Florida Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

Are you presently in a situation where you require documents for occasional business or personal purposes nearly every day.

There are numerous reliable form templates accessible online, but finding ones you can rely on isn’t easy.

US Legal Forms offers thousands of document templates, including the Florida Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Restrictions, designed to meet federal and state regulations.

Utilize US Legal Forms, the most comprehensive collection of legitimate forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Florida Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Restrictions template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the template you need and ensure it is for your specific city/area.

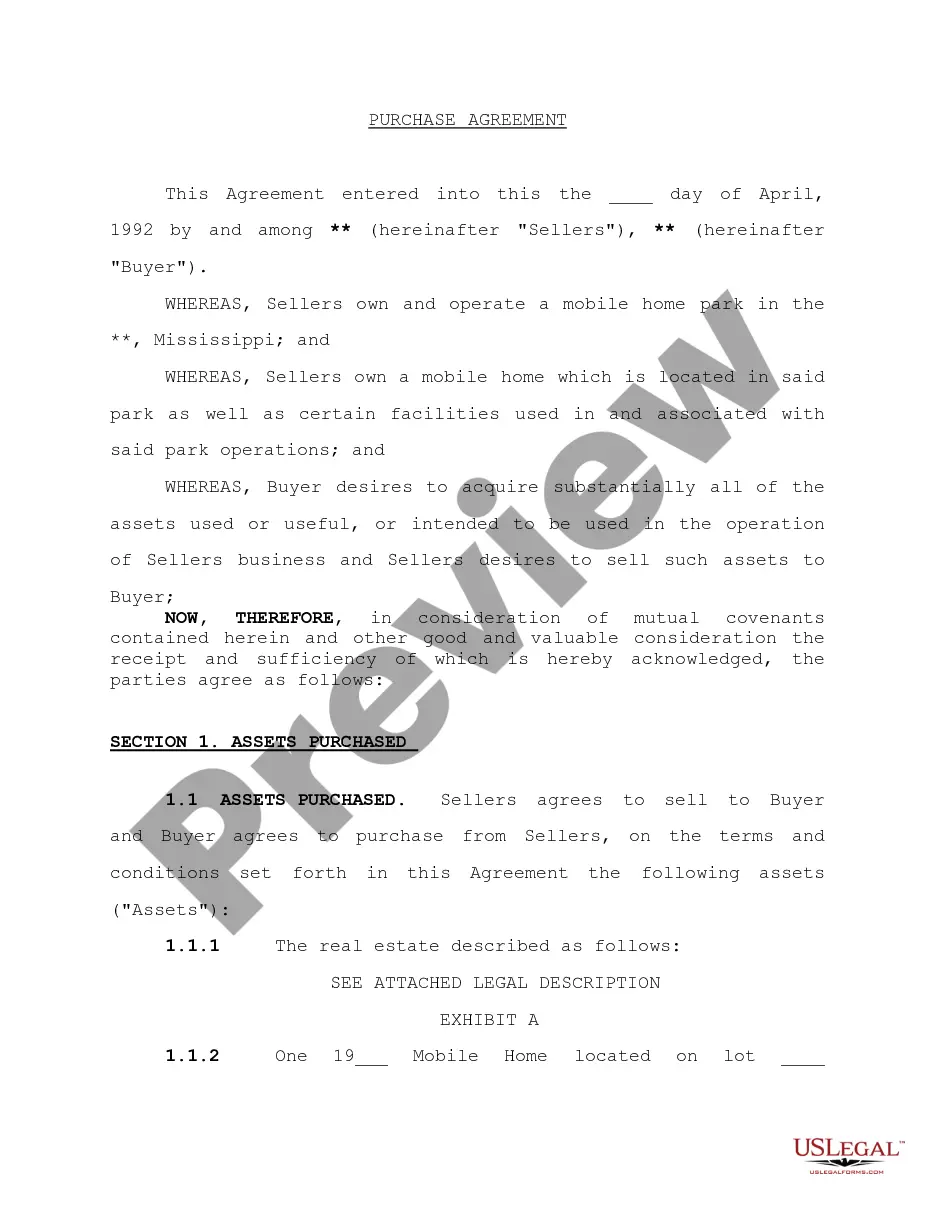

- Utilize the Preview option to review the form.

- Check the details to ensure you have selected the correct template.

- If the template isn’t what you’re looking for, use the Search field to find the form that meets your needs.

- Once you find the appropriate template, click Purchase now.

- Select the pricing plan you wish, provide the required information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section.

- You may obtain an additional copy of the Florida Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Restrictions at any time if needed. Just click on the desired template to download or print the document.

Form popularity

FAQ

According to Section 607.0731 of the Florida Statutes, voting agreements allow shareholders to form a written agreement determining how they will vote their shares. One common example is a predetermined dissolution of the corporation, which will require shareholders to vote for dissolution at that time.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

The sale of the shares may be accomplished in two very different ways. First, each shareholder can agree to purchase, pro rata or otherwise, all the stock being sold. This is called a "cross purchase" of stock.

Shareholder Agreements in Florida Voting Agreement Plus, F.S. §607.0731 (2) provides that a voting agreement created under this section is specifically enforceable. For instance, it is possible to draft a voting shareholder agreement that permits the dissolution of a corporation after ten years.

A shareholders' agreement is a legally binding contract among the shareholders of a company that sets out their rights and obligations, maps out how the company should be managed, establishes share ownership, and share transfer rules all in order to provide clear solutions to contentious scenarios that may arise in

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

Does a shareholders' agreement override articles? No, a shareholders' agreement will not override the Articles if there is a conflict, then the articles will prevail.

A shareholders agreement is a private contract between all of the shareholders which contain the rules for running and owning the company.

In a cross-purchase agreement, one or more of the remaining shareholders agrees to purchase the stock from the estate of a deceased shareholder or from the departing shareholder.