Florida Personal Property Lease

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

How to fill out Personal Property Lease?

It is feasible to spend numerous hours online seeking the legal document template that meets the federal and state requirements you desire.

US Legal Forms provides thousands of legal forms that have been evaluated by experts.

It is easy to obtain or print the Florida Personal Property Lease from our service.

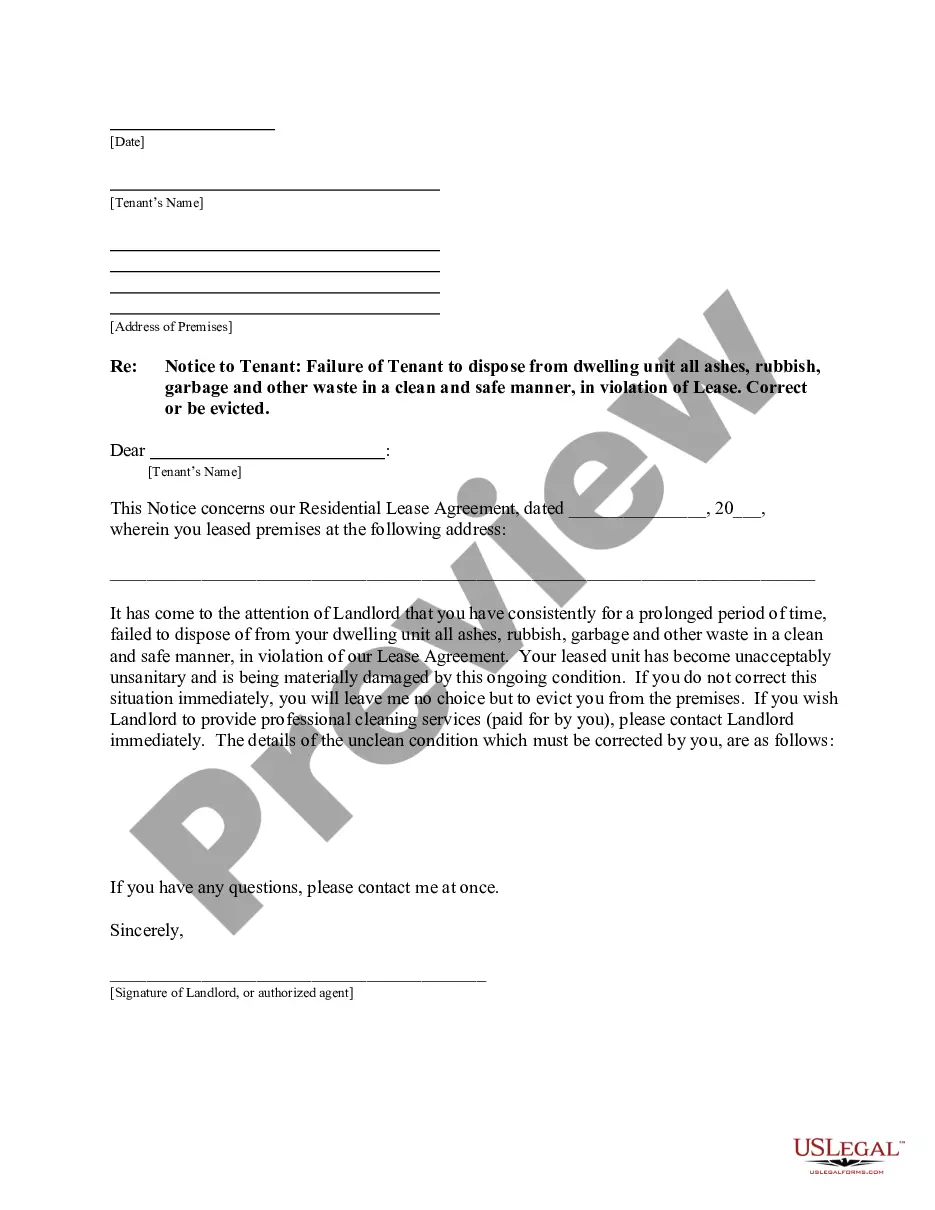

If available, use the Preview button to view the document template as well. If you wish to find another variation of the form, utilize the Lookup field to find the template that suits your needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Next, you can complete, adjust, print, or sign the Florida Personal Property Lease.

- Every legal document template you purchase is your own property permanently.

- To obtain an additional version of an acquired form, navigate to the My documents tab and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions outlined below.

- Firstly, ensure you have selected the correct document template for the state/city you choose.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

Absolutely, a vehicle is classified as personal property in Florida. This designation includes any car, truck, or similar conveyance owned by an individual or entity. If you’re considering leasing a vehicle under a Florida Personal Property Lease, recognizing it as personal property can simplify your leasing experience and clarify ownership rights.

Yes, a car can be part of an estate in Florida when determining the assets of a deceased person. This includes any vehicles owned at the time of death. When working with a Florida Personal Property Lease, it’s important to clarify the status of leased vehicles, as they may not be considered part of the estate, depending on the lease terms.

A leasehold property in Florida refers to a property where the tenant has the right to occupy the space for a specific period, as defined in a lease agreement. Essentially, when you secure a Florida Personal Property Lease, you gain exclusive rights to use that personal property for the duration of the lease. It’s a common arrangement, particularly for businesses and individuals who prefer flexibility.

Yes, a car is considered personal property in Florida. Personal property refers to movable items that are not fixed to real estate. This includes vehicles, which can be leased under a Florida Personal Property Lease. Understanding this classification can help you navigate leasing and ownership effectively.

Personal property is best defined as assets that can be moved and are not permanently fixed to a location. This includes items such as vehicles, furniture, and appliances. In the context of a Florida Personal Property Lease, recognizing what constitutes personal property can be key to ensuring compliance and making informed leasing decisions.

Private property in Florida typically refers to land and structures owned by individuals or entities, which are not publicly accessible. This can include residential homes, commercial buildings, and undeveloped land. Understanding the distinction between private property and personal property is essential when exploring your options for a Florida Personal Property Lease.

Personal property tax in Florida is a tax levied on movable assets owned by individuals or businesses. This tax applies to items that are not part of real estate, such as equipment and supplies. When leasing personal property under a Florida Personal Property Lease, being aware of these tax implications can help you manage costs effectively.

In Florida, personal property includes movable items that are not fixed to real estate. This category covers assets like furniture, electronics, and vehicles. When entering into a Florida Personal Property Lease, it is crucial to understand what qualifies as personal property, as it can affect your leasing agreements and tax obligations.

Any business owner who possesses tangible personal property with a value above a certain threshold must file a Florida tangible personal property tax return. This includes items like machinery, fixtures, and other equipment. If you are involved in a Florida Personal Property Lease, understanding this requirement is vital to avoid penalties. Be proactive and file your return on time to stay compliant with state laws.

Florida does not impose a personal income tax on individuals, which is a significant benefit for residents and investors. However, it is essential to consider other tax obligations, such as property taxes or sales taxes on certain transactions. If you are considering a Florida Personal Property Lease, you may benefit from the overall lower tax burden. This tax structure supports business growth and encourages investments.