A Legacy is a gift of property or money under the terms of the will of a person who has died. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Assignment of Legacy in Order to Pay Indebtedness

Description

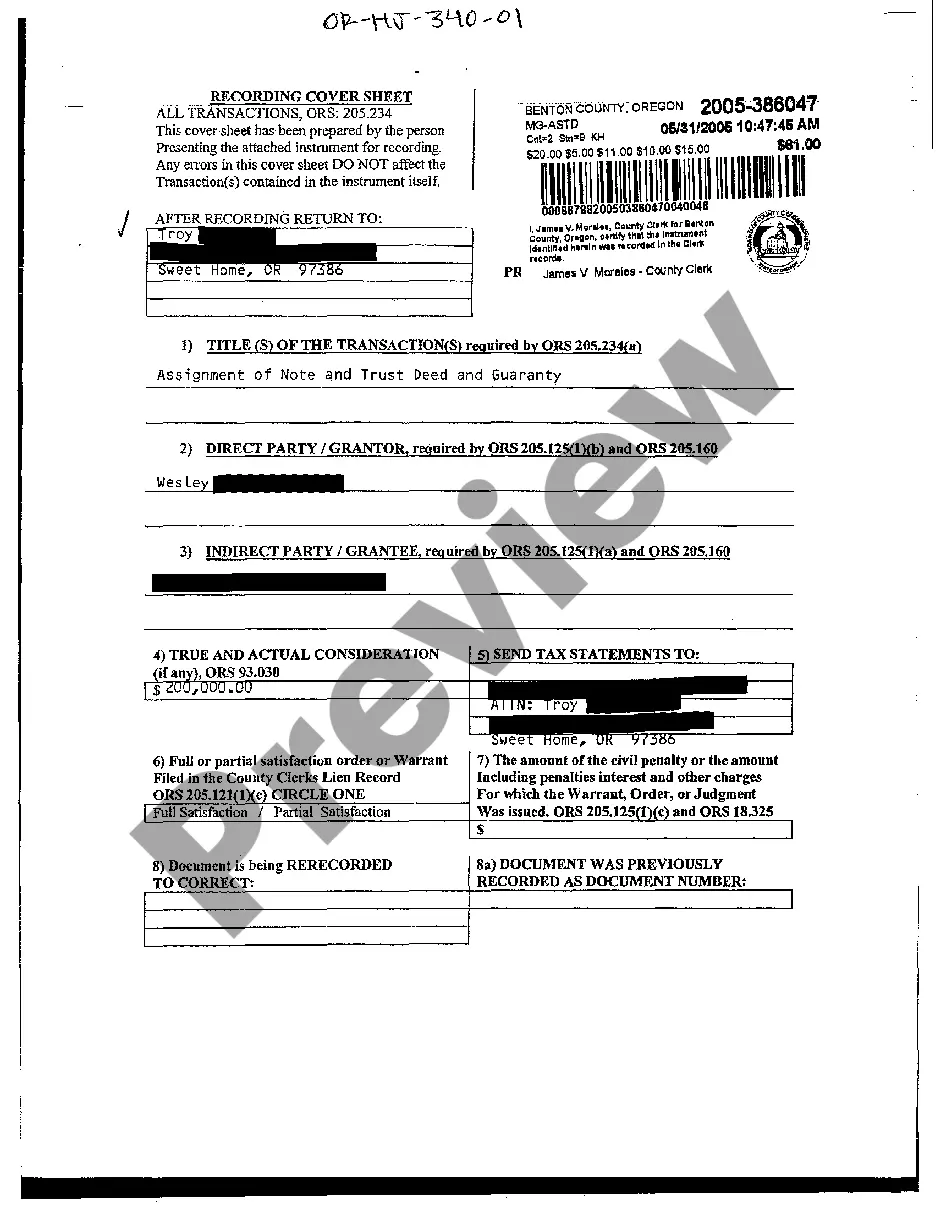

How to fill out Assignment Of Legacy In Order To Pay Indebtedness?

If you need to complete, download, or printing legal document themes, use US Legal Forms, the most important variety of legal forms, that can be found on-line. Make use of the site`s simple and convenient lookup to obtain the paperwork you will need. Different themes for business and person purposes are sorted by types and says, or keywords and phrases. Use US Legal Forms to obtain the Florida Assignment of Legacy in Order to Pay Indebtedness in just a couple of click throughs.

Should you be already a US Legal Forms customer, log in in your profile and click on the Obtain switch to get the Florida Assignment of Legacy in Order to Pay Indebtedness. Also you can gain access to forms you earlier acquired inside the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that appropriate metropolis/land.

- Step 2. Take advantage of the Review solution to examine the form`s information. Never overlook to learn the explanation.

- Step 3. Should you be unhappy together with the develop, use the Research discipline towards the top of the screen to discover other variations of your legal develop design.

- Step 4. When you have found the shape you will need, go through the Acquire now switch. Select the pricing prepare you prefer and add your credentials to sign up on an profile.

- Step 5. Process the purchase. You should use your credit card or PayPal profile to complete the purchase.

- Step 6. Pick the format of your legal develop and download it on your own device.

- Step 7. Comprehensive, edit and printing or indication the Florida Assignment of Legacy in Order to Pay Indebtedness.

Every single legal document design you purchase is your own property eternally. You possess acces to each develop you acquired in your acccount. Click the My Forms section and choose a develop to printing or download yet again.

Remain competitive and download, and printing the Florida Assignment of Legacy in Order to Pay Indebtedness with US Legal Forms. There are millions of specialist and state-particular forms you may use to your business or person requirements.

Form popularity

FAQ

Florida law sets a specific order in which a person's final expenses should be paid. First priority is given to the costs administering the estate, attorney fees, and your fee for acting as personal representative, followed by funeral and burial expenses.

Secured debts will get paid first, as they are connected to the assets themselves. Unsecured debts, like credit cards or personal loans, are generally paid last. As executor, it is your legal obligation to put off payment of unsecured debts until funeral costs, estate expenses, taxes, and medical expenses are paid off.

You're not typically responsible for repaying the debt of someone who's died, unless: You're a co-signer on a loan with outstanding debt. You're a joint account holder on a credit card.

Your mother or father may have had substantial credit card debt, a mortgage, or car loan. The short answer to the question is no, you will not be personally responsible for the debt, but failure to pay such a debt can affect the use and control of secured assets like real estate and vehicles.

Debts of the deceased in Florida cannot legally be passed down to the next surviving family member. Florida law does allow for debts to be paid out of the estate before the family receives what is left.

Debts of the deceased in Florida cannot legally be passed down to the next surviving family member. Florida law does allow for debts to be paid out of the estate before the family receives what is left.

You generally aren't responsible for your deceased parents' consumer debt unless you specifically signed on as a co-signer or co-applicant.

As a general rule, the answer is 'no'. A child is typically not responsible for a parent's debts. That being said, creditors could make a claim against your estate?seeking repayment from money that would otherwise be left to a child as their inheritance.