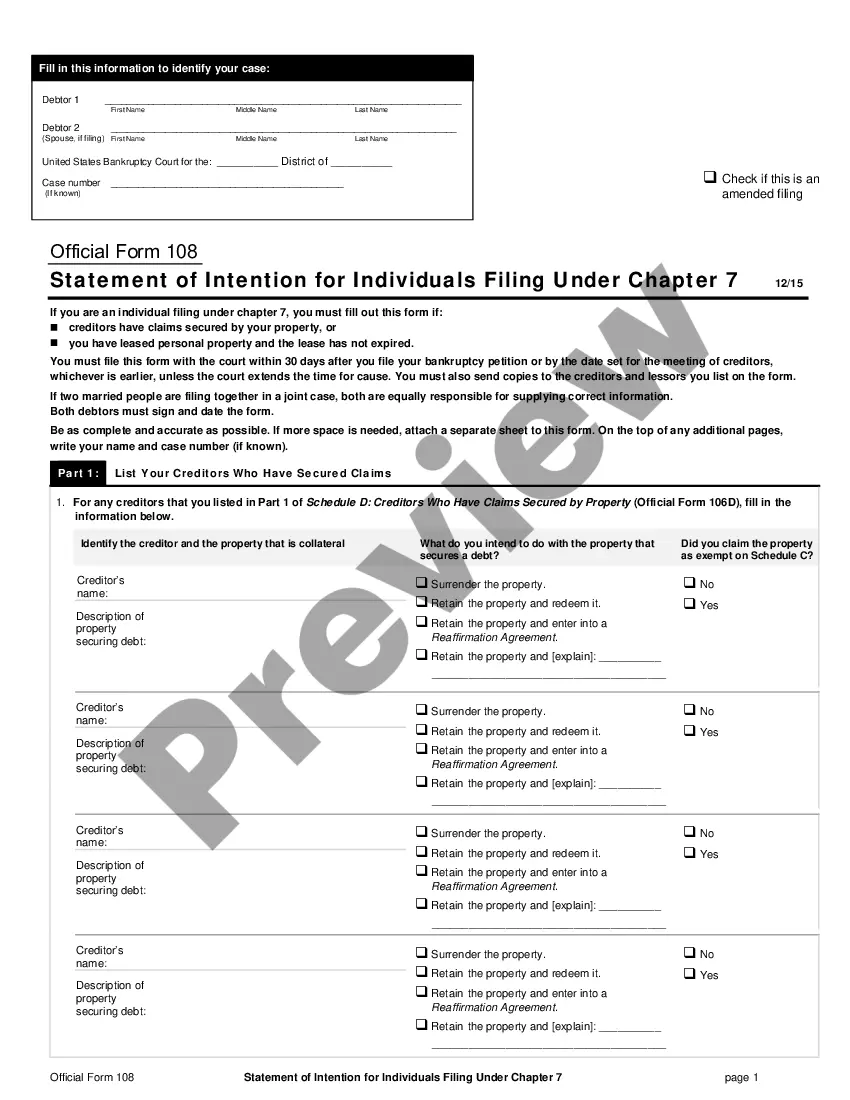

Florida Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

Discovering the right legal papers format might be a have difficulties. Obviously, there are plenty of templates available on the Internet, but how would you find the legal develop you want? Utilize the US Legal Forms internet site. The services gives a huge number of templates, such as the Florida Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, which you can use for business and private requirements. All of the forms are inspected by pros and meet up with federal and state needs.

Should you be presently registered, log in for your profile and then click the Acquire option to have the Florida Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005. Utilize your profile to search through the legal forms you might have purchased in the past. Proceed to the My Forms tab of your own profile and obtain an additional duplicate of your papers you want.

Should you be a whole new end user of US Legal Forms, listed below are simple instructions that you can comply with:

- Initially, ensure you have chosen the proper develop for your personal metropolis/area. It is possible to look through the shape using the Preview option and read the shape information to ensure this is basically the right one for you.

- When the develop is not going to meet up with your preferences, use the Seach industry to find the right develop.

- When you are certain the shape is acceptable, go through the Acquire now option to have the develop.

- Choose the costs strategy you desire and enter in the necessary information and facts. Build your profile and purchase your order with your PayPal profile or bank card.

- Select the file file format and down load the legal papers format for your system.

- Comprehensive, modify and print and indicator the acquired Florida Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

US Legal Forms may be the largest local library of legal forms where you can see numerous papers templates. Utilize the service to down load skillfully-created papers that comply with state needs.

Form popularity

FAQ

Disadvantages to a Chapter 7 Bankruptcy: If you want to keep a secured asset, such as a car or home, and it is not completely covered by your bankruptcy exemptions then Chapter 7 is not an option. The automatic stay created by filing Chapter 7 Bankruptcy only serves as a temporary defense against foreclosure.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

Disadvantages to a Chapter 7 Bankruptcy: The Trustee will sell any non-exempt property you own. ... The automatic stay created by filing Chapter 7 Bankruptcy only serves as a temporary defense against foreclosure. Co-signors of a loan can be stuck with your debt unless they also file for bankruptcy protection.

Filing for Chapter 7 bankruptcy will wipe out your mortgage obligation. Still, if you aren't willing to pay the mortgage, you'll have to give up the home because your lender's right to foreclose doesn't go away when you file for Chapter 7.

That being said, here's what you're not allowed to do with a Chapter 7: Lie under oath about your financial or property assets. Keep property that must be used to discharge your debts. Miss payments to certain creditors in order to keep your home.

A Chapter 7 bankruptcy wipes out mortgages, car loans, and other secured debts. But if you don't continue to pay as agreed, the lender will take back the home, car, or other collateralized property using the lender's lien rights.

The consequences of a Chapter 7 bankruptcy are significant: you will likely lose property, and the negative bankruptcy information will remain on your credit report for ten years after the filing date.

Filing Chapter 7 bankruptcy in Florida includes the following steps: Determine if bankruptcy is the best option. ... Evaluate applicable exemptions. ... Prepare the bankruptcy petition. ... Automatic stay. ... Assignment to a Chapter 7 trustee. ... Objection to exemptions. ... Adversary claims. ... Bankruptcy discharge.