Florida Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Locating the appropriate legal document template can be a challenge.

Clearly, there are numerous web templates accessible online, but how do you find the legal format you need.

Utilize the US Legal Forms website.

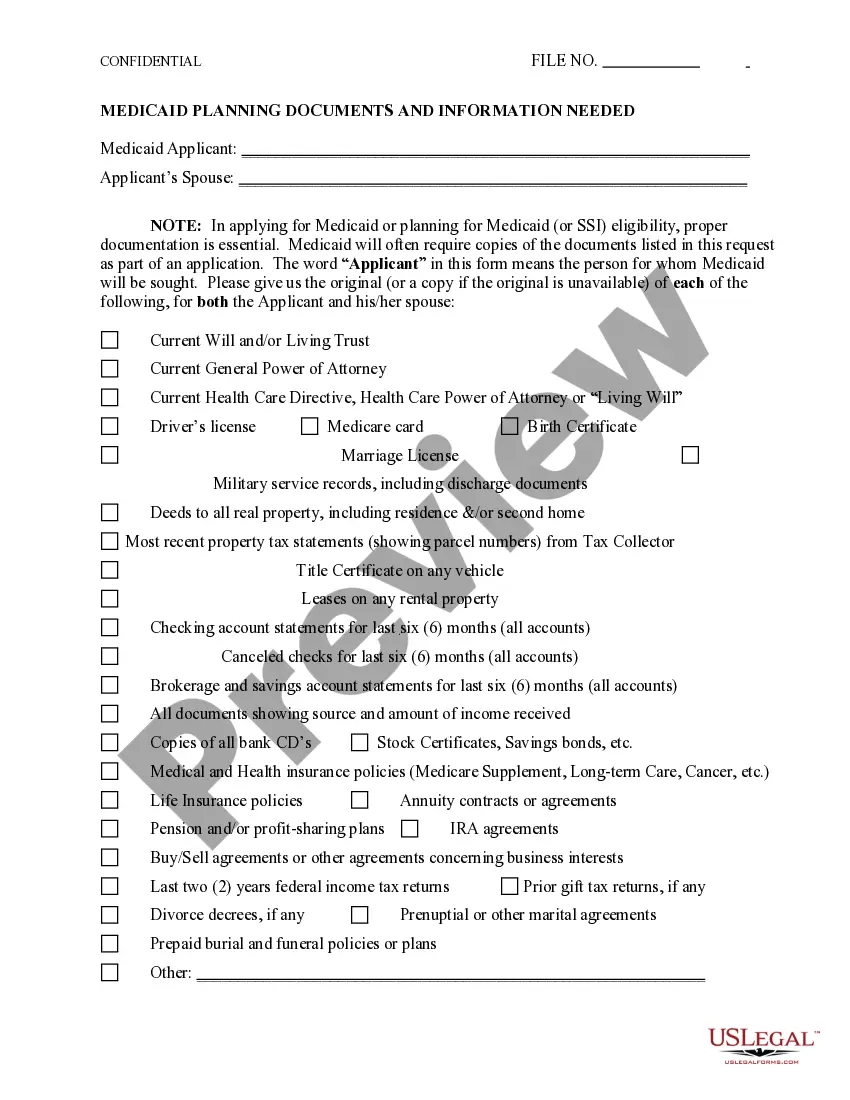

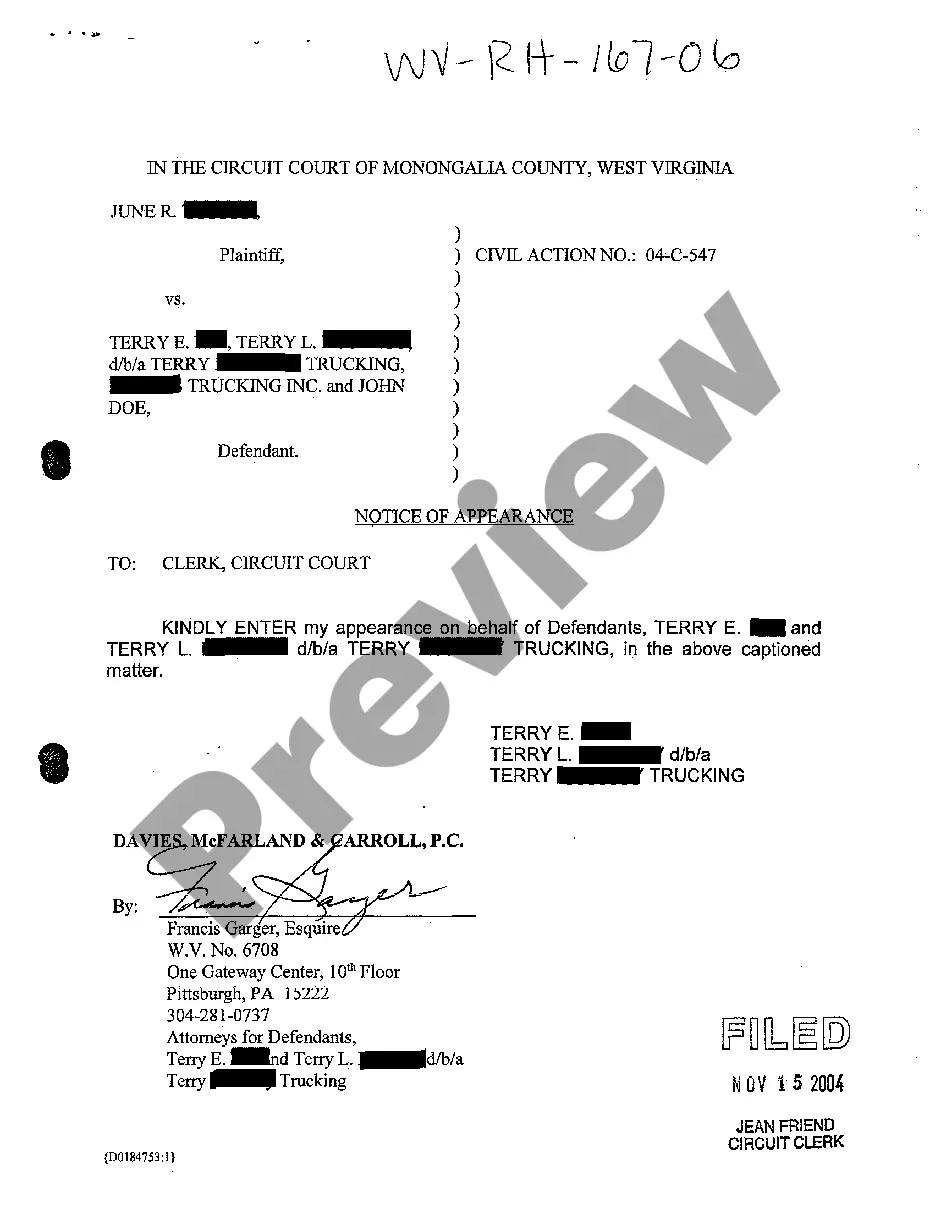

First, ensure that you have selected the correct document for your city/state. You can preview the form using the Review button and read the document details to verify it meets your needs.

- The service offers a wide array of templates, such as the Florida Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, that you can use for business and personal needs.

- All templates are reviewed by experts and comply with federal and state regulations.

