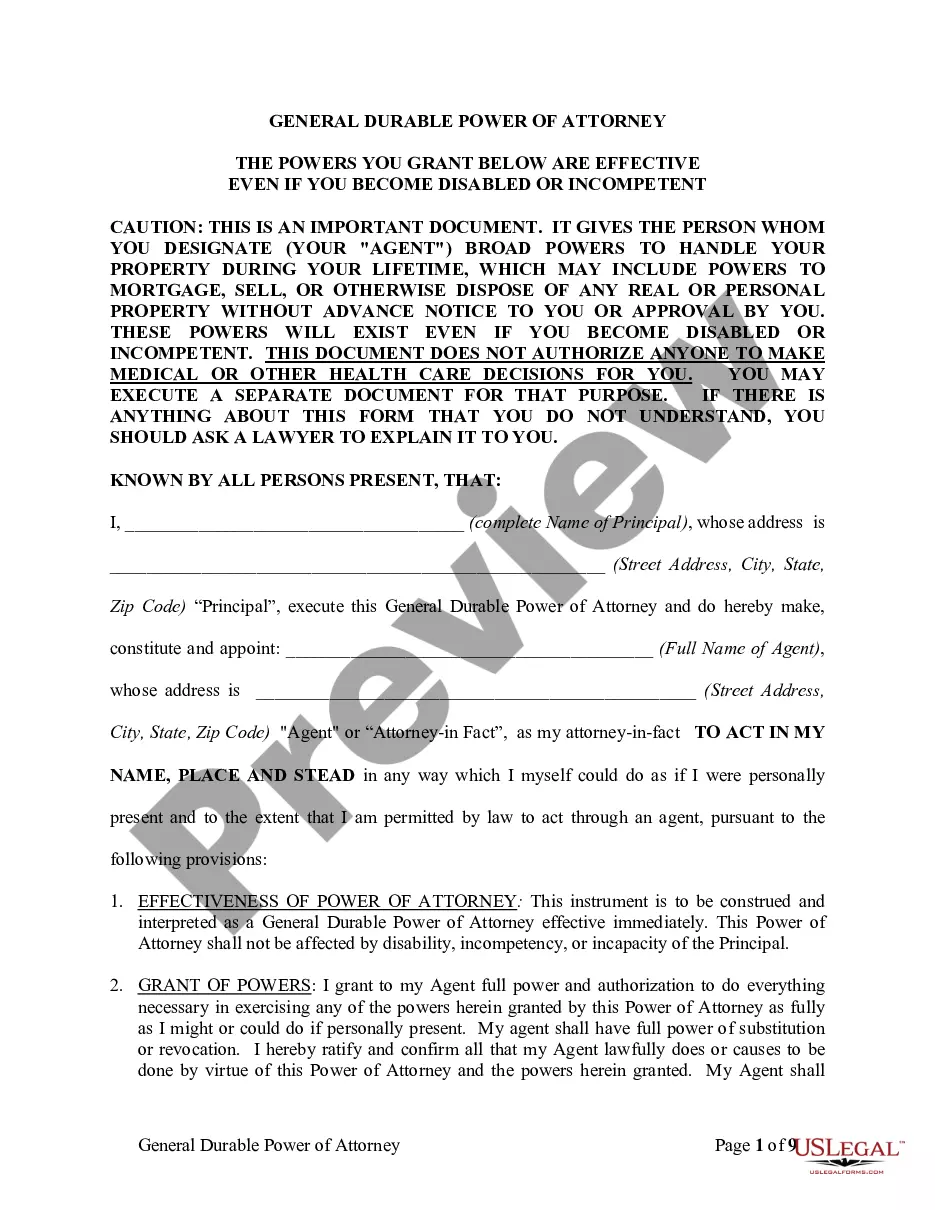

Florida Owner Financing Contract for Vehicle is a legally binding agreement between the seller and the buyer for purchasing a vehicle through a financing arrangement. This contract allows the buyer to make monthly payments to the seller, who acts as the lender, instead of obtaining a traditional auto loan from a bank or financial institution. It provides an alternative financing option for individuals who may not qualify for a conventional loan or prefer to avoid the lengthy application process and rigorous credit checks. The Florida Owner Financing Contract for Vehicle outlines the specific terms and conditions agreed upon by both parties. It includes important details such as the vehicle's make, model, year, identification number, and purchase price. The contract also specifies the down payment amount, the duration of the financing period, and the interest rate applied to the outstanding balance. Additionally, it covers the consequences of defaulting on payments or violating any terms of the agreement. There are various types of Owner Financing Contracts for Vehicles in Florida, each tailored to suit different buyer-seller circumstances. These include: 1. Simple Interest Contract: This type of contract calculates interest on the outstanding balance daily, reducing the overall interest paid over time. 2. Balloon Payment Contract: In this arrangement, the buyer makes smaller monthly payments for a set period, typically 3-5 years, with a significant lump sum payment (balloon payment) due at the end of the term. 3. Lease Purchase Contract: This contract combines elements of a lease and a purchase agreement. The buyer leases the vehicle for a predetermined period, with an option to purchase it at the end of the lease term. 4. Installment Sales Contract: This contract outlines regular installment payments over a specified period, ensuring the gradual repayment of the purchase price. 5. Hybrid Contract: A hybrid contract incorporates features from multiple types mentioned above, creating a customized financing arrangement that best suits the buyer and seller. When entering into a Florida Owner Financing Contract for a Vehicle, it is crucial for both parties to carefully review all terms and conditions, consult legal experts if necessary, and ensure clarity regarding payment obligations, interest rates, and potential penalties. This contract offers an alternative path to vehicle ownership, providing financial flexibility to buyers and expanding the market for sellers in Florida.

