Florida Affidavit of Domicile for Deceased

Description

How to fill out Affidavit Of Domicile For Deceased?

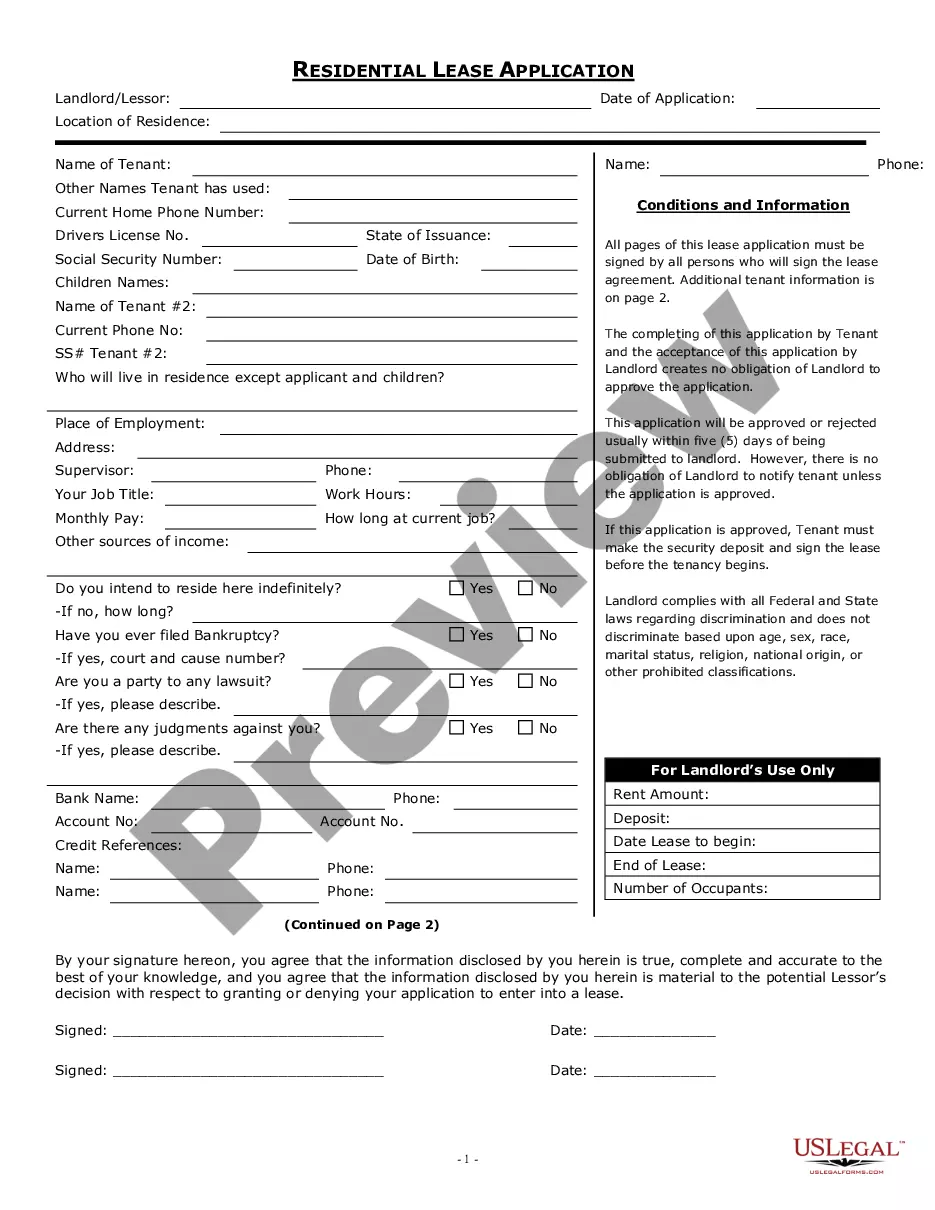

It is possible to commit hrs online searching for the legitimate document format that suits the federal and state demands you require. US Legal Forms offers a huge number of legitimate forms which can be evaluated by professionals. It is simple to acquire or print out the Florida Affidavit of Domicile for Deceased from my service.

If you have a US Legal Forms account, you are able to log in and click the Acquire switch. Following that, you are able to total, edit, print out, or indicator the Florida Affidavit of Domicile for Deceased. Each and every legitimate document format you get is your own forever. To have an additional copy of any purchased form, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms website initially, keep to the simple recommendations under:

- Initially, make certain you have chosen the right document format for your county/area of your choosing. See the form explanation to make sure you have chosen the appropriate form. If available, utilize the Review switch to check from the document format too.

- If you wish to find an additional model in the form, utilize the Lookup area to obtain the format that meets your requirements and demands.

- After you have identified the format you need, click Acquire now to proceed.

