Florida Hospital Audit Program

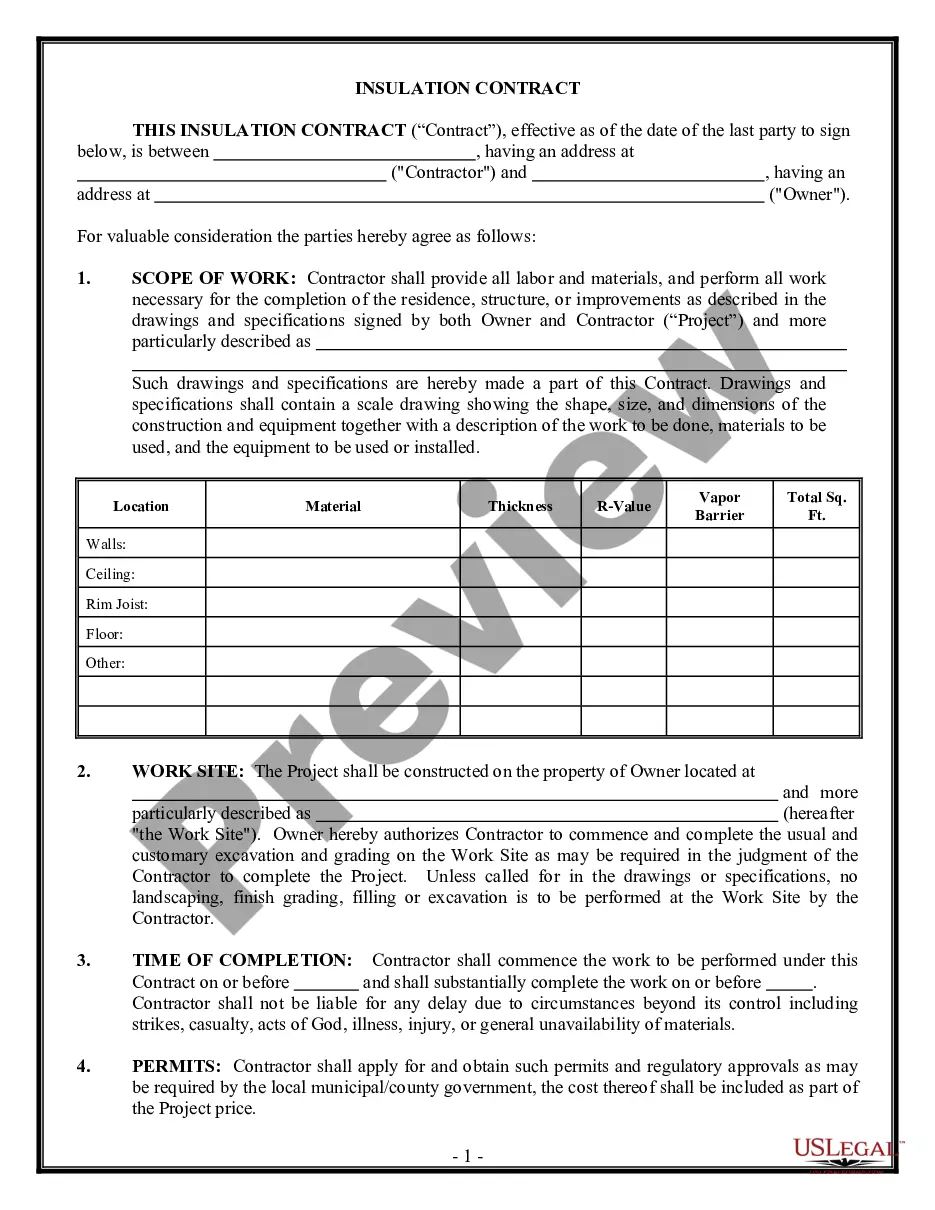

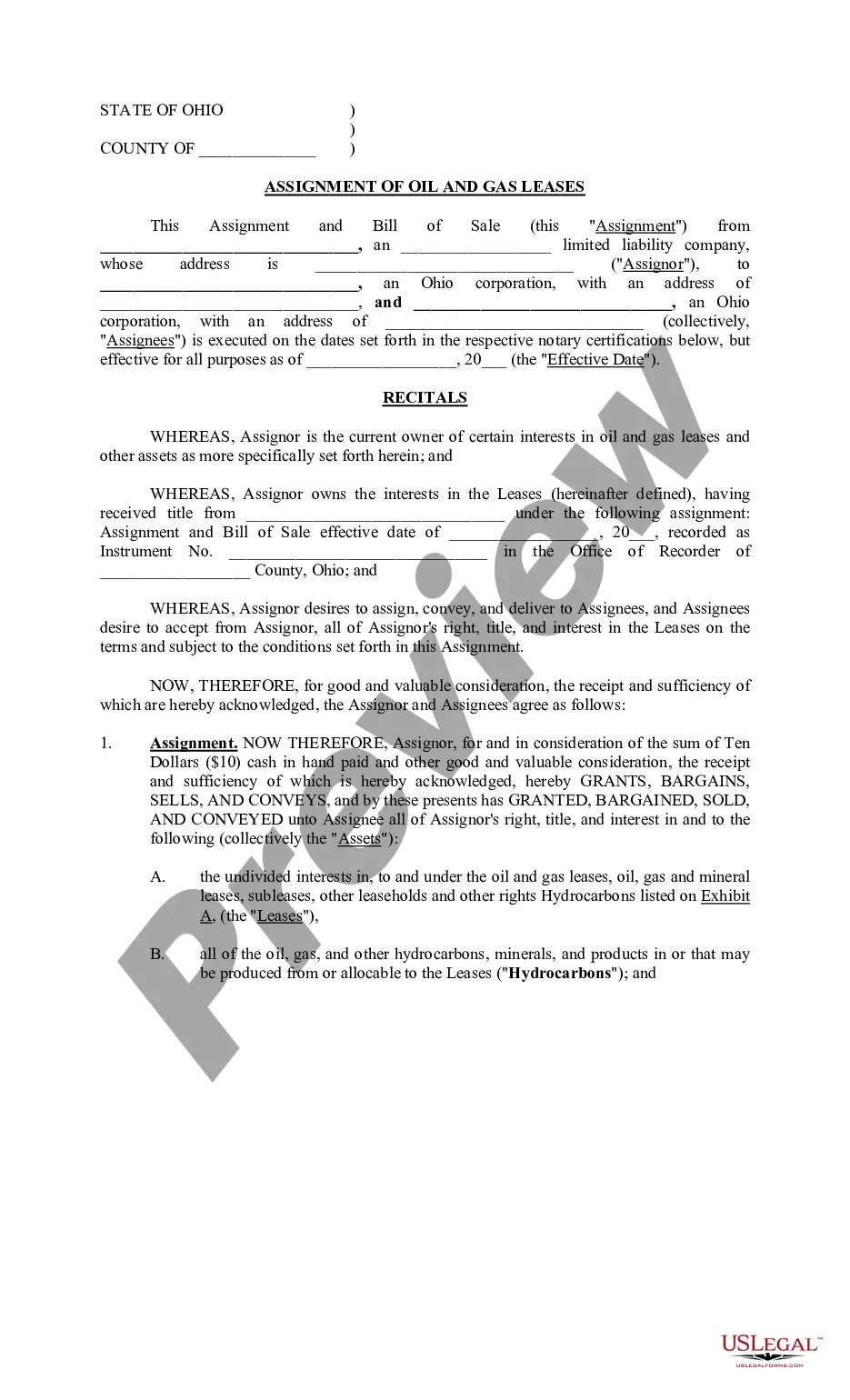

Description

How to fill out Hospital Audit Program?

Are you currently in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating ones you can trust isn’t straightforward.

US Legal Forms offers a vast array of form templates, such as the Florida Hospital Audit Program, that are designed to comply with both state and federal requirements.

Once you locate the appropriate form, click on Buy now.

Choose the payment plan you prefer, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the Florida Hospital Audit Program template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct city/area.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have chosen the right document.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

How to Build an Audit PlanAssess business risks.Verify the appropriateness of accounting policies and procedures.Identify areas where special audit consideration may be necessary.Establish materiality thresholds.Develop expectations for analytical procedures.Develop audit procedures.Reassess the plan.

Medicare RACs perform audit and recovery activities on a postpayment basis, and claims are reviewable up to three years from the date the claim was filed.

What Triggers a Medicare Audit? A key factor that often triggers an audit is claiming reimbursement for a higher than usual frequency of services over a period of time compared to other health professionals who provide similar services.

