Florida Merchandise Return Sheet

Description

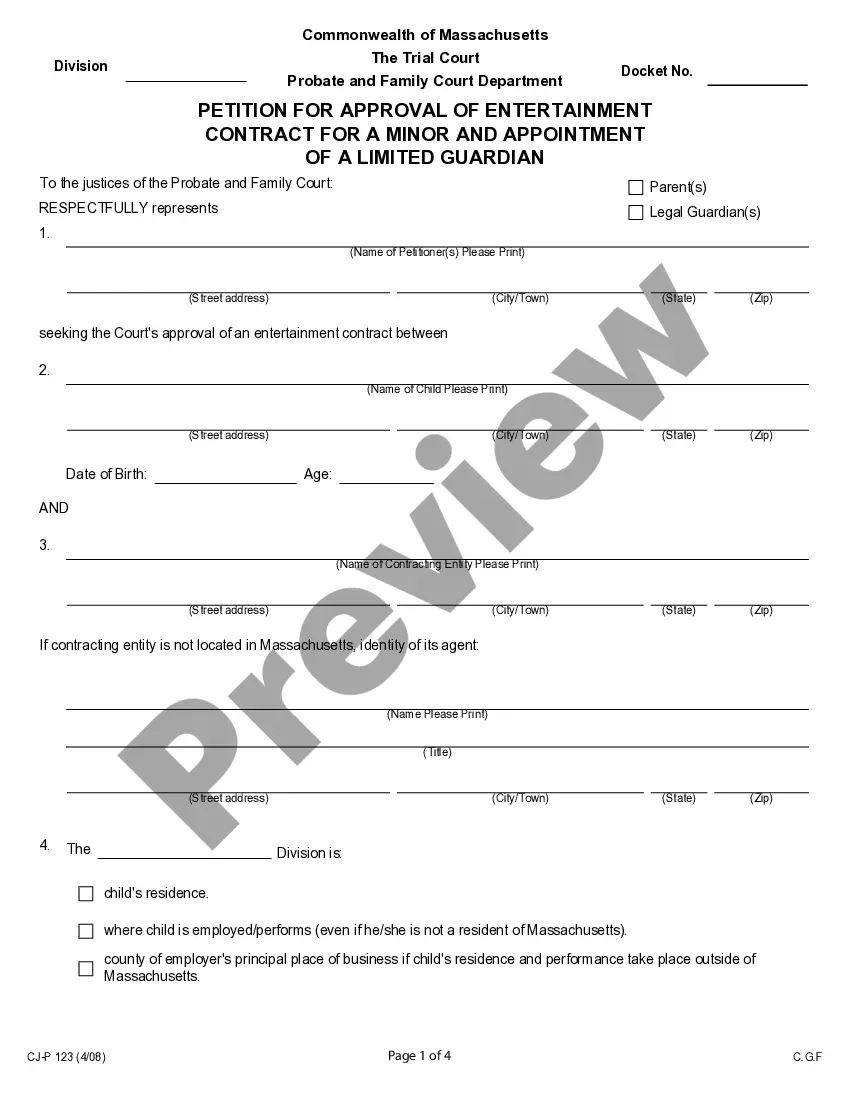

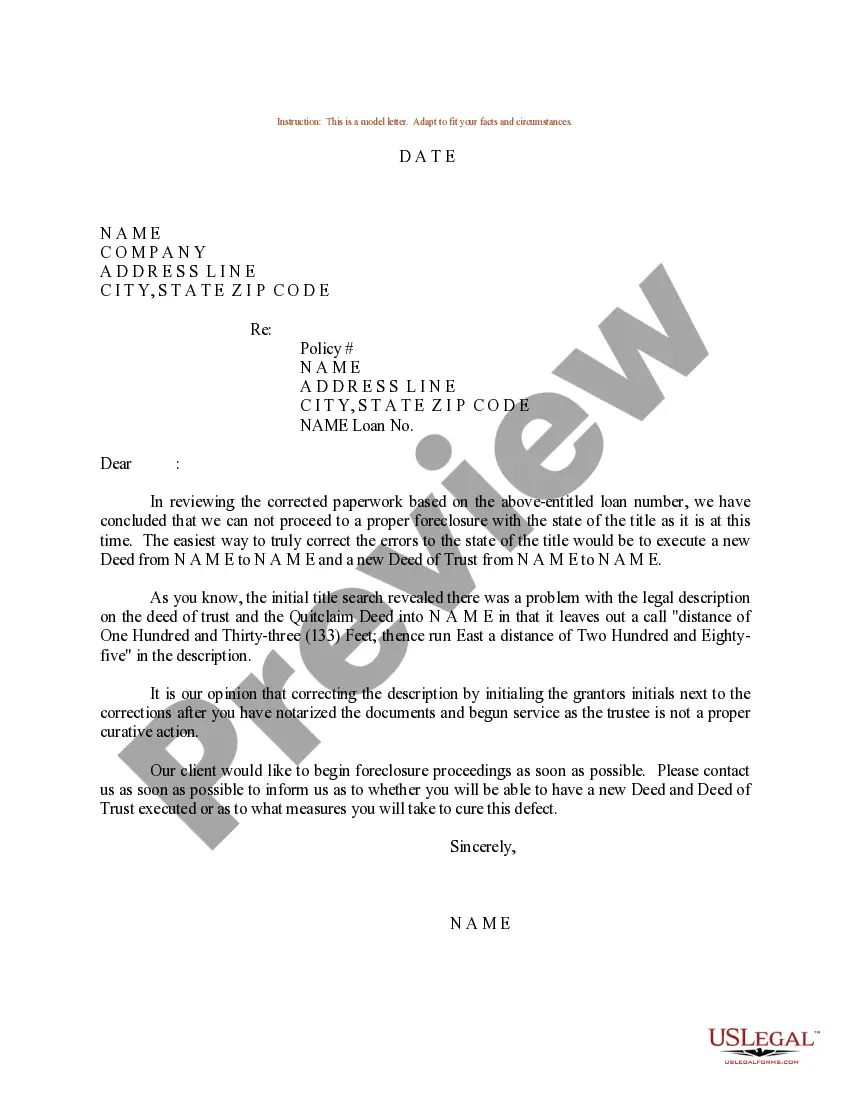

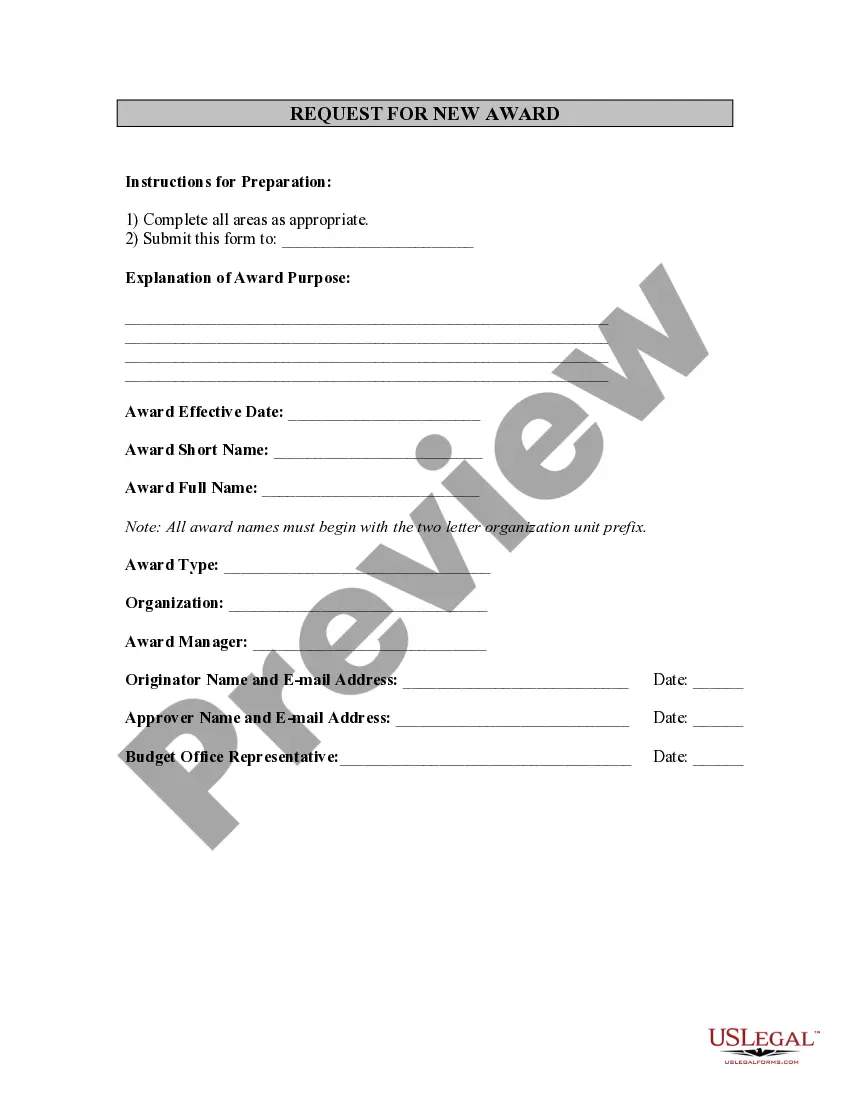

How to fill out Merchandise Return Sheet?

Locating the correct sanctioned document format can pose a challenge. Obviously, there are numerous templates available online, but how do you locate the sanctioned form you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the Florida Merchandise Return Sheet, that you can utilize for business and personal purposes.

All of the forms are vetted by experts and comply with federal and state requirements.

If you are already a registered user, sign in to your account and then click the Acquire button to get the Florida Merchandise Return Sheet. Use your account to browse the sanctioned forms you may have purchased before. Navigate to the My documents tab in your account to download another copy of the document you need.

Select the file format and download the sanctioned document format to your device. Complete, modify, and print and sign the acquired Florida Merchandise Return Sheet. US Legal Forms is the largest collection of sanctioned forms where you can find various document templates. Benefit from the service to obtain expertly crafted documents that adhere to state regulations.

- First, confirm that you have selected the correct form for your city/region.

