Florida Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

If you wish to complete, retrieve, or create lawful document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Leverage the website's user-friendly and accessible search functionality to locate the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to obtain the Florida Agreement to Sell Partnership Interest to Third Party with just a few clicks.

Every legal document format you acquire is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and download, then print the Florida Agreement to Sell Partnership Interest to Third Party with US Legal Forms. There are numerous professional and state-specific forms available for your business or individual needs.

- If you are a current US Legal Forms customer, Log In to your account and click the Download button to acquire the Florida Agreement to Sell Partnership Interest to Third Party.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

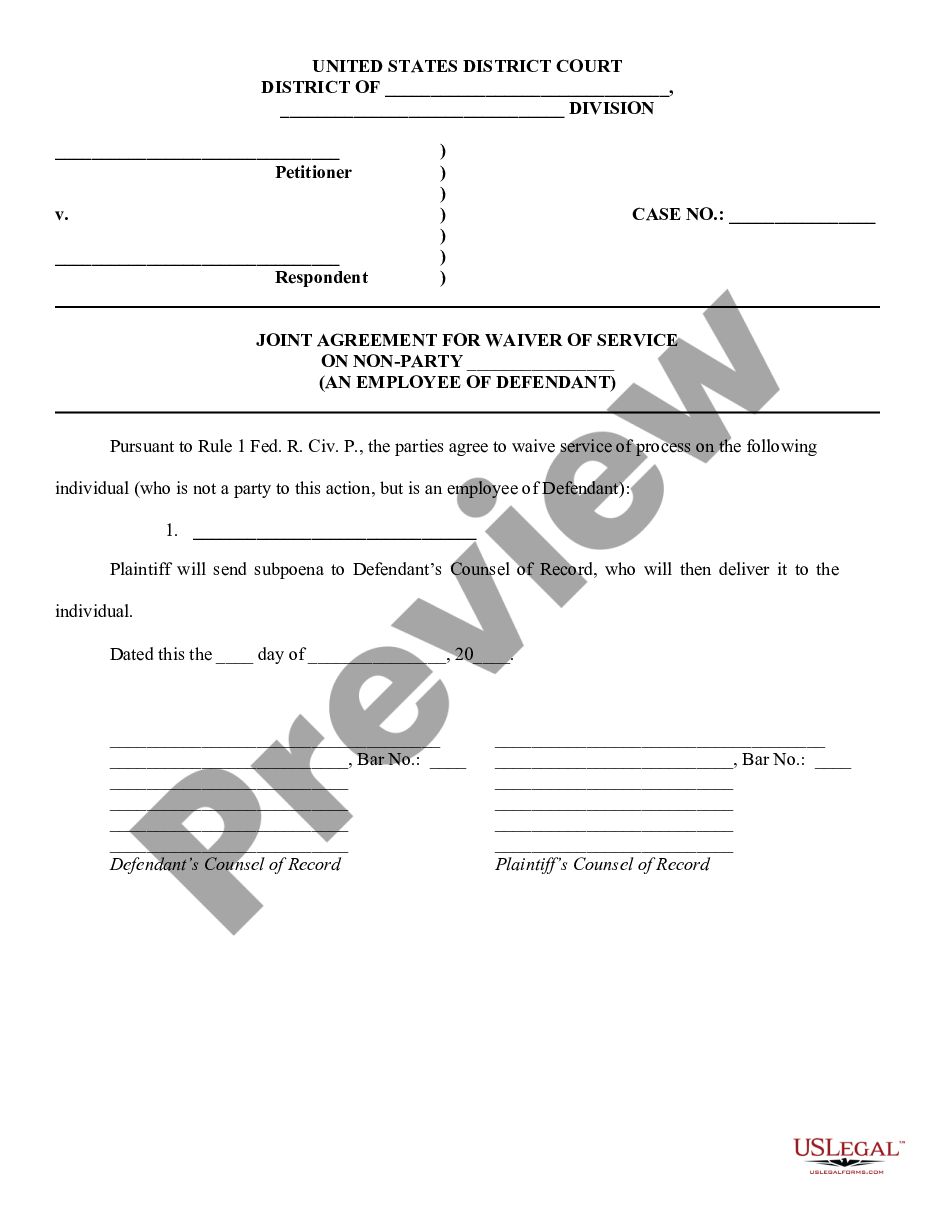

- Step 2. Utilize the Preview feature to review the form's content. Remember to check the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you require, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to sign up for an account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Florida Agreement to Sell Partnership Interest to Third Party.

Form popularity

FAQ

Here's an overview of what those steps entail:Review your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.

How to Sell Limited Partnership InterestRealize the interest's value immediately.Convert a non-functioning tax shelter into cash.Eliminate future k-1 reporting.Avoid ongoing annual payment of income tax on the investment in question.Simplify your tax return and estate planning.More items...?

Buyouts over time agree that the purchasing partner will pay the bought out partner a predetermined amount over time until their ownership has been fully purchased. Similarly, an earn-out pays the partner out over time but requires the partner to stay with the company during a defined transition period.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

2212 If a partner is selling his entire partnership interest, then his share of partnership liabilities will be reduced to zero and thus his amount realized will increase by at least the entire amount of his former share of partnership liabilities.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).