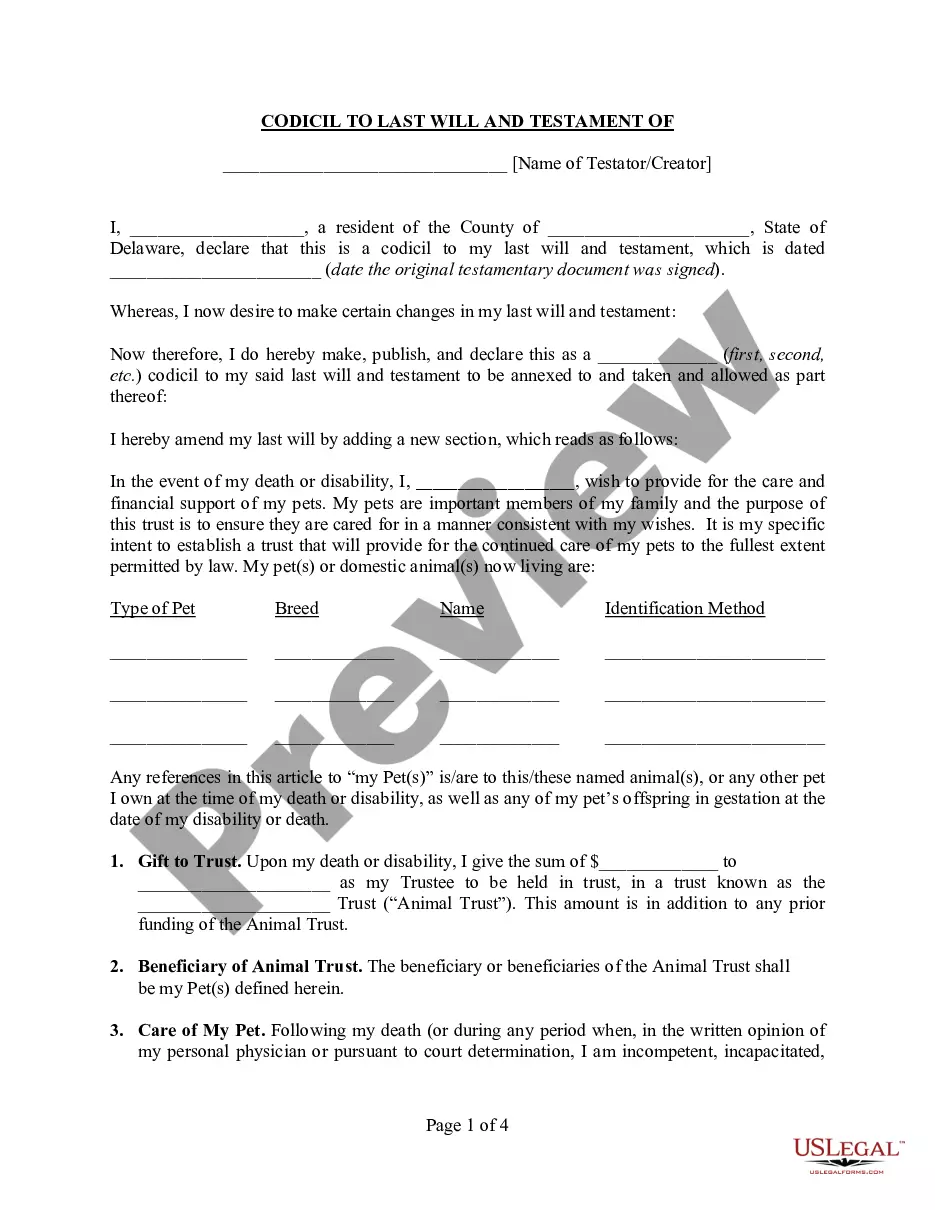

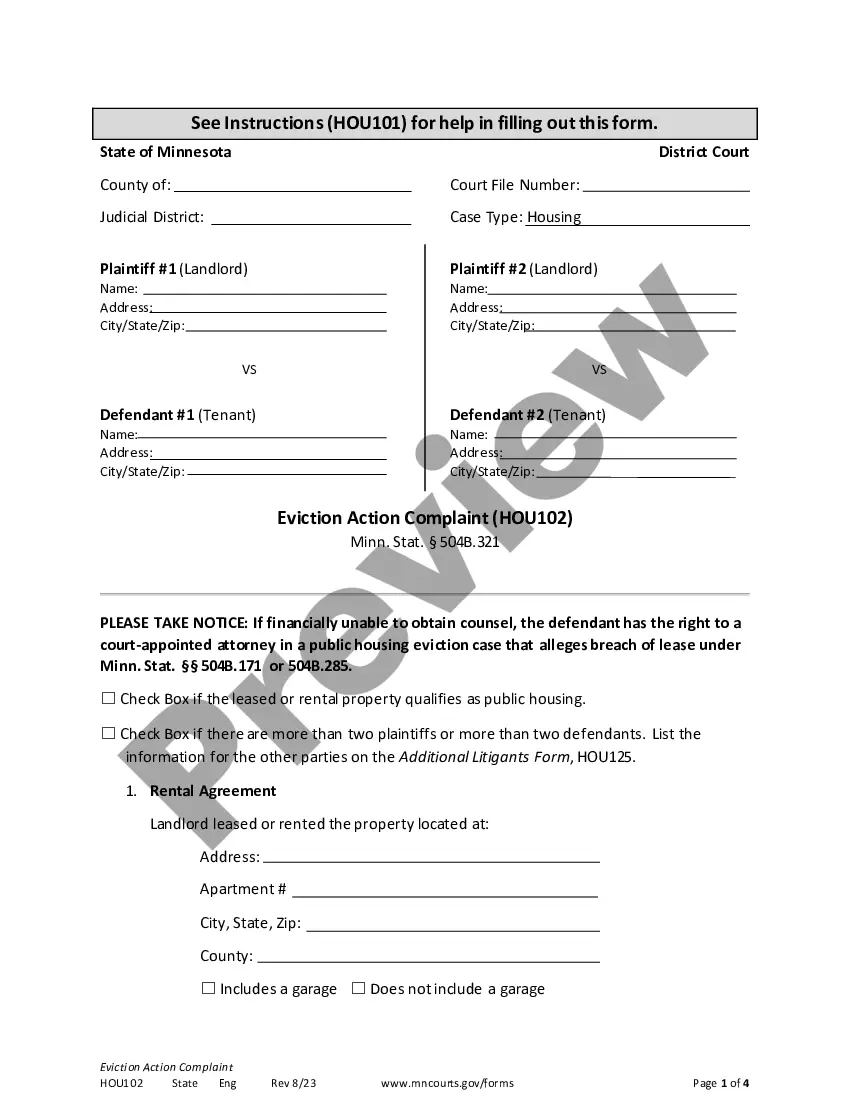

Florida Mutual Release of Claims based on Real Estate Purchase Contract with Rescission of Contract is a legal document that helps parties involved in a real estate transaction to settle disputes and release each other from any potential claims or liabilities associated with the purchase contract. This release agreement allows the parties to terminate the contract and return to the same position they were in prior to entering the contract. Keywords: Florida, Mutual Release of Claims, Real Estate Purchase Contract, Rescission of Contract There are several types of Florida Mutual Release of Claims based on Real Estate Purchase Contract with Rescission of Contract, such as: 1. Complete Mutual Release: This type of release fully absolves both parties of any claims or liabilities arising out of the real estate purchase contract. It indicates that both parties have agreed to terminate the contract and release each other from any further obligations. 2. Partial Mutual Release: In certain cases, parties may choose to release only specific claims or liabilities related to the real estate purchase contract. This can happen when certain aspects of the contract have been fulfilled, while others remain disputed. The partial mutual release allows the parties to resolve and release specific claims while maintaining the contract for other aspects. 3. Conditional Mutual Release: This type of release is executed when the parties have certain conditions or requirements that need to be fulfilled before releasing each other from claims. For example, a party may agree to release claims only upon the completion of repairs or resolution of specific issues mentioned in the contract. 4. Unilateral Mutual Release: In some cases, one party may decide to release the other party from any claims or liabilities arising from the real estate purchase contract. This release is typically executed when one party acknowledges that the other party has fulfilled their obligations and wishes to terminate the contract without further dispute. It is important to consult with a qualified attorney to ensure that a Florida Mutual Release of Claims based on Real Estate Purchase Contract with Rescission of Contract is prepared accurately, and all relevant legal requirements and considerations are met. Each type of release may have its own unique terms and conditions, so it is crucial to select the appropriate release that aligns with the specific circumstances of the real estate transaction.

