Florida Disclosure of Compensation of Attorney for Debtor - B 203

Description

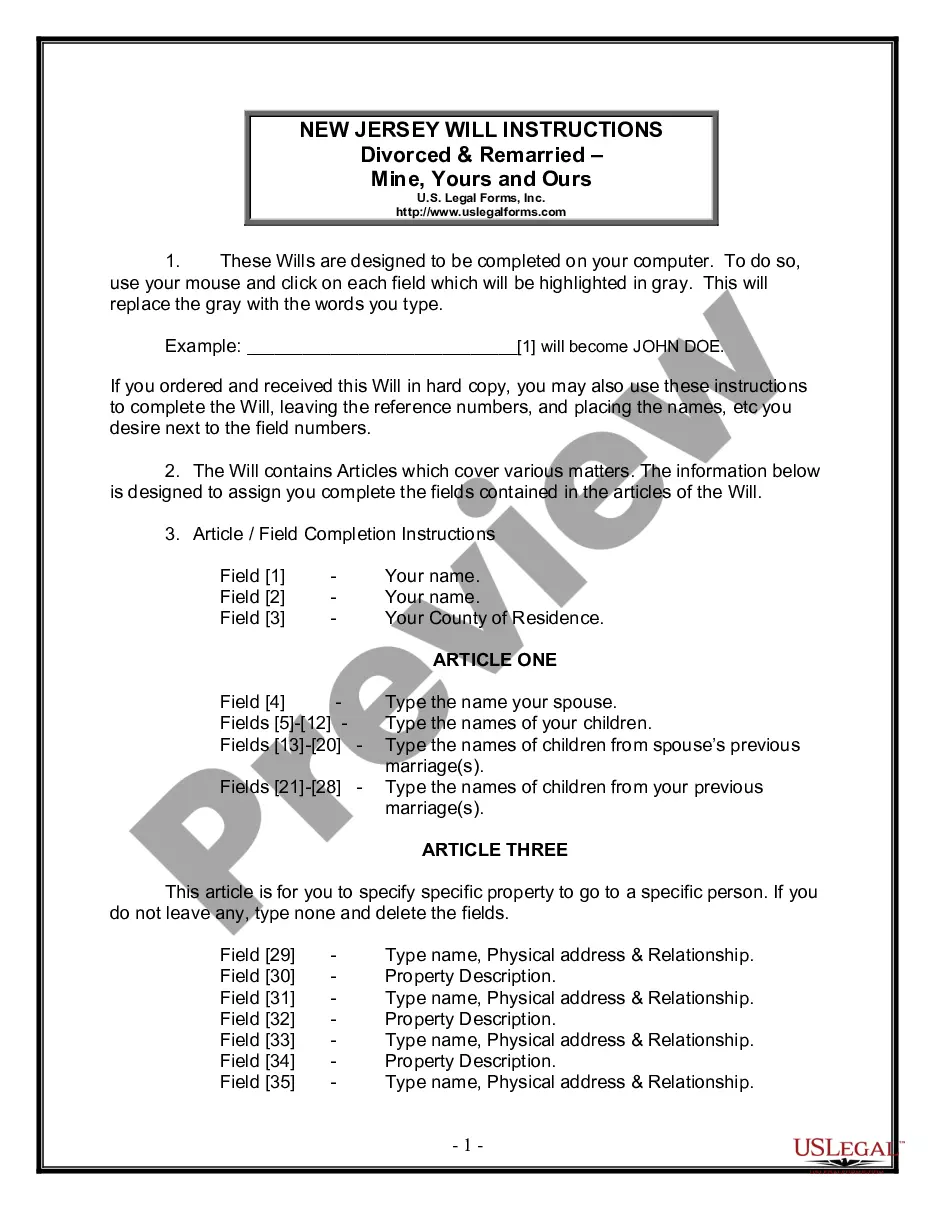

How to fill out Disclosure Of Compensation Of Attorney For Debtor - B 203?

If you need to complete, obtain, or printing lawful record templates, use US Legal Forms, the largest collection of lawful kinds, that can be found on the Internet. Use the site`s basic and handy look for to get the paperwork you require. Various templates for company and specific reasons are sorted by groups and says, or key phrases. Use US Legal Forms to get the Florida Disclosure of Compensation of Attorney for Debtor - B 203 with a number of mouse clicks.

In case you are already a US Legal Forms buyer, log in to the bank account and click on the Obtain switch to get the Florida Disclosure of Compensation of Attorney for Debtor - B 203. You can also accessibility kinds you formerly acquired in the My Forms tab of the bank account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the form for that appropriate town/nation.

- Step 2. Make use of the Review method to look over the form`s content. Do not forget to read the information.

- Step 3. In case you are not happy using the form, make use of the Look for discipline on top of the display screen to get other models of the lawful form web template.

- Step 4. Upon having located the form you require, click the Purchase now switch. Pick the prices strategy you favor and include your accreditations to sign up on an bank account.

- Step 5. Approach the deal. You can use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Pick the formatting of the lawful form and obtain it on your own gadget.

- Step 7. Total, modify and printing or signal the Florida Disclosure of Compensation of Attorney for Debtor - B 203.

Each lawful record web template you acquire is your own permanently. You have acces to each and every form you acquired in your acccount. Go through the My Forms area and select a form to printing or obtain once more.

Contend and obtain, and printing the Florida Disclosure of Compensation of Attorney for Debtor - B 203 with US Legal Forms. There are millions of professional and express-particular kinds you can use for your personal company or specific requirements.