- Pick the costs strategy you need, type your references, and register for an account on US Legal Forms.

- Total the financial transaction. You may use your Visa or Mastercard or PayPal account to fund the legitimate form.

- Pick the formatting in the document and acquire it to your device.

- Make changes to your document if possible. It is possible to total, edit and indicator and print out Florida Affidavit of Domicile for Deceased.

Acquire and print out a huge number of document layouts making use of the US Legal Forms site, which offers the greatest variety of legitimate forms. Use skilled and state-specific layouts to take on your business or specific requires.

Form popularity

FAQ

A decedent can be ?domiciled? in the U.S. for estate and gift tax purposes if they lived in the U.S. and had no present intention of leaving.

Florida's intestacy laws determine what heirs are entitled to inherit from the decedent's estate. The Affidavit of Heirs is a tool that gives the court the information in needs to apply the law and make sure that those heirs entitled to inherit from the decedent's estate receive his or her share.

Factors That Affect Where You're Legally Domiciled Some factors that indicate where you're domiciled include where you live, vote, register your car, and where your spouse or partner and children live.

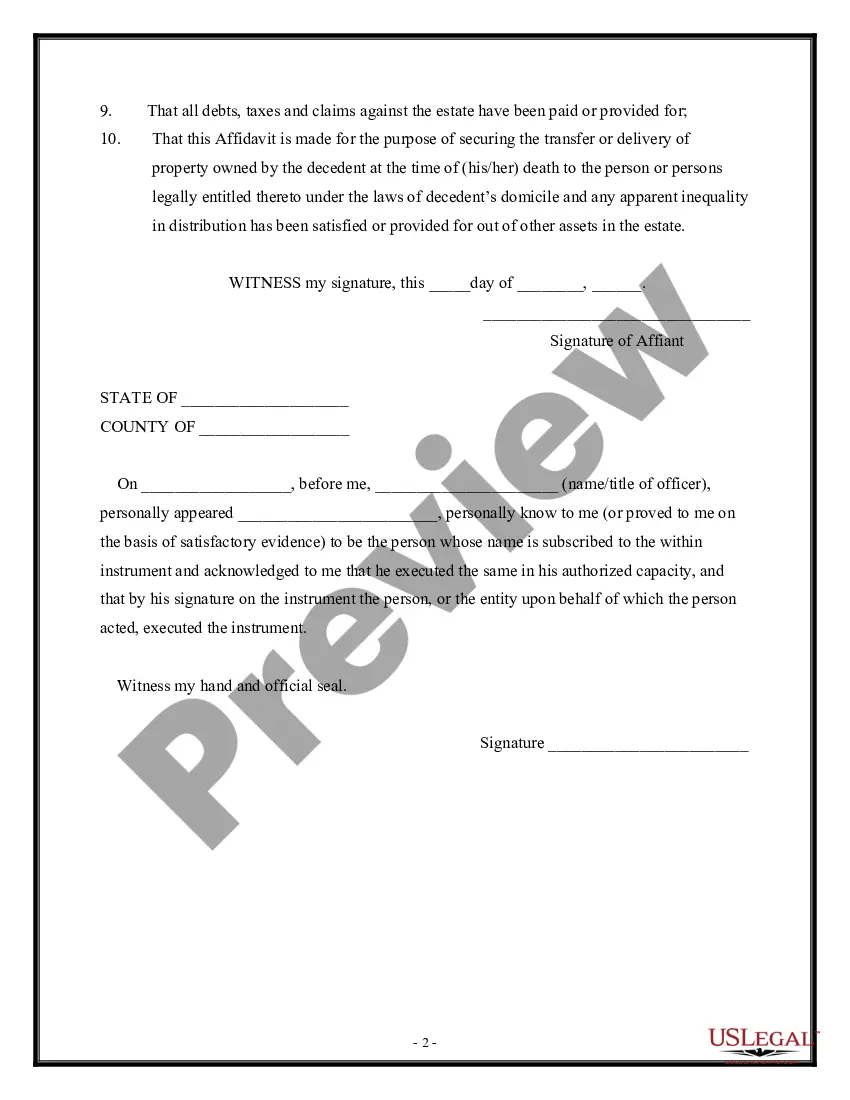

The affidavit must include the name, address, and age of the decedent, plus a listing of all their assets. You will also need to provide information about their closest relatives, including spouses and children. Finally, the document should list the names and addresses of all the heirs.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

Where a person's real property is located.

Domicile ? Determination of intent. An intention to make a place a permanent home is determined by facts and circumstances on a case-by-case basis.

You may download a domicile form or obtain one at any Clerk of the Circuit Court & Comptroller location. Bring or mail the form to a Clerk's office location to be recorded. You must bring some form of legal identification if you need your document notarized.