Florida Transfer of Property under the Uniform Transfers to Minors Act

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

Are you currently inside a place where you need files for either enterprise or individual reasons almost every working day? There are plenty of lawful file templates accessible on the Internet, but finding types you can trust is not straightforward. US Legal Forms delivers a large number of develop templates, such as the Florida Transfer of Property under the Uniform Transfers to Minors Act, that are published to satisfy federal and state demands.

When you are previously acquainted with US Legal Forms internet site and have a merchant account, merely log in. Afterward, you can down load the Florida Transfer of Property under the Uniform Transfers to Minors Act design.

Unless you have an accounts and need to begin to use US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for your appropriate metropolis/state.

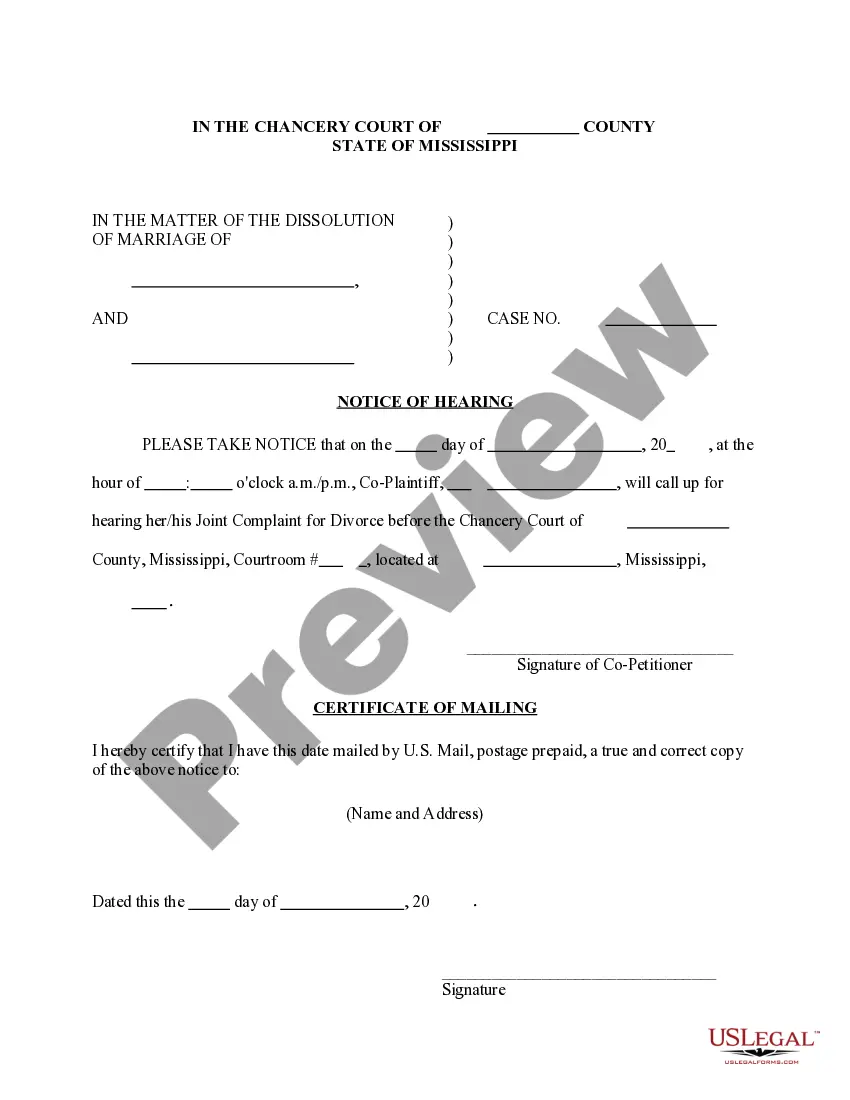

- Take advantage of the Preview button to examine the form.

- Read the description to ensure that you have chosen the right develop.

- If the develop is not what you are trying to find, use the Look for discipline to obtain the develop that suits you and demands.

- Once you obtain the appropriate develop, click on Acquire now.

- Choose the costs program you want, complete the required information to produce your bank account, and pay money for an order with your PayPal or credit card.

- Decide on a convenient paper formatting and down load your version.

Locate all of the file templates you might have bought in the My Forms food list. You can aquire a additional version of Florida Transfer of Property under the Uniform Transfers to Minors Act at any time, if possible. Just go through the required develop to down load or print out the file design.

Use US Legal Forms, probably the most considerable assortment of lawful types, to save lots of time as well as steer clear of mistakes. The service delivers expertly created lawful file templates that can be used for a selection of reasons. Make a merchant account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.

Note that in Florida, a UTMA can last until the beneficiary turns 25 ?if the transferor expresses a clear intent that the account continue to the age of 25.

The Uniform Gifts to Minors Act (UGMA) allows money and financial securities to be transferred to minors through a UGMA account and is allowed in all states.

The age of majority for an UTMA is different in each state. In most states, the age of majority is 21 ? which means that when a child turns 21, the custodianship of assets will end. But in other states, the age of majority is either 18 or 25. The custodian can also sometimes choose between a selection of ages.

Age of Majority and Trust Termination StateUGMAUTMAConnecticut2121Delaware1821District of Columbia1818Florida182149 more rows

A UGMA account is limited to purely financial products such as cash, stocks, mutual funds, bonds, other securitized instruments and insurance policies. A UTMA account, on the other hand, can hold any form of property, including real property and real estate.

The Florida Uniform Transfers to Minors Act (FUTMA or Act) is the Florida law which allows a person to make a gift of money, or tangible or intangible property to a minor by transferring the money or property to a custodian, which (depending on the nature of the transfer) the custodian manages until the minor has ...

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.