Florida Mutual Release of Claims based on Real Estate Purchase Contract with Rescission of Contract

Description

How to fill out Mutual Release Of Claims Based On Real Estate Purchase Contract With Rescission Of Contract?

You can devote hours on the internet looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a wide array of legal templates that have been reviewed by experts.

It's easy to obtain or create the Florida Mutual Release of Claims based on Real Estate Purchase Agreement with Rescission of Agreement from my service.

If available, make use of the Preview option to examine the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and click the Get option.

- Afterward, you can complete, modify, create, or sign the Florida Mutual Release of Claims based on Real Estate Purchase Contract with Rescission of Contract.

- Every legal document template you acquire is yours forever.

- To get another copy of any purchased form, navigate to the My documents tab and click the corresponding option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for your preferred county/city.

- Review the form description to ensure you have chosen the correct template.

Form popularity

FAQ

The process of rescission typically involves several steps. First, one party must provide written notice to the other, outlining the intention to rescind based on the Florida Mutual Release of Claims. Following the notification, both parties should verify and agree on the terms of rescission, which may involve returning any exchanged funds or property.

A mutual rescission and release agreement annuls the contract and releases both parties from its obligations, freeing them both up to continue business as usual without the broken contract hanging over their them.

Rescinding a real estate contract gives you a way to back out of a deal for various reasons. A rescission puts you in the same place you were before you signed a contract.

Rescission as a Remedy to Parties Where a Business or Real Estate Contract has Been Entered Into Based on Duress, Fraud or Mistake. Generally speaking, rescission is a statutory and equitable remedy which restores the parties to the condition they were in prior to execution of the agreement.

Rescission allows a nonbreaching party to cancel the contract as a remedy for a breach. Rather than seeking monetary damages, the nonbreaching party can simply refuse to complete their end of the bargain. Rescission puts the parties back in the position they would have been in had they never entered into the contract.

A rescission is also referred to as an unmaking of a contract. When a mutual release agreement and rescission are drafted well, they represent a definitive ending point for the commitments of each party. These documents can also help the involved parties avoid any disputes or misunderstandings in the future.

Under Florida law (contract and case law), a buyer and/or seller is able, under certain circumstances, to terminate a residential real estate contract and walk away from the deal without penalty. One way a buyer can get out of a deal is by seeking rescission.

The act of putting an end to a contract by mutual agreement of the parties.

A Mutual Release Agreement is a straightforward document that allows you to settle disputes quickly and professionally. No matter what your dispute, a Mutual Release Agreement allows both parties to agree to drop all claims and get out of the contract.

A mutual rescission and release agreement annuls the contract and releases both parties from its obligations, freeing them both up to continue business as usual without the broken contract hanging over their them.

Interesting Questions

More info

“ The short answer is, it's really up to you! You will want to do research when choosing a mortgage; look over the various types of home loans to see which one will be a good fit in terms of quality, convenience, features, rate, and more. The only limit is your budget. There are many kinds of home loans, and each person has their own set of needs. This is why it's absolutely key to do your research before deciding to mortgage your home. Finding the best home loan can be a daunting process, but you have to keep the best interests in mind the entire time. Here is a comparison chart of some of the most popular home loan types to help you learn which home loan is best for you. Below is a table that shows common home loan features you should look for when choosing a home loan. FHA — It is easy for the FHA borrower to apply for or renew. The FHA is one of the most widely known mortgage loan products. It typically offers lower rates than more traditional mortgages.