Here are our top seven tips to prepare for a healthcare compliance audit.Examine your last risk assessment or prior audit results.Ensure you have an audit trail.Pull together the pieces of the audit's focus.Break down the audit scope into manageable pieces.More items...?

Recovery Auditors who choose to review a provider using their Adjusted ADR limit must review under a 6-month look-back period, based on the claim paid date. Recovery Auditors who choose to review a provider using their 0.5% baseline annual ADR limit may review under a 3-year look-back period, per CMS approval. 7.

Auditing Medical Records in 8 Easy StepsStep 1: Choose the Focus of Your Audit.Step 2: Define Measurement Criteria.Step 3: Determine Which Records to Review.Step 4: Decide Sample Size.Step 5: Develop Recordkeeping Tools.Step 6: Gather Data.Step 7: Summarize Your Findings.More items...?

Audit of Income of HospitalsBills should be verified with the fees/charges structure. Concession and waiver on account of fees and other charges should be verified. Bills should be verified with cash receipt book, counterfoil of receipts and cash book. Verification of arrears of bills should be done.

RACs review claims on a post-payment basis and will be able to look back three years from the date the claim was paid.

An audit program is a set of directions that the auditor and its team members need to follow for the proper execution of the audit. After preparing an audit plan, the auditor allocates the work and prepares a program which contains steps that the audit team needs to follow while conducting an audit.