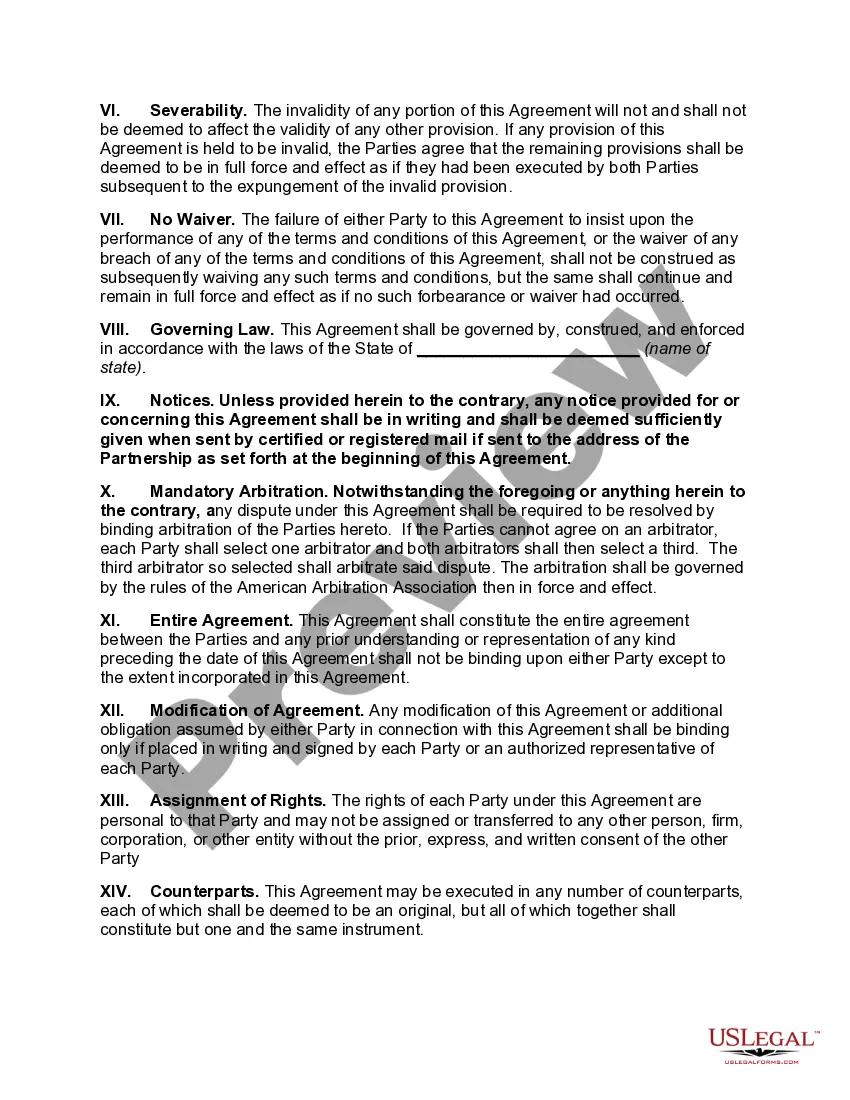

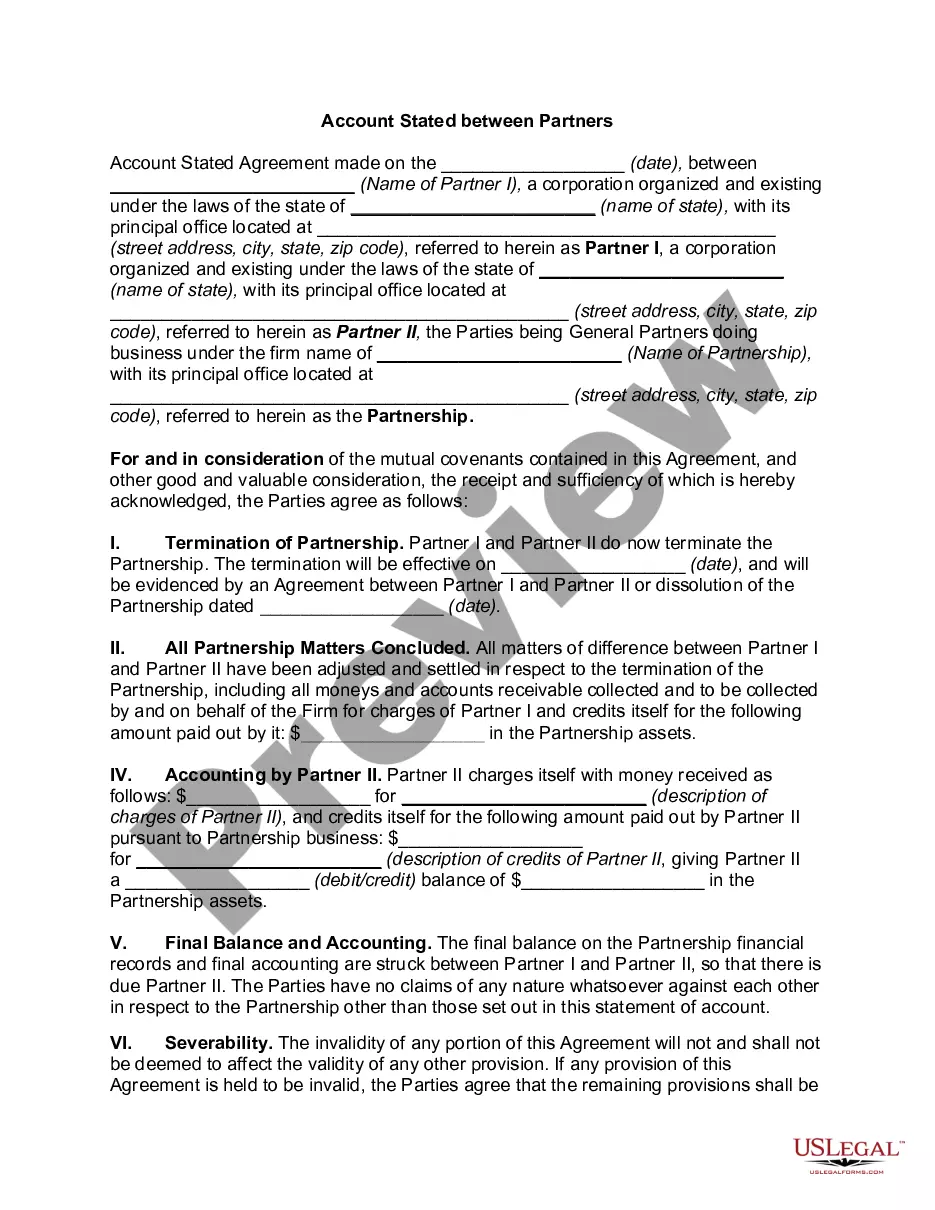

Florida Account Stated Between Partners and Termination of Partnership

Description

How to fill out Account Stated Between Partners And Termination Of Partnership?

Have you been in the position where you need to have papers for both enterprise or personal purposes almost every day time? There are tons of legal record web templates accessible on the Internet, but getting kinds you can rely is not effortless. US Legal Forms gives 1000s of form web templates, like the Florida Account Stated Between Partners and Termination of Partnership, which can be published in order to meet federal and state demands.

In case you are currently acquainted with US Legal Forms web site and get a merchant account, simply log in. Following that, you are able to obtain the Florida Account Stated Between Partners and Termination of Partnership design.

Should you not provide an account and wish to begin using US Legal Forms, follow these steps:

- Find the form you require and make sure it is for your right town/state.

- Take advantage of the Review switch to review the shape.

- See the outline to ensure that you have chosen the right form.

- When the form is not what you`re looking for, take advantage of the Research area to obtain the form that meets your requirements and demands.

- If you get the right form, click Buy now.

- Choose the costs strategy you would like, fill out the required information to generate your account, and purchase the order utilizing your PayPal or credit card.

- Select a convenient paper formatting and obtain your version.

Get all the record web templates you might have bought in the My Forms menu. You can aquire a further version of Florida Account Stated Between Partners and Termination of Partnership any time, if required. Just click the required form to obtain or produce the record design.

Use US Legal Forms, probably the most extensive assortment of legal kinds, to conserve time as well as stay away from errors. The services gives professionally created legal record web templates that can be used for a selection of purposes. Generate a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

1] Realisation Account The object of preparing Realisation account is to close the books of accounts of the dissolved firm and to determine profit or loss on the Realisation of assets and payment of liabilities. It is prepared by: Transferring all the assets except Cash or Bank Account to the debit side of the account.

