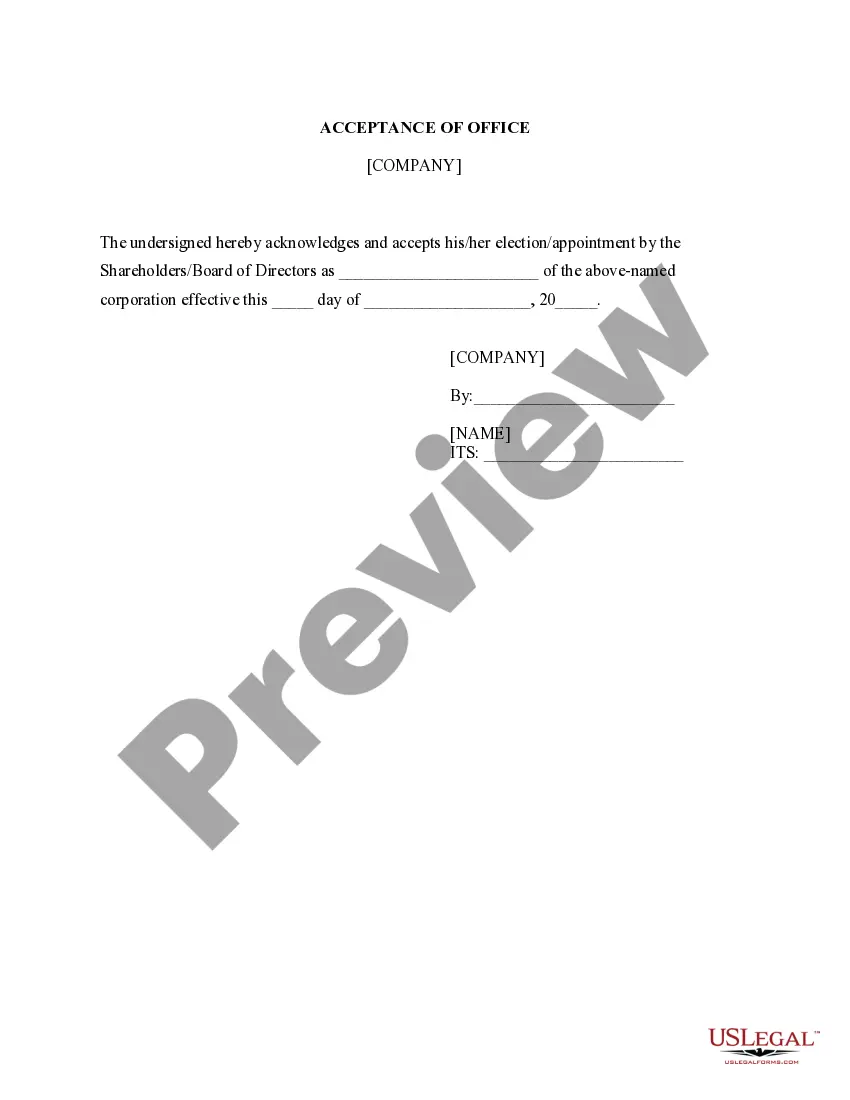

This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Florida Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

You can dedicate several hours online searching for the legal document template that meets the federal and state requirements you have. US Legal Forms provides a vast array of legal forms that can be reviewed by professionals.

You can easily obtain or print the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure from your service.

If you already possess a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure. Every legal document template you acquire is yours indefinitely. To obtain another copy of a purchased form, visit the My documents section and click the corresponding button.

Select the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure. Download and print a multitude of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice. Review the form description to confirm you have chosen the right form.

- If available, use the Review button to examine the document template at the same time.

- If you wish to find another version of the form, utilize the Search field to locate the template that fits your requirements.

- Once you have found the template you need, click on Purchase now to proceed.

- Choose the pricing plan you desire, enter your details, and create an account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to buy the legal form.

Form popularity

FAQ

You should file Form 14135, the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure, with the local IRS office that handles your area. This form is essential for initiating the release of your property from tax lien status. Make sure to double-check the submission guidelines and address to avoid delays. For a seamless experience, consider using US Legal Forms to access the correct forms and receive guidance on the filing process.

In Florida, the redemption period for tax liens typically lasts for two years from the date of the tax deed sale. During this time, property owners can reclaim their property by paying the tax debt and any applicable fees. Understanding this timeframe is crucial for anyone dealing with tax liens. Utilizing the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure can facilitate this process.

To have the IRS release a lien, you should file the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure. This form initiates the process of clearing any tax lien on your property. Ensure you provide all necessary documentation to support your request. Once the IRS reviews your application, they will inform you of their decision.

The right to redeem property after a foreclosure allows the former owner to reclaim their property by paying off the necessary debts within a specified time frame. This right provides a second chance to retain ownership, which can be crucial for many homeowners. Knowing your rights in this regard is vital to making informed decisions. The Florida Application for Release of Right to Redeem Property from IRS After Foreclosure can be a useful resource in this process.

Foreclosure redeemed means that a property owner has reclaimed their property after paying off the outstanding debts associated with the foreclosure. This process helps restore ownership and allows the individual to regain control of their property. Understanding the redemption process is essential for property owners facing foreclosure. The Florida Application for Release of Right to Redeem Property from IRS After Foreclosure may provide valuable insights.

The IRS 7 year rule refers to the time frame in which a federal tax lien may remain on your credit report. Generally, the IRS can collect taxes owed for up to ten years, but the impact on your credit report fades after seven years. Knowing this rule can assist you in planning your financial future. For further assistance, consider the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure.

The IRS right of redemption in a foreclosure refers to the ability of the IRS to reclaim property after a foreclosure sale, provided that the owner pays the owed taxes. This right typically lasts for 120 days after the sale. Property owners should be aware of this right, as it can impact their financial decisions. By considering the Florida Application for Release of Right to Redeem Property from IRS After Foreclosure, you can better navigate this situation.