- You can review the form using the Preview button and read the form description to ensure it is the proper one for you.

- If the form does not meet your requirements, use the Search section to find the correct form.

- Once you are confident that the form is accurate, click on the Purchase now button to obtain the form.

- Choose the pricing plan you desire and enter the required information.

- Create your account and finalize your order using your PayPal account or credit card.

Form popularity

FAQ

A purchase return authorization is a return that is processed much like a typical transaction. Through this process, the cardholder will see the transaction pending in their account as soon as it is submitted, instead of having to wait days for the return to post.

Customer Returns and Refunds Under Federal Law While many retailers have decided this makes for the best business practice, they aren't legally required to accept returns. Rather, retailers are required to accept returns only if the sold good is defective or if they otherwise break the sales contract.

United States. While there are no federal refund laws in the US, many state laws don't legally require refunds, instead allowing businesses to set their own refund policy. In some states, not conspicuously displaying a no refund policy means customers are entitled to refunds.

A purchase return occurs when a buyer returns merchandise that it had purchased from a supplier. Since the return of purchased merchandise is time consuming and costly, under the periodic inventory system there will be an account Purchases Returns.

In retail, a product return is the process of a customer taking previously purchased merchandise back to the retailer, and in turn receiving a refund in the original form of payment, exchange for another item (identical or different), or a store credit.

U.S. state laws do not require a Return & Refund Policy either but under certain circumstances, you will need to post this policy conspicuously in your storefront or through your ecommerce website. Issuing returns and refunds is at your store discretion.

Merchandise return transactions are SEPARATE transaction from the original purchase request. No reference to the original authorization or clearing record is required in the purchase return authorization request.

A purchase return occurs is when the buyer of merchandise, inventory, fixed assets, or other items sends these goods back to the seller. Excessive purchase returns can interfere with the profitability of a business, so they should be closely monitored.

A business cannot have a 'No Refund' policy. It's against the law to say you will not provide a refund under any circumstances. This includes sales, gift items and even secondhand goods.

If a retailer does have a returns policy, then you'll usually have between 28-30 days to return an item and get a refund or exchange.