Florida Renewable Performance Bond

Description

How to fill out Renewable Performance Bond?

Are you within a place in which you need papers for possibly enterprise or individual reasons almost every working day? There are tons of authorized record templates available on the Internet, but finding types you can rely on isn`t effortless. US Legal Forms provides a huge number of kind templates, much like the Florida Renewable Performance Bond, that are published to fulfill federal and state demands.

In case you are previously familiar with US Legal Forms site and have a merchant account, merely log in. Following that, you can download the Florida Renewable Performance Bond template.

Unless you come with an accounts and need to begin using US Legal Forms, abide by these steps:

- Get the kind you require and make sure it is for the right town/county.

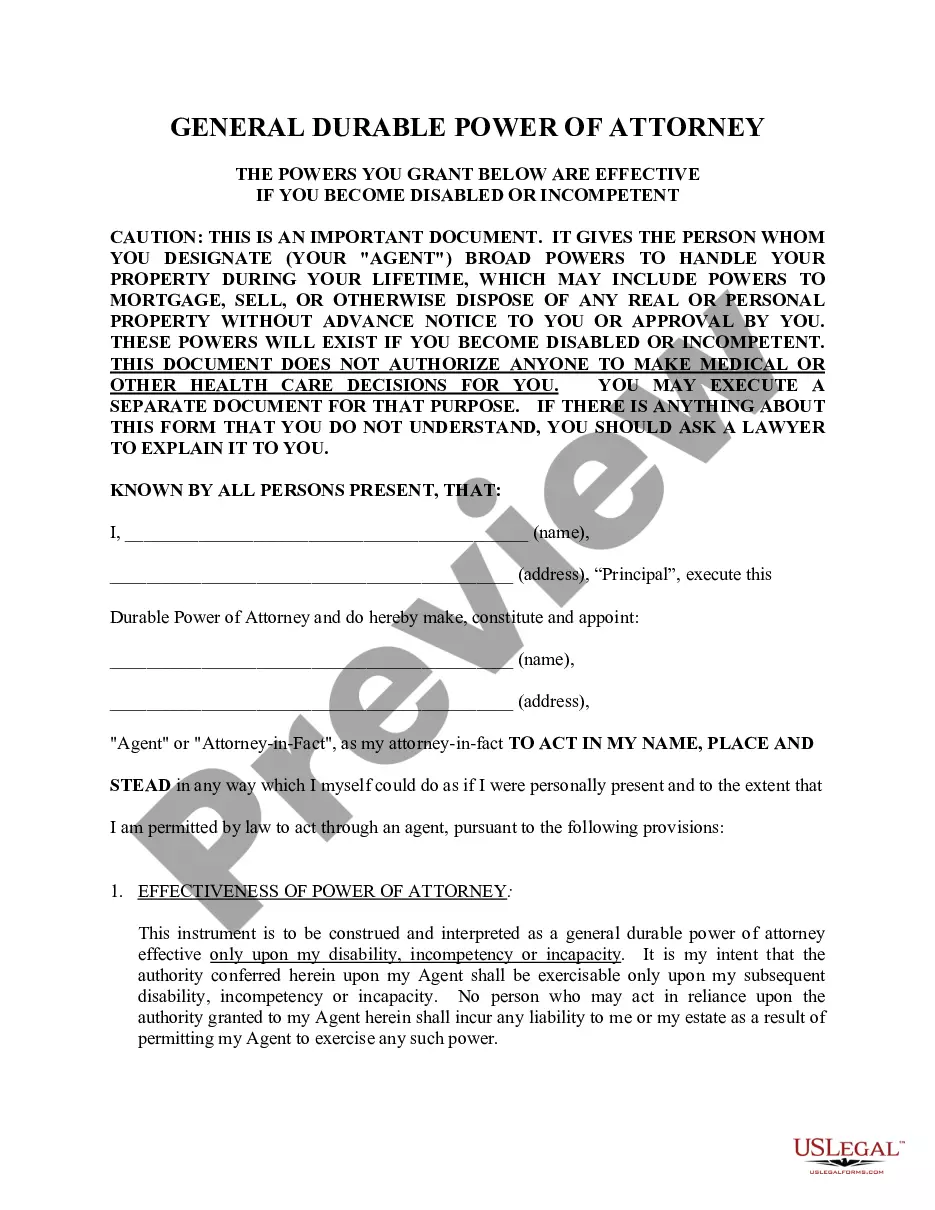

- Use the Review option to examine the form.

- Read the description to ensure that you have chosen the proper kind.

- In case the kind isn`t what you`re looking for, use the Lookup field to find the kind that meets your requirements and demands.

- If you get the right kind, simply click Buy now.

- Choose the rates program you desire, complete the required information to create your account, and pay money for the order utilizing your PayPal or bank card.

- Pick a practical paper file format and download your copy.

Locate each of the record templates you possess purchased in the My Forms food list. You can get a additional copy of Florida Renewable Performance Bond at any time, if required. Just click the required kind to download or printing the record template.

Use US Legal Forms, probably the most extensive collection of authorized kinds, to save time as well as avoid mistakes. The assistance provides professionally created authorized record templates which can be used for a variety of reasons. Create a merchant account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities. Another difference is the party responsible for paying the bond premium.

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project ing to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.

How much do bonds cost in FL? Bond Amount NeededFee<$800,0002-3%>$800,000<$1,500,001.5-3%>$1.500,0001-3%

Under Florida law, most legal or equitable actions based upon a breach of a written contract must be brought within five years.

A performance bond is a guarantee in favor of one party to a contract to protect against the failure of another party to meet its obligations. Because it focuses on performance, the bond relates to the satisfactory completion of the project in ance with the project plans and specifications.

How Long Does a Performance Bond Last? The time limit for claiming a performance bond will be spelled out in the bond contract. However, most performance bonds have a duration of twelve months, with some lasting for 36 months. In addition, your bond may be renewable or non-renewable.

Importantly, performance bonds have a five year statute of limitations irrespective of the ten year statute of repose period in Florida. See Federal Ins. Co.

A performance guarantee (a performance bond) protects downside risk by holding the EPC accountable for ensuring all the equipment works as expected when connected for operation. In its simplest form, an EPC performance wrap is an engineering design guarantee.