Florida Investment Letter regarding Intrastate Offering

Description

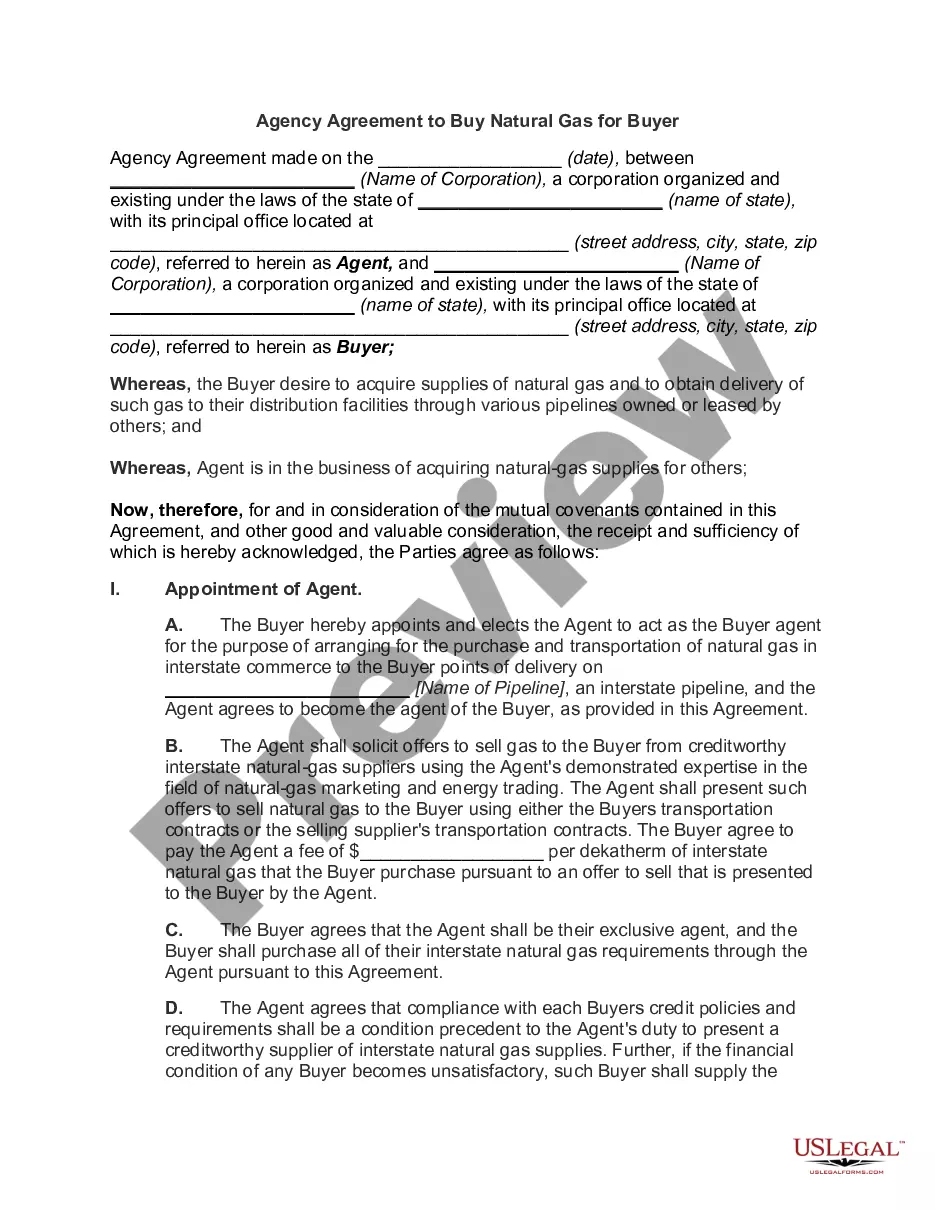

How to fill out Investment Letter Regarding Intrastate Offering?

