Florida Guaranty of Promissory Note by Individual - Corporate Borrower

Description

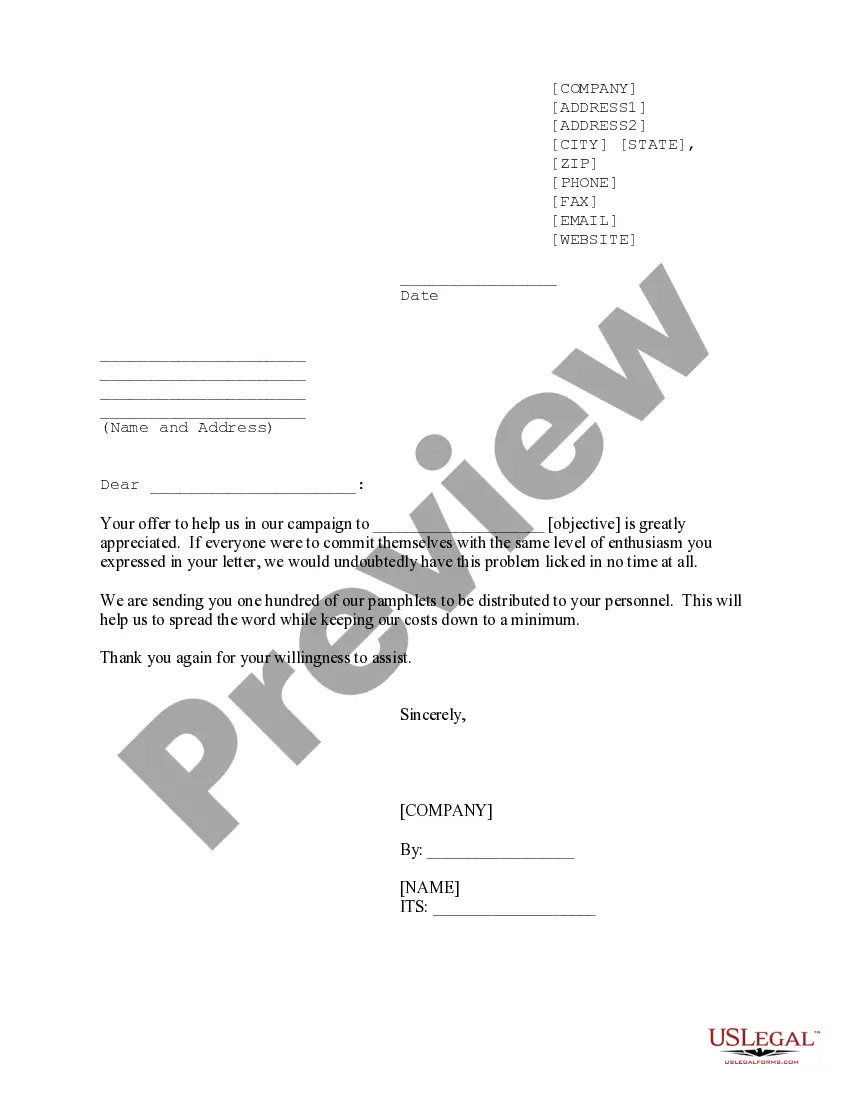

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

It is feasible to spend hours online searching for the legal document template that meets the state and federal requirements you will necessitate.

US Legal Forms offers a wide variety of legal documents that are assessed by experts.

You can download or print the Florida Guaranty of Promissory Note by Individual - Corporate Borrower from the service.

If offered, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Florida Guaranty of Promissory Note by Individual - Corporate Borrower.

- Each legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any acquired form, go to the My documents tab and select the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure you have selected the correct document template for the state/region of your preference.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

A guarantee in which a corporation agrees to be held responsible for completing the duties and obligations of a Sponsor, in the event that the Sponsor fails to fulfill the terms of the contract.

A guarantor is usually a close relative or friend of the borrower. They commit or 'guarantee' to covering repayments or even repaying an entire loan if the borrower isn't able to do so themselves. As a guarantor, you will need to sign a credit agreement alongside the borrower.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like or .

The general rule is that no corporation has the power, by any form of contract or endorsement, to become a guarantor or surety or otherwise lend its credit to another person or corporation.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

The guarantor must be a citizen of India above 18 years of age where the payment agreement agrees. He/she is expected to have a good credit score and sufficient income to cover loan repayments.

Florida Promissory Note RequirementsNames and contact information of all parties to the agreement;A statement of the promise to pay;Amount of the loan;Collateral used to secure the loan, if any;Repayment schedule (amounts, frequency) and interest;Date repayment is due;Penalties and late fees;More items...?

A personal guarantee is a written promise to guarantee the liability of one party for the debts of another party. Commonly, personal guarantees are given by directors and shareholders of companies to personally guarantee the payment of money or obligations on behalf of their company.

Most lenders making loans to family-owned companies, LLPs or LLCs will insist on a personal guarantee. But if you waived your limited liability by giving a personal guarantee to a lender or a landlord, that doesn't mean that you've waived your protection for other liabilities.