Florida Adoption of Incentive Stock Plan

Description

How to fill out Adoption Of Incentive Stock Plan?

Choosing the best legal document design can be a struggle. Needless to say, there are a variety of web templates available on the Internet, but how would you get the legal develop you require? Utilize the US Legal Forms site. The assistance offers thousands of web templates, including the Florida Adoption of Incentive Stock Plan, that you can use for organization and personal demands. All the forms are examined by specialists and meet up with state and federal demands.

If you are presently authorized, log in in your account and click on the Download switch to get the Florida Adoption of Incentive Stock Plan. Use your account to look from the legal forms you have purchased previously. Go to the My Forms tab of your respective account and obtain an additional backup of your document you require.

If you are a new consumer of US Legal Forms, listed below are basic directions that you should follow:

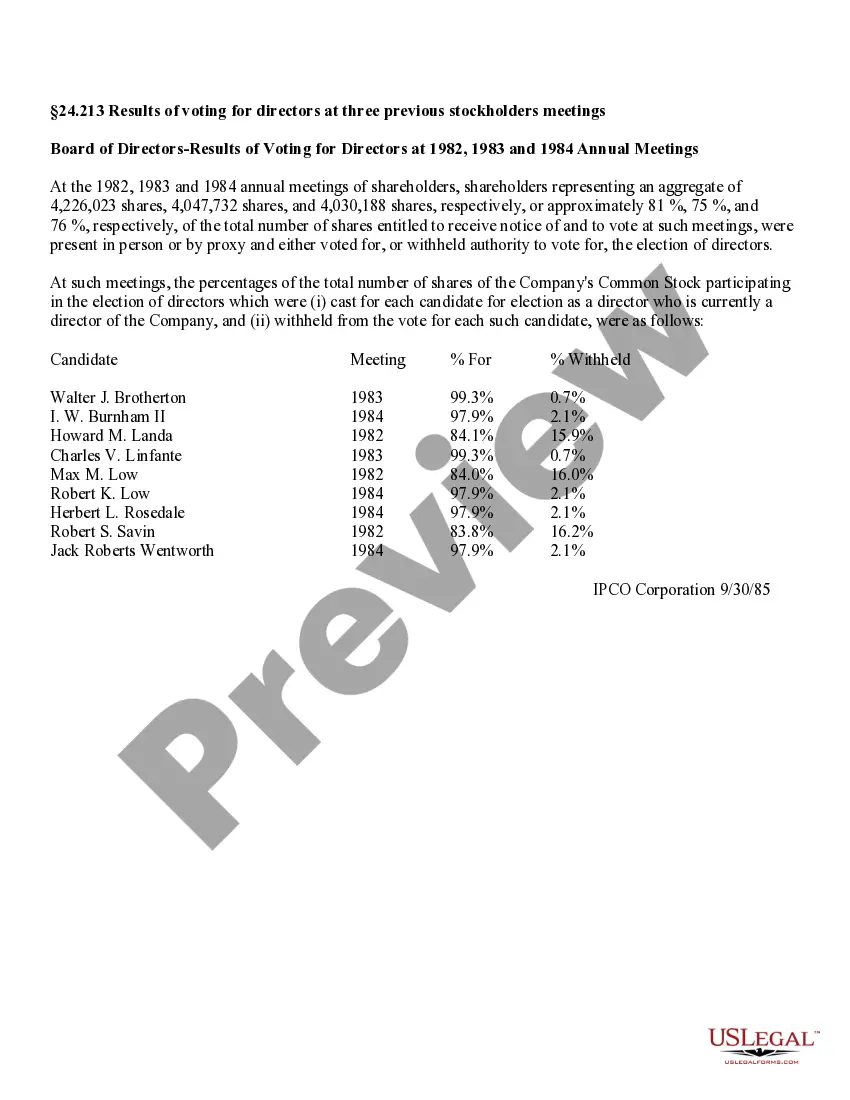

- Initially, be sure you have chosen the appropriate develop to your city/state. You may look over the shape making use of the Review switch and look at the shape description to guarantee it will be the best for you.

- In the event the develop will not meet up with your preferences, utilize the Seach discipline to obtain the proper develop.

- When you are certain the shape is proper, select the Buy now switch to get the develop.

- Pick the rates strategy you would like and enter in the needed information. Make your account and pay for the transaction using your PayPal account or Visa or Mastercard.

- Select the file formatting and obtain the legal document design in your system.

- Comprehensive, change and print out and indication the obtained Florida Adoption of Incentive Stock Plan.

US Legal Forms may be the largest library of legal forms that you can find various document web templates. Utilize the service to obtain skillfully-manufactured documents that follow condition demands.

Form popularity

FAQ

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

You have to exercise ISOs and purchase shares before you can sell your shares. If you choose to exercise your ISOs, you usually have two options: pay for the total in cash or do a ?same-day sale??in other words, sell a portion of your shares to cover the cost of exercise.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

When you exercise your stock options and sell enough shares to cover the option exercise costs, taxes, commissions and fees. You then receive the remaining shares.

Tax Treatment for Incentive Stock Options (ISOs) Stock shares must be held for more than one year for the profit on their sale to qualify as capital gains rather than ordinary income. In the case of ISOs, the shares must be held for more than one year from the date of exercise and two years from the time of the grant.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

Once an option has been selected, the trader would go to the options trade ticket and enter a sell to open order to sell options. Then, he or she would make the appropriate selections (type of option, order type, number of options, and expiration month) to place the order.