You can spend countless hours on the internet searching for the valid document template that fulfills the federal and state regulations you require.

US Legal Forms offers a vast selection of legal documents that are reviewed by experts.

You can download or print the Florida Investment Letter for Intrastate Offering from my service.

If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Get button.

- After that, you can complete, modify, print, or sign the Florida Investment Letter for Intrastate Offering.

- Every legal document template you obtain is yours permanently.

- To receive another copy of the purchased form, visit the My documents section and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the document information to confirm you have chosen the right form.

Form popularity

FAQ

The de minimis rule in Florida refers to the exemptions that allow companies to offer securities without extensive regulatory scrutiny, provided they meet certain thresholds. Specifically, this rule applies to intrastate offerings where the number of investors is limited, enabling businesses to operate efficiently while attracting local investment. Utilizing the de minimis rule can prove beneficial for startups and small enterprises issuing a Florida Investment Letter regarding Intrastate Offering by facilitating access to capital within the state. Engaging with a platform like uslegalforms can help you navigate these regulations seamlessly.

Section 517.061(11) of the Florida Securities and Investor Protection Act outlines the regulations concerning intrastate offerings. This section is crucial for businesses seeking to raise funds within Florida without having to register their securities federally. By adhering to these rules, companies can issue a Florida Investment Letter regarding Intrastate Offering, allowing them to promote their investment opportunities more easily within the state. Understanding this section helps ensure compliance and supports local investment efforts.

Section 517.061 11 of the Florida Securities and Investor Protection Act outlines specific exemptions for securities transactions within the state. It delineates the criteria under which certain offerings can be sold without full registration, facilitating easier access for investors. This section is crucial for those looking to explore investments presented in a Florida Investment Letter regarding Intrastate Offering, ensuring compliance with state regulations.

The de minimis exemption allows investment advisors in Florida to manage up to five clients within the state without registering as an investment advisor. This exemption streamlines operations, making it more accessible for small firms to offer personalized services. Understanding this exemption could be beneficial when considering various investment strategies highlighted in a Florida Investment Letter regarding Intrastate Offering.

In Florida, the accredited investor exemption allows qualified investors to participate in private security offerings without having to register with state authorities. This enables businesses to attract investments while maintaining compliance. By utilizing a Florida Investment Letter regarding Intrastate Offering, you can tap into local investment opportunities tailored for accredited investors.

An accredited investor exemption allows investors who meet specific income or net worth thresholds to participate in private investment opportunities that are not available to the general public. This exemption is designed to provide a regulatory framework that allows for investment in less regulated securities. Engaging with a Florida Investment Letter regarding Intrastate Offering often leverages these exemptions, enabling you to explore new investment avenues.

No, a person with a net worth of $500,000 does not automatically qualify as an accredited investor. The SEC requires individuals to have a net worth of at least $1 million, excluding the value of their primary residence. Thus, if you are interested in investments detailed in a Florida Investment Letter regarding Intrastate Offering, you may need to reassess your financial standing.

To qualify as an accredited investor, you need to meet specific financial criteria established by the SEC. This typically includes having a net worth of over $1 million, excluding your primary residence, or earning an income of $200,000 in the last two years, or $300,000 with a spouse. Meeting these requirements allows you to invest in more complex offerings, including opportunities presented through a Florida Investment Letter regarding Intrastate Offering.

A Form D filing is triggered when a company begins to offer securities under Regulation D, particularly when the offering is made to residents in Florida. This filing must occur within 15 days of the first sale of securities. The Florida Investment Letter regarding Intrastate Offering acts as a valuable resource in this process, providing clarity and support for navigating the filing requirements.

Yes, Florida requires a Form D filing for certain securities offerings, specifically those conducted under Regulation D exemptions. This ensures compliance with state law and protects your investment from potential legal issues. Utilizing the Florida Investment Letter regarding Intrastate Offering can aid in the Form D filing process, making it more straightforward.