If you want to finish, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online. Use the site's simple and convenient search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Florida Sale and Assignment of a Majority Ownership Interest in a Limited Liability Company According to an Installment Sales Agreement and Retaining a Security Interest in the Membership Interest Being Sold and Assigned Until Paid with just a few clicks.

If you are already a US Legal Forms client, Log In to your account and click the Download button to acquire the Florida Sale and Assignment of a Majority Ownership Interest in a Limited Liability Company According to an Installment Sales Agreement and Retaining a Security Interest in the Membership Interest Being Sold and Assigned Until Paid. You can also access forms you previously saved from the My documents tab of your account.

Every legal document format you obtain is yours permanently. You can access each document you saved within your account. Go to the My documents section and select a document to print or download again.

Stay competitive and download, and print the Florida Sale and Assignment of a Majority Ownership Interest in a Limited Liability Company According to an Installment Sales Agreement and Retaining a Security Interest in the Membership Interest Being Sold and Assigned Until Paid using US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Step 1. Ensure you have selected the form for the appropriate city/state.

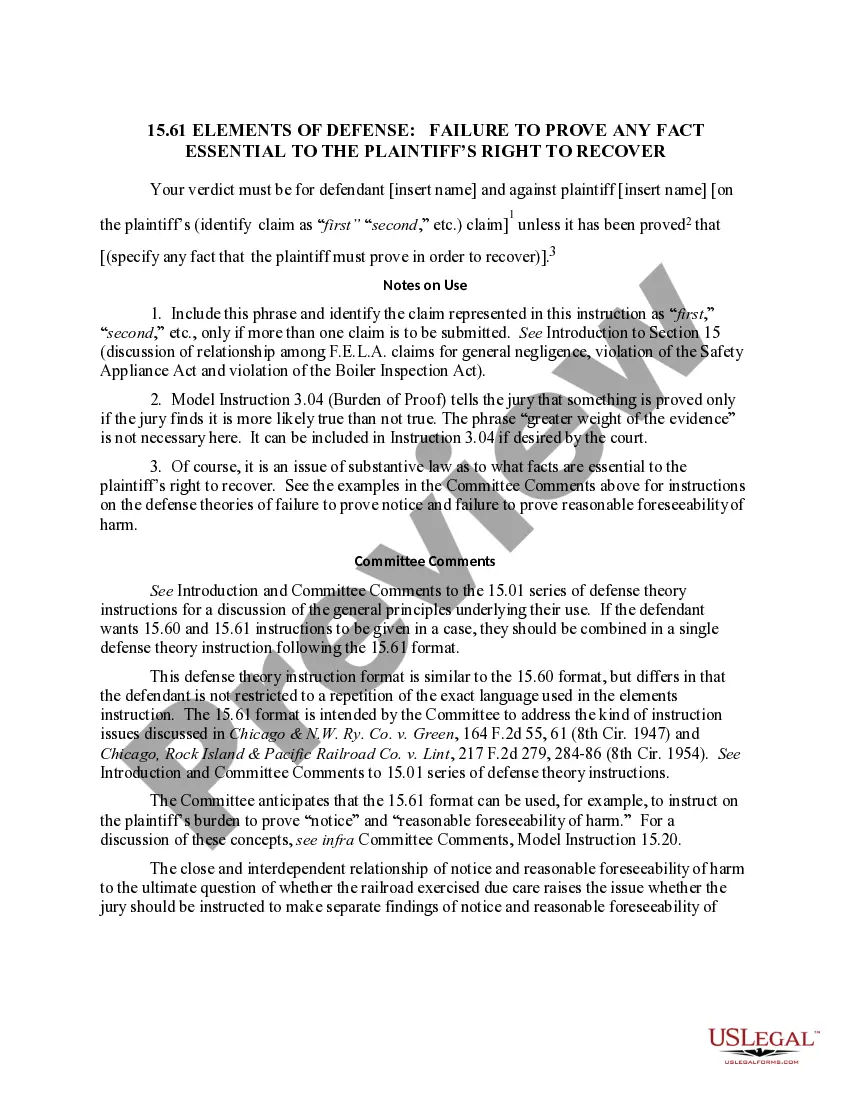

- Step 2. Use the Preview option to view the form's content. Don’t forget to read the description.

- Step 3. If you are not happy with the document, use the Search area at the top of the screen to find other types of the legal document format.

- Step 4. Once you have located the form you need, click the Get Now button. Choose the pricing plan you prefer and input your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, review, and print or sign the Florida Sale and Assignment of a Majority Ownership Interest in a Limited Liability Company According to an Installment Sales Agreement and Retaining a Security Interest in the Membership Interest Being Sold and Assigned Until Paid.