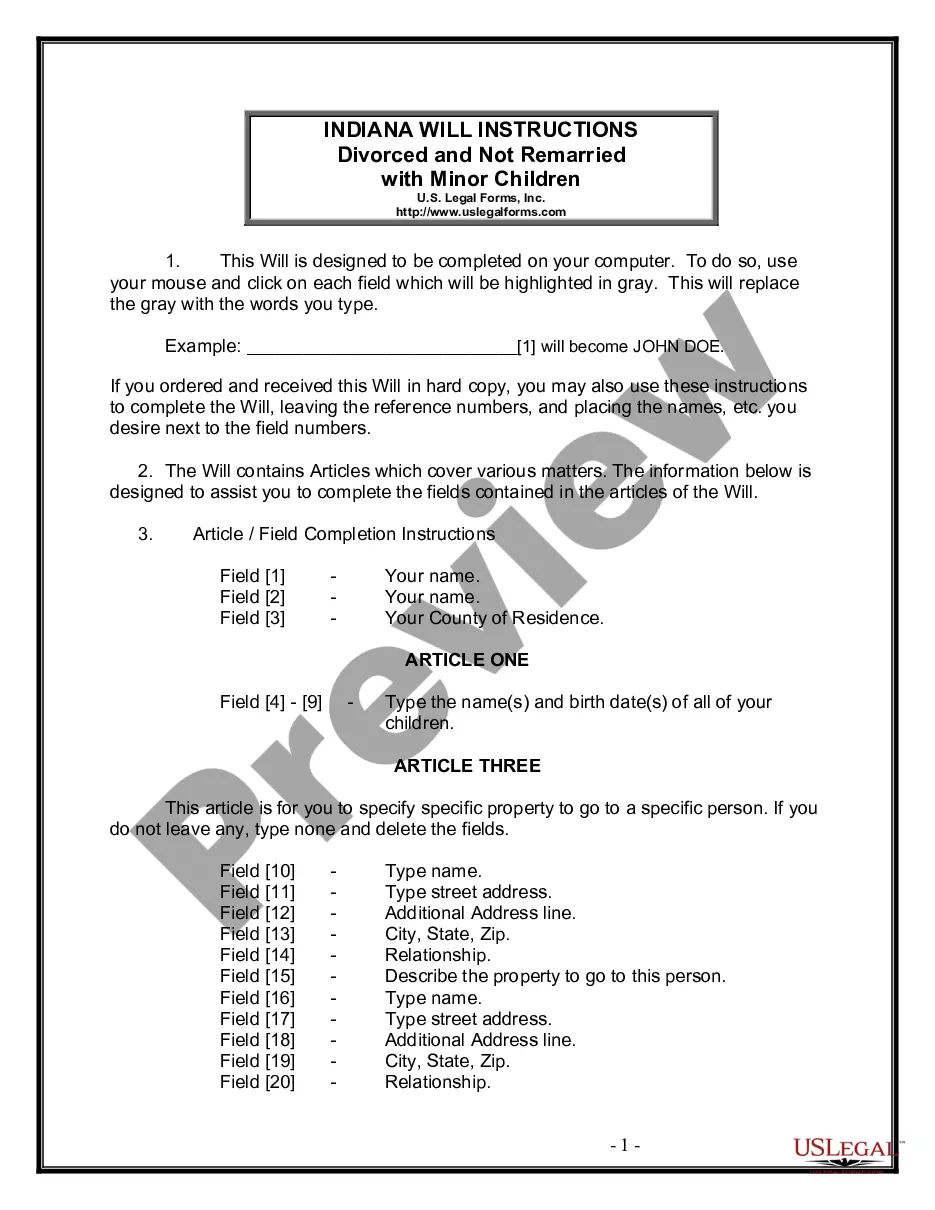

When you are a new user of US Legal Forms, listed here are basic guidelines that you can follow:

- Initial, make sure you have selected the proper kind to your metropolis/region. You can look over the form utilizing the Preview key and look at the form explanation to guarantee it will be the right one for you.

- When the kind is not going to meet your expectations, use the Seach field to obtain the proper kind.

- When you are positive that the form would work, click the Get now key to have the kind.

- Pick the pricing strategy you desire and enter in the necessary details. Build your bank account and pay money for the order making use of your PayPal bank account or bank card.

- Choose the file formatting and download the legal document template in your system.

- Complete, edit and print out and indicator the received Florida Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp..

US Legal Forms is definitely the most significant collection of legal varieties in which you will find a variety of document web templates. Use the service to download professionally-manufactured files that follow express demands.

Form popularity

FAQ

UGI's transfer agent, Computershare Trust Company, N.A., sponsors and administers the direct stock purchase of UGI Corporation stock.

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.

Who owns Ugi? Ugi (NYSE: UGI) is owned by 80.42% institutional shareholders, 1.74% Ugi insiders, and 17.84% retail investors. Blackrock Inc is the largest individual Ugi shareholder, owning 26.92M shares representing 12.85% of the company. Blackrock Inc's Ugi shares are currently valued at $593.32M.

A dividend equivalent payment is treated as a dividend from sources within the United States. ingly, the dividend is subject to the flat 30-percent withholding tax (or lower withholding tax rate, if provided for by a treaty) if received by a nonresident alien or foreign corporation (IRC § 871(m); Reg. §1.881-2).