Florida Sample Letter regarding Motion to Sell Property of an Estate

Description

How to fill out Sample Letter Regarding Motion To Sell Property Of An Estate?

Are you in the placement in which you will need files for sometimes enterprise or personal uses virtually every time? There are plenty of lawful file web templates accessible on the Internet, but getting types you can rely is not easy. US Legal Forms provides a large number of form web templates, just like the Florida Sample Letter regarding Motion to Sell Property of an Estate, which are written to fulfill federal and state requirements.

Should you be presently familiar with US Legal Forms internet site and possess an account, merely log in. Afterward, you can down load the Florida Sample Letter regarding Motion to Sell Property of an Estate format.

If you do not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Get the form you will need and make sure it is for your proper metropolis/area.

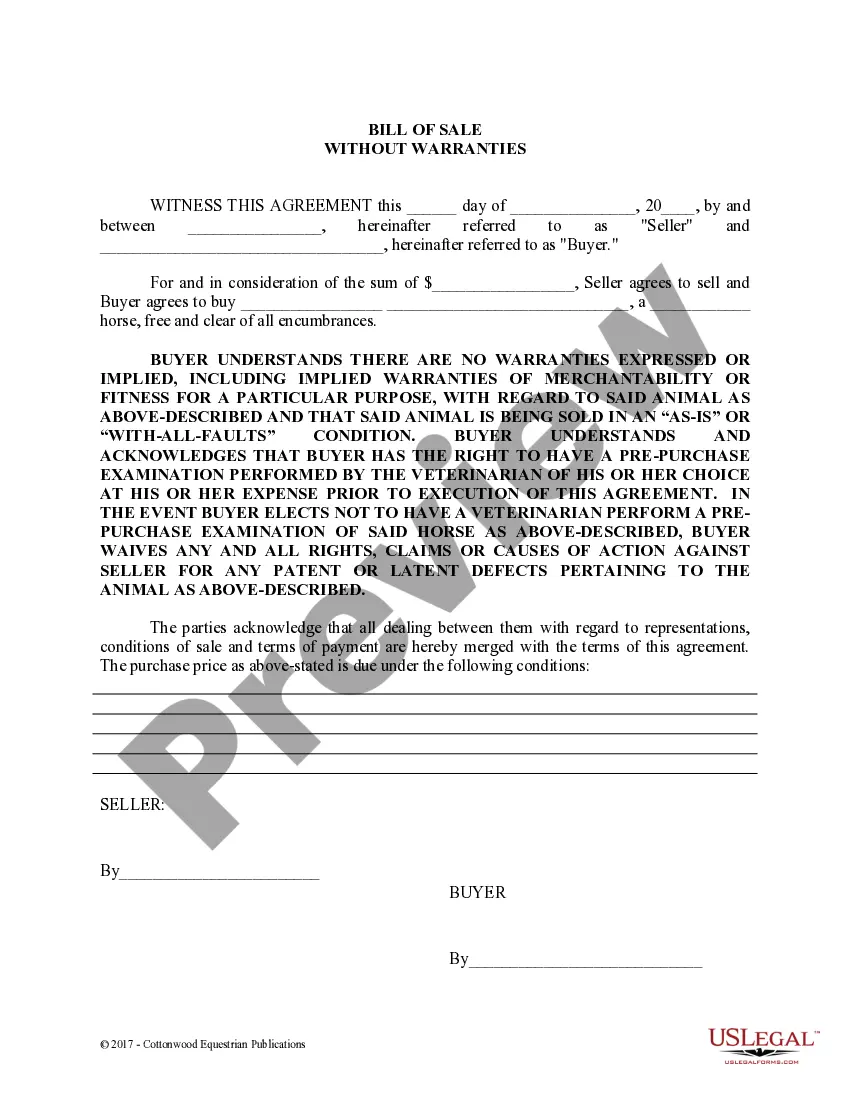

- Make use of the Review switch to examine the form.

- Browse the description to actually have chosen the correct form.

- In the event the form is not what you`re trying to find, make use of the Research industry to get the form that meets your needs and requirements.

- Once you discover the proper form, click Purchase now.

- Select the prices program you want, fill out the desired info to make your money, and purchase an order utilizing your PayPal or credit card.

- Pick a hassle-free document file format and down load your duplicate.

Get all of the file web templates you have bought in the My Forms menus. You can aquire a more duplicate of Florida Sample Letter regarding Motion to Sell Property of an Estate anytime, if possible. Just click the essential form to down load or print the file format.

Use US Legal Forms, the most comprehensive assortment of lawful varieties, to save time and steer clear of faults. The service provides professionally produced lawful file web templates that can be used for a variety of uses. Produce an account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

Homestead property in Probate is not considered part of the ?Probate Estate.? This confusing aspect of Probate is found under Florida Statute 733.607. It means that the Personal Representative may have no control or ability to sell Homestead property.

The personal representative of a Florida estate can sell real property during probate administration. However, as highlighted in the article below, there are some instances when the Florida probate statute requires the estate's executor to get a court order before a property in probate administration can be sold.

If you remove any items from a house before it has gone through probate, you could be held legally responsible. You must also secure the property to ensure nothing is stolen or damaged.

In many cases, to clear the legal title of the home and be able to sell it, it will take 4-5 months after the probate proceedings. If you inherited the house by deed, selling is much easier and does not require going through the probate process in Florida.

If they explicitly grant the executor the power to sell property, they can proceed with the sale without obtaining unanimous approval from all beneficiaries. The executor's authority in this regard is usually outlined in the will and can include some limitations.

An executor must adhere to the stipulations in the will. They cannot alter beneficiary distributions or introduce new beneficiaries. They must also ensure they communicate and notify all beneficiaries and heirs as required. Any deviation from these obligations may result in legal consequences.

If your loved one left a will containing a ?power of sale clause,? then the personal representative can sell property belonging to the estate without attaining an order from the probate court. However, if you don't have that, don't worry. You can still sell property, but you will have to go through the court.