The partner takes the distributed property with the same basis that he had in his partnership interest, reduced by the amount of money received. As a result, any gain or loss realized on the liquidation is eventually recognized when the former partner disposes of the distributed property. Liquidating Partnership Distributions - Federal - Topics | Wolters Kluwer cch.com ? topic ? liquidating-partn... cch.com ? topic ? liquidating-partn...

In settling accounts among the partners, the profits and losses that result from the liquidation of the partnership assets must be credited and charged to the partners' accounts. The partnership shall make a distribution to a partner in an amount equal to that partner's positive account balance. 35-10-629. Settlement of accounts among partners, MCA Montana Legislature (.gov) ? mca ? part_0060 ? section_0290 Montana Legislature (.gov) ? mca ? part_0060 ? section_0290

Dissolving a partnership firm means discontinuing the business under the name of the said partnership firm. In this case, all liabilities are finally settled by selling off assets or transferring them to a particular partner, settling all accounts that existed with the partnership firm.

Accounting entries for dissolution of a partnership business: Transfer all assets. Dr Realisation account. ... Sale of assets. Dr Bank account. ... Assets taken by partner. Dr Capital account. ... Receipts from customers. ... Payment to trade payable. ... Dissolution expenses and any other expense. ... Transfer of current account. Payment of Loan.

5 steps to dissolve a partnership. Dissolving a partnership includes reviewing your agreement, discussing the situation with your partner, preparing dissolution papers, closing accounts, and then communicating the change to relevant parties.

How are accounts settled. Losses of the firm will be paid out of the profits, next out of the capital of the partners, and even then if losses aren't paid off, losses will be divided among the partners in profit sharing ratios. Third party debts will be paid first. How to Dissolve a Partnership Firm? - ClearTax ClearTax ? ... ? MANAGE-BUSINESS ClearTax ? ... ? MANAGE-BUSINESS

The following are the rules of settlement of accounts on dissolution as per the Section 48 of Partnership Act 1932. Application of Assets: Amount received by the realisation (sale) of the assets shall be used in the following order: First of all the external liabilities and expenses are to be paid. State the Order of Settlement of Accounts on Dissolution. shaalaa.com ? question-bank-solutions ? stat... shaalaa.com ? question-bank-solutions ? stat...