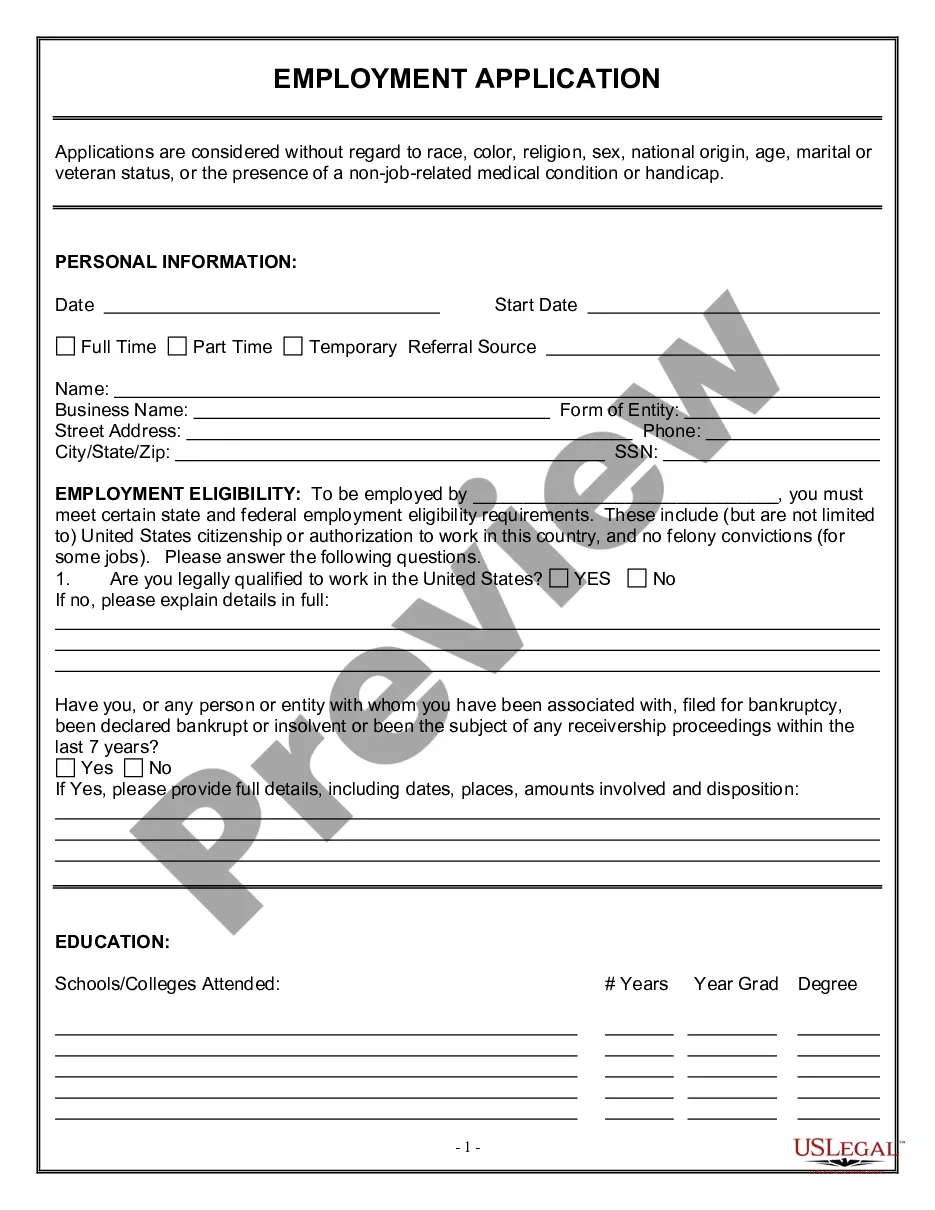

- If you are already registered, sign in to your account and then click the Download button to obtain the Florida Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- Utilize your account to review the legal documents you have previously purchased.

- Go to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

Form popularity

FAQ

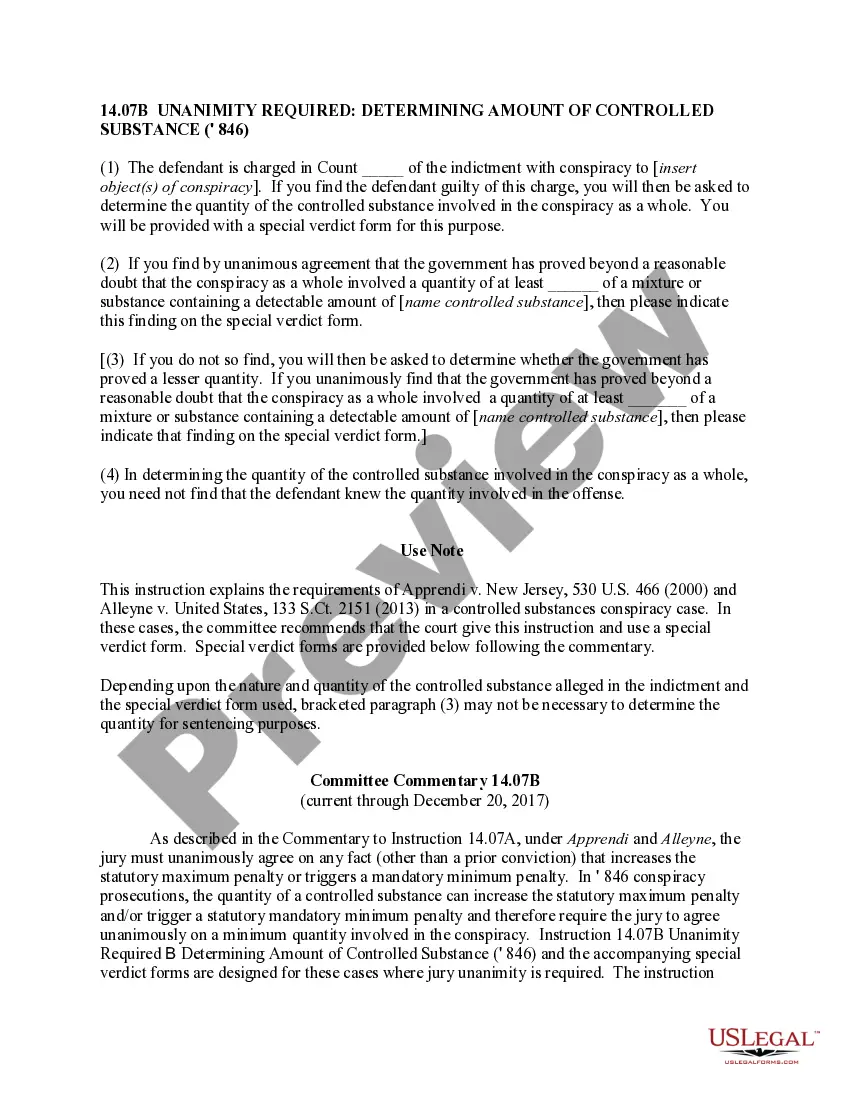

When a partnership interest is sold, gain or loss is determined by the amount of the sale minus the partner's interest, often called the partner's outside basis.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

Each partner's basis decreases with his/her share of the decrease in the liabilities of a partnership. If a partner's personal liabilities decreases because the partnership has assumed the liability, it is considered to be distributed to the partner by the partnership. This means it also reduces the partner's basis.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

Generally, a partner selling his partnership interest recognizes capital gain or loss on the sale. The amount of the gain or loss recognized is the difference between the amount realized and the partner's adjusted tax basis in his partnership interest.