Florida Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

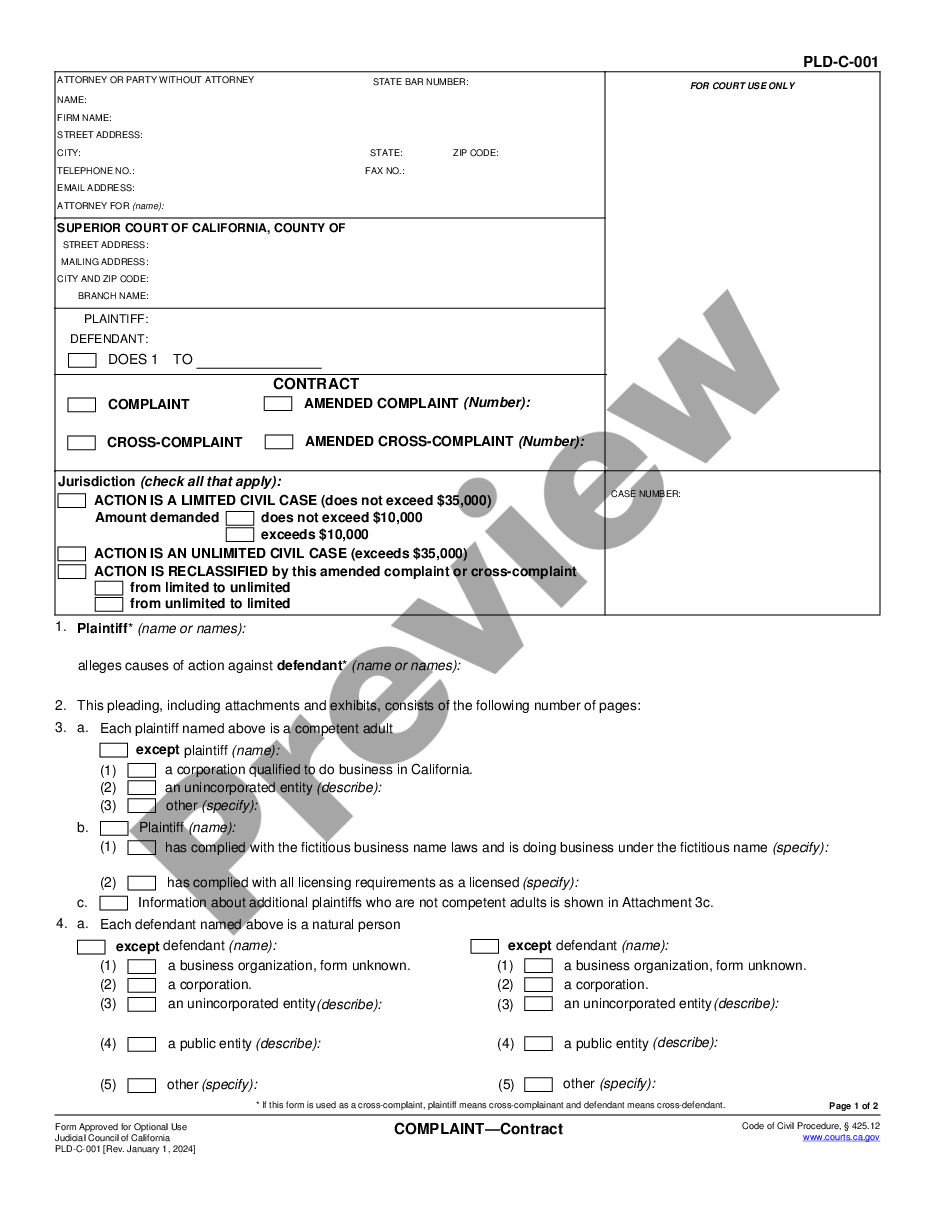

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal paperwork templates that can be downloaded or printed.

Using the platform, you can access thousands of forms for business and personal use, categorized by type, state, or keywords. You can find the latest versions of forms such as the Florida Notice of Adverse Action - Non-Employment - Due to Credit Report in just a few minutes.

If you already have an account, Log In to download the Florida Notice of Adverse Action - Non-Employment - Due to Credit Report from the US Legal Forms database. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form onto your device. Make edits. Complete, modify, print, and sign the downloaded Florida Notice of Adverse Action - Non-Employment - Due to Credit Report. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Florida Notice of Adverse Action - Non-Employment - Due to Credit Report with US Legal Forms, which boasts one of the most comprehensive catalogs of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure that you have selected the correct form for your city/region.

- Click on the Preview button to review the form's content.

- Read the form description to make sure you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Waiting period. While not explicitly prescribed by the FCRA, courts and Federal Trade Commission guidance suggest five days is a reasonable period to wait after the pre-adverse action notice and before taking adverse action.

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

Continue with the hire or take adverse action Taking adverse action is regrettable for both the organization and the candidate, but eventually you'll need to decide to rescind your job offer or proceed with hiring.

An adverse action notice will not hurt your credit score or show up on your credit report. However, if the creditor pulls a hard credit inquiry, this may temporarily lower your scoreand all hard inquiries remain on your credit report for two years.

The creditor must notify an applicant of adverse action within 90 days after making a counteroffer unless the applicant accepts or uses the credit during that time. incomplete and the creditor sent the applicant a notice of incompleteness that met certain requirements set forth in 12 CFR 1002.9(c).

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

The first part of the 30-day rule requires creditors to provide notification of their credit decision within 30 days after receiving a completed application concerning the creditor's approval of, or counteroffer to, or adverse action on the application. While this is a mouthful to say, it really isn't that difficult.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

These checks include employment history, criminal records, and the sex offender registry. It may also include a credit check. To be the subject of a level 1 check, an individual should neither be awaiting arrest nor holding any record of felony or delinquency as prohibited by the Florida Statutes.

In the credit score exception notices, creditors are required to disclose the distribution of credit scores among consumers who are scored under the same scoring model that is used to generate the consumer's credit score using the same scale as that of the credit score provided to the consumer.