This notice is not from a debt collector but from the party to whom the debt is owed.

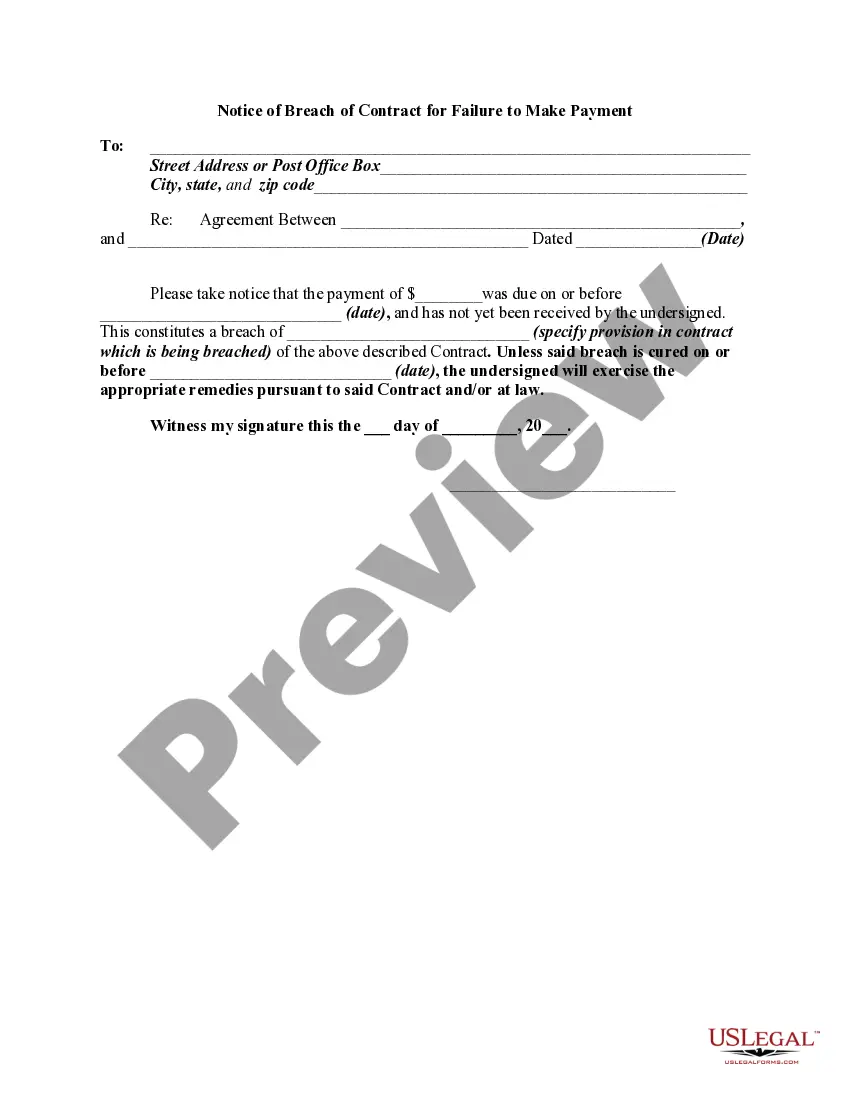

Florida Notice by Mail to Debtor of Action if Payment not Made

Description

How to fill out Notice By Mail To Debtor Of Action If Payment Not Made?

Have you been in the position where you require files for possibly enterprise or individual purposes nearly every working day? There are a variety of legitimate record web templates available on the net, but locating versions you can trust is not straightforward. US Legal Forms gives a large number of kind web templates, such as the Florida Notice by Mail to Debtor of Action if Payment not Made, that happen to be created to fulfill state and federal demands.

Should you be already familiar with US Legal Forms website and have a free account, just log in. Following that, you can download the Florida Notice by Mail to Debtor of Action if Payment not Made design.

If you do not have an account and want to begin to use US Legal Forms, follow these steps:

- Discover the kind you will need and ensure it is for that correct city/county.

- Use the Review key to analyze the shape.

- See the information to ensure that you have selected the proper kind.

- In case the kind is not what you are trying to find, take advantage of the Look for area to find the kind that fits your needs and demands.

- Whenever you find the correct kind, click Buy now.

- Opt for the pricing prepare you desire, submit the specified info to generate your account, and pay for the transaction making use of your PayPal or bank card.

- Select a hassle-free data file file format and download your copy.

Discover all of the record web templates you possess bought in the My Forms menus. You can obtain a extra copy of Florida Notice by Mail to Debtor of Action if Payment not Made at any time, if required. Just select the essential kind to download or produce the record design.

Use US Legal Forms, by far the most extensive collection of legitimate varieties, to save time as well as steer clear of errors. The services gives skillfully produced legitimate record web templates that you can use for a selection of purposes. Produce a free account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

The FCCPA prohibits creditors and debt collectors from engaging in abusive, harassing, unfair, fraudulent, deceptive, or misleading practices. Some actions that creditors and debt collectors can't do under the FCCPA include: pretending to be a police officer and acting on behalf of a government agency.

Collectors are required by Fair Debt Collection Practices Act (FDCPA) to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact.

But what must the creditor provide by way of documentation? At a minimum, it must produce: A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you.

(c) Notice by electronic transmission is written notice. (2) A notice or other communication may be given by any method of delivery, including voice mail where oral notice is allowed, except that electronic transmissions must be in ance with this section.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one. Why? Because it helps you determine if the debt is actually yours and if there's anything fishy going on behind the scenes.

You should receive a statement before you are asked to make a payment. Generally, the creditor does not have to tell you before it sends your debt to a debt collector, but a creditor usually will try to collect the debt from you before sending it to a collector.

In your dispute, say that you were never notified of the debt. The credit bureaus will then have to remove the negative mark on your report until they can either verify the debt or determine that you don't actually owe the amount in question. You can dispute incorrect information either with a letter or online.

Generally, this information is provided in a written notice sent as the initial communication to you or within five days of their first communication with you, and it may be sent by mail or electronically. This information will help you recognize whether the debt is yours and, if not, how to dispute it.