Florida Revocable Living Trust for Unmarried Couples

Description

How to fill out Revocable Living Trust For Unmarried Couples?

Are you currently in a location where you need documents for either business or personal purposes almost every day.

There are many legitimate form templates available online, but finding ones you can trust isn't simple.

US Legal Forms offers numerous form templates, such as the Florida Revocable Living Trust for Unmarried Couples, that are designed to comply with federal and state regulations.

Once you find the right form, click on Buy now.

Choose the pricing plan you desire, fill out the required information to set up your account, and pay for the order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Florida Revocable Living Trust for Unmarried Couples template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

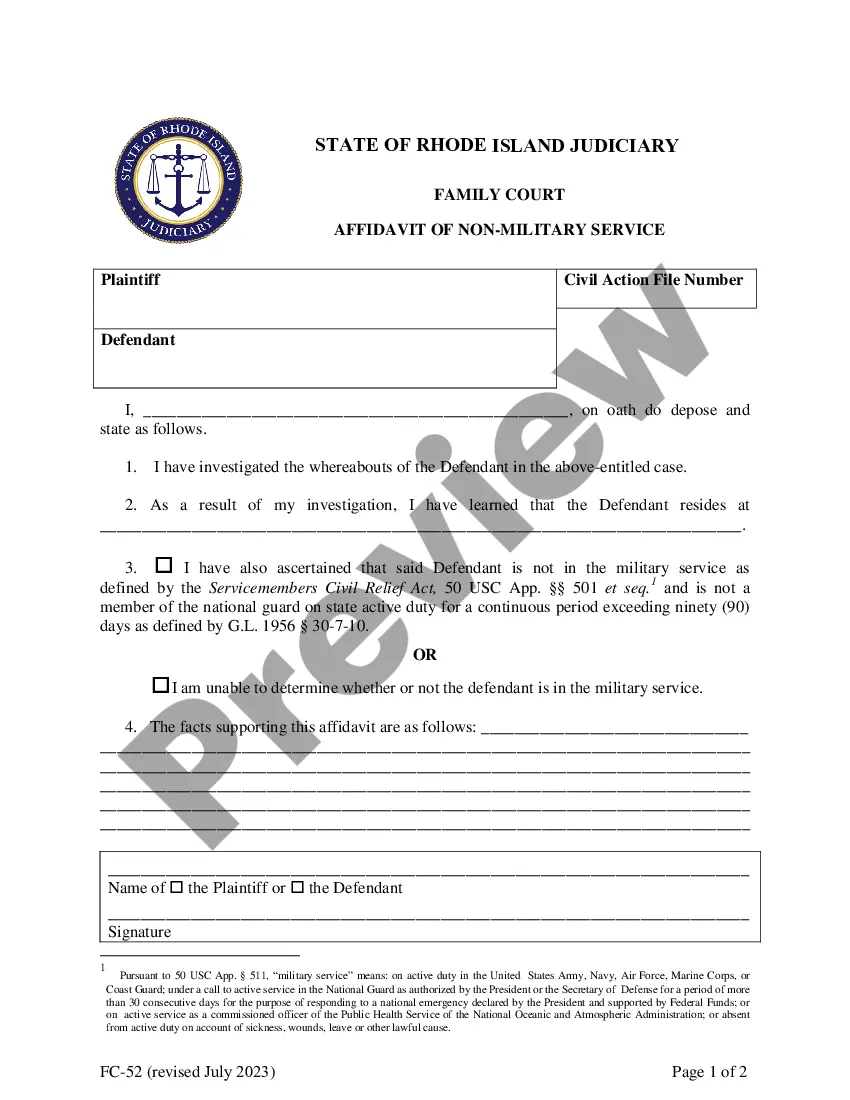

- Use the Review option to examine the form.

- Read the description to ensure that you have selected the right form.

- If the form isn't what you're looking for, use the Research field to find the form that meets your needs and criteria.

Form popularity

FAQ

A lawyer is not required to make a trust in Florida, particularly when creating a Florida Revocable Living Trust for Unmarried Couples. However, handling trust creation independently can be challenging and may lead to mistakes. A legal professional can clarify instructions, avoid common pitfalls, and ensure that your trust aligns with Florida laws. Platforms like US Legal Forms also provide resources and templates, enabling you to create your trust efficiently while offering guidance along the way.

You do not necessarily need an attorney to prepare a Florida Revocable Living Trust for Unmarried Couples, but having professional assistance can be beneficial. While DIY options exist, working with an attorney ensures that the trust meets all legal requirements and effectively reflects your wishes. An attorney can also help address specific needs unique to unmarried couples, such as asset division and guardianship considerations. Therefore, it is wise to evaluate your comfort level with the legal process and the complexity of your situation.

Unmarried couples should consider various estate planning documents, including a Florida revocable living trust, wills, and power of attorney. A will outlines your wishes regarding asset distribution, while a power of attorney allows you to appoint someone to manage your financial affairs if you become incapacitated. Utilizing platforms like US Legal Forms can help you access the necessary templates and guidance to ensure all bases are covered.

Certain assets may be better off not included in a revocable trust. For example, retirement accounts like IRAs or 401(k)s generally require different beneficiary designations. Additionally, assets that may require management by a different entity, such as jointly owned property, should also be considered with caution. This decision can greatly impact your overall estate plan, especially for unmarried couples.

One primary disadvantage of placing your house in a Florida revocable living trust for unmarried couples is the initial setup effort involved. Transferring property into the trust may require additional paperwork and time. Additionally, while this trust avoids probate, it does not provide asset protection from creditors. Thus, it’s essential to weigh these factors against the benefits.

Yes, you can prepare your own living trust in Florida, but it's essential to ensure the document is valid and meets all legal requirements. Many couples opt to use resources like US Legal Forms to access templates and guides specifically aimed at unmarried couples. While DIY creation is possible, consulting with a legal professional can help avoid costly mistakes and ensure your trust reflects your intentions for property distribution.

In a Florida revocable living trust for unmarried couples, the trust itself typically owns the property. However, the individuals who create the trust, known as grantors, maintain control over the assets during their lifetime. They can modify or revoke the trust at any time. This setup allows for smoother management of assets and avoids probate upon death.

Whether to have one trust or two can depend on the specific needs and circumstances of each couple. A single Florida Revocable Living Trust for Unmarried Couples can simplify management and distribution of assets. However, separate trusts may offer distinct tax benefits and individualized control over assets. Evaluating your unique situation with a legal advisor can lead you to the best decision.

When one person dies in a Florida Revocable Living Trust for Unmarried Couples, the trust typically becomes irrevocable. This means the remaining partner generally loses the ability to alter the trust but continues to benefit from the assets. The trust will dictate how the assets are distributed after the death of one partner, ensuring that your wishes are followed. You can easily prepare for this scenario by setting up your trust correctly with the help of resources from uslegalforms.

Yes, you can create a Florida Revocable Living Trust for Unmarried Couples without needing a spouse. This type of trust allows you to manage your assets and designate beneficiaries as you wish. It gives you significant control over your estate, ensuring your partner is protected in case of unforeseen circumstances. Utilizing a legal platform like uslegalforms can simplify the process, providing templates and guidance tailored for unmarried couples.