Florida Owner Financing Contract for Vehicle

Description

How to fill out Florida Owner Financing Contract For Vehicle?

Are you in a situation where you need documents for both business and personal purposes nearly all the time.

There are numerous legal document templates accessible on the internet, but finding reliable ones is challenging.

US Legal Forms offers thousands of form templates, including the Florida Owner Financing Contract for Vehicle, which can be tailored to meet federal and state requirements.

Once you find the right form, click Get now.

Select the pricing plan you desire, enter the necessary information to create your account, and complete your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Florida Owner Financing Contract for Vehicle template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Review button to inspect the document.

- Read the description to ensure you have chosen the correct form.

- If the form does not match what you're looking for, use the Search box to find the form that fits your needs and requirements.

Form popularity

FAQ

Yes, you can definitely get your own car financing. Many consumers choose to seek their own loans to have better control over the terms. Additionally, exploring a Florida Owner Financing Contract for Vehicle can be an ideal option, providing straightforward payment structures and direct agreements with sellers.

Good terms for seller financing typically involve a reasonable down payment, manageable monthly payments, and a competitive interest rate. Clarity on repayment timelines and any fees or penalties for late payments is also crucial. When creating a Florida Owner Financing Contract for Vehicle, both parties should strive for a fair agreement that benefits everyone involved. Consulting with a knowledgeable platform like US Legal Forms can enhance the reliability of your contract.

The average length of seller financing can range from several months to several years, with many contracts spanning three to five years. The specific duration depends on the agreement reached between the seller and buyer. In terms of a Florida Owner Financing Contract for Vehicle, considering the repayment timeline is essential for both parties. One should also be open to renegotiating terms as circumstances change over time.

One downside of owner financing is the potential for higher interest rates compared to traditional loans. Another concern is the risk of buyer default, which could lead to financial loss for the seller. Additionally, the Florida Owner Financing Contract for Vehicle may involve more paperwork and legal considerations, making the process complex. It's important to fully understand these risks before proceeding.

Typical terms for owner financing include a down payment, a competitive interest rate, and a repayment period ranging from a few months to several years. The Florida Owner Financing Contract for Vehicle should outline these elements explicitly. Additional clauses may address default consequences, repair responsibilities, and insurance obligations. Familiarizing yourself with these terms can streamline the financing process.

Writing an owner finance contract requires clarity and completeness. Begin by listing the parties involved, the vehicle details, and the total sale amount. Then, clearly state the terms of payment, including any interest fees and the schedule of payments within a Florida Owner Financing Contract for Vehicle. Ensure both parties review the terms thoroughly to promote a smooth agreement.

To report owner financing income, sellers must track and document all received payments and the interest earned. At tax time, this income is typically reported on the seller's tax return as part of their gross income. It's important to keep detailed records to substantiate your claims to the IRS. Using a Florida Owner Financing Contract for Vehicle can simplify this process by providing a clear outline of the transaction.

Seller-financed interest is generally reported as interest income on the seller's tax return. It is vital for the seller to maintain clear records of the interest charged in the owner financing agreement. This ensures that proper documentation exists for tax purposes. Using a Florida Owner Financing Contract for Vehicle provides the structure needed to track such interest payments efficiently.

Typically, seller financing does not appear on a buyer's credit report unless the seller reports it. Buyers should understand that while their history with the seller carries weight in their relationship, it may not affect their credit score unless it's reported. Therefore, negotiating these terms ahead of time is crucial. A well-structured Florida Owner Financing Contract for Vehicle can facilitate this discussion.

When reporting owner financing on taxes, sellers must calculate the interest income they earned throughout the year. Owners need to keep accurate records of the payments received and any applicable expenses related to the vehicle. It's essential to file the correct forms and accurately report this income to avoid any issues with the IRS. Utilizing a Florida Owner Financing Contract for Vehicle can help clarify your financial obligations and reporting requirements.