Florida Sample Letter for Tax Deeds

Description

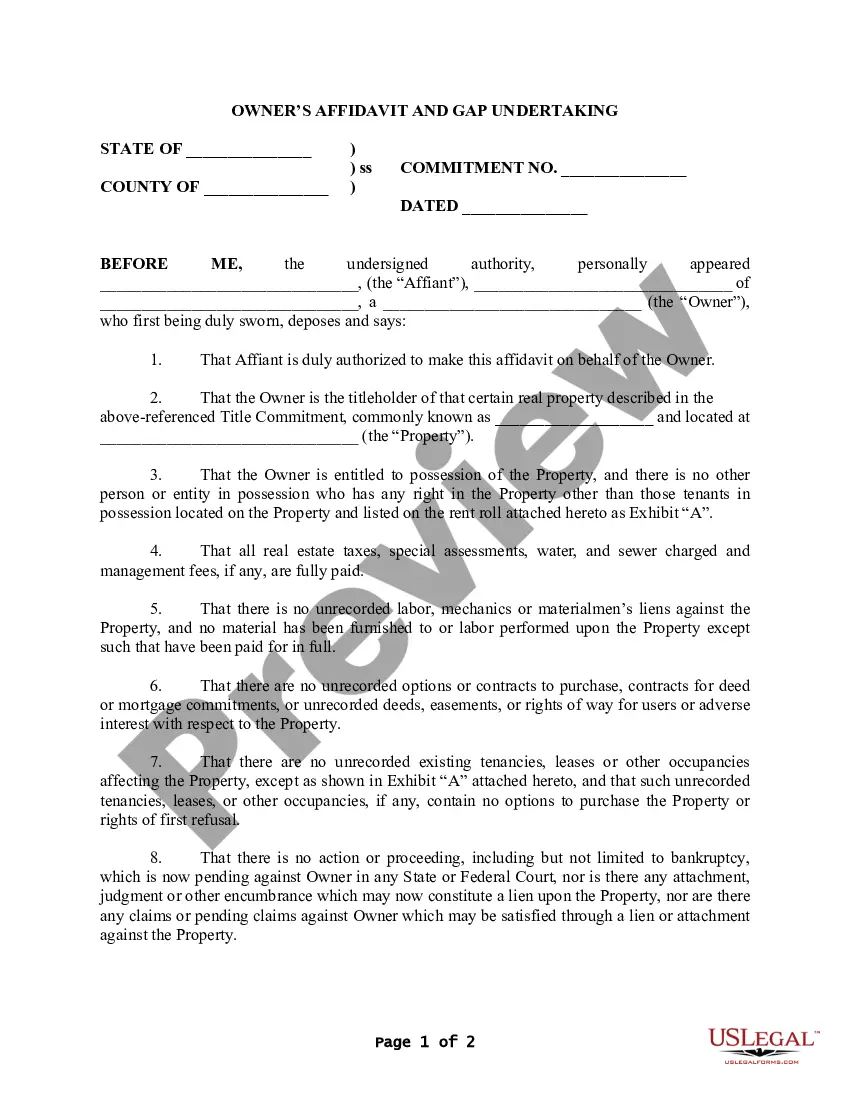

How to fill out Sample Letter For Tax Deeds?

If you require to accumulate, acquire, or generate official document templates, utilize US Legal Forms, the most significant selection of legal documents, which are accessible online.

Take advantage of the site’s straightforward and convenient search to find the forms you need. A variety of templates for business and personal uses are organized by categories and claims, or keywords.

Use US Legal Forms to obtain the Florida Sample Letter for Tax Deeds in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, review, and print or sign the Florida Sample Letter for Tax Deeds. Each legal document template you purchase is yours forever. You have access to every form you downloaded with your account. Click on the My documents section and choose a form to print or download again. Compete and obtain, and print the Florida Sample Letter for Tax Deeds with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal business or individual needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to acquire the Florida Sample Letter for Tax Deeds.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions in the legal document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

In short, a tax lien has a lot of negatives. It affects your ability to sell your property and limits the effectiveness of bankruptcy relief. It also hurts your ability to get credit and ? through prospective employer credit checks ? can even harm your chances of getting a new job.

A successful quiet claim action means the holder of the tax deed can sell the property after a short appeal time period ? typically 30 days. Florida Statute Section 65.081. provides the authority for quieting title to tax deeds.

What is a Tax Deed Application? Tax Deed application is the action, initiated by a tax certificate holder, which begins the process of selling a property at public auction for the delinquent taxes.

Tax Deed states auction off the real estate when property owners become delinquent. A Tax Lien state sells tax certificates to investors when homeowners become delinquent. Once the homeowner pays the taxes the investor is paid off their investment plus interest. Florida is a Tax Deed and a Tax Lien state.

A tax certificate is basically a lien against your property. The certificates themselves are sold at auction. The bidder must pay the delinquent taxes plus costs. The successful bidder is the one who will demand the lowest interest rate on the certificate from the delinquent property owner.

The question that we're answering today is, ?Does a mortgage survive a tax deed sale in Florida?? The answer is no. Nothing survives the tax defaulted auction except, possibly, another government lien, and it must be filed by date and time.

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and place a lien on a property, while with a tax deed, an investor is actually purchasing the property, by virtue of a tax deed for unpaid real property taxes, at auction.

When a property is sold at a tax deed sale, the proceeds first pay for the delinquent taxes and the costs of bringing the property to auction. Any surplus over the opening bid amount is deposited with the Clerk and Comptroller and subject to a registry fee.