Florida Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a vast selection of legal document formats that you can download or print. Through the website, you can access thousands of forms for business and personal purposes, organized by types, states, or keywords.

You can find the latest editions of forms such as the Florida Contractor's Affidavit of Payment to Subs within moments.

If you already have a subscription, Log In and retrieve the Florida Contractor's Affidavit of Payment to Subs from your US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms within the My documents tab of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the purchase.

Choose the file format and download the form to your device. Make alterations. Fill out, edit, print, and sign the downloaded Florida Contractor's Affidavit of Payment to Subs. Each template you add to your account has no expiration date and is yours indefinitely. Thus, if you need to download or print an additional copy, just go to the My documents section and click on the form you require.

- Ensure you have chosen the correct form for your city/county.

- Click the Preview button to review the content of the form.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

Florida allows payments to be withheld for the following reasons: An improper pay request, A bona fide dispute, A material breach of contract by the claimant.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

You cannot usually withhold payment from a subcontractor if the job you are contracted to run does not pay you for work on time or at all. The subcontractor can place a mechanic's lien against your property to recover his owed funds, and he can sue you to recover additional damages.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

This can be due to a dispute or contractual breach between two parties for non-performance of a certain clause. Provided that a party to a contract issues a compliant withholding-notice setting out the grounds and the sums attributable to each ground, then the party may legitimately withhold payment.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

Generally, state laws state that general contractors must pay subs within 7 to 14 days from receipt of payment from the owner.

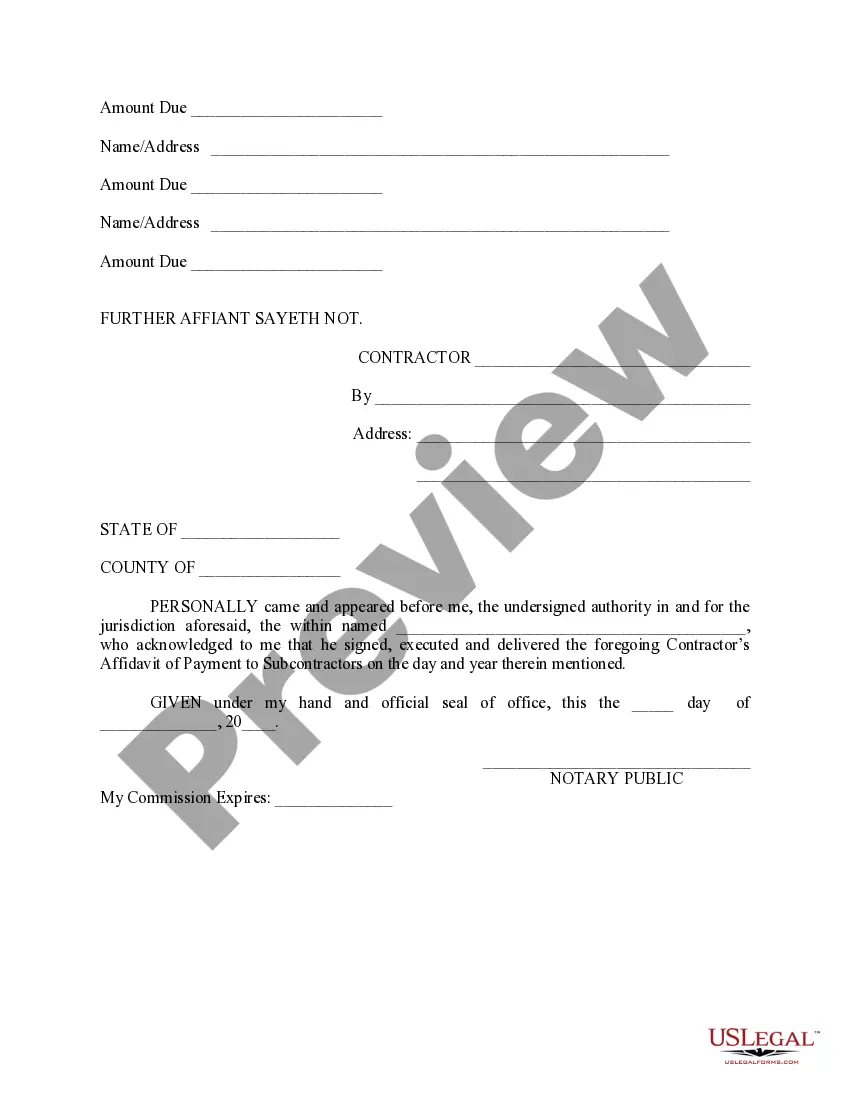

AIA Document G70621221994 requires the contractor to list any indebtedness or known claims in connection with the construction contract that have not been paid or otherwise satisfied.