Florida Satisfaction of Mortgage is a legal document that is used to release a mortgage lien from a property in Florida. It is signed by the mortgagor (the original borrower) and the mortgagee (the original lender) and acknowledges that the loan has been paid in full. The document must be recorded in the county where the property is located and must include the legal description of the property, the mortgage amount, and the parties’ names. There are two types of Florida Satisfaction of Mortgage: Cancellation of Mortgage and Release of Mortgage. A Cancellation of Mortgage is used when the loan is fully paid off and the borrower no longer owes the lender any money. A Release of Mortgage is used when the loan is paid off, but the lender still retains a lien on the property as security for the debt.

Florida Satisfaction of Mortgage

Description

How to fill out Florida Satisfaction Of Mortgage?

How much time and effort do you typically invest in creating formal documentation.

There is a superior alternative to acquiring such forms than recruiting legal professionals or spending countless hours scouring the internet for a fitting template. US Legal Forms is the premier online repository that offers expertly drafted and confirmed state-specific legal documents for various purposes, including the Florida Satisfaction of Mortgage.

An additional advantage of our service is that you can access previously obtained documents that you securely store in your profile under the My documents tab. Retrieve them anytime and redo your paperwork as often as necessary.

Save time and energy filling out formal paperwork with US Legal Forms, one of the most dependable online solutions. Join us today!

- Browse through the form content to verify it aligns with your state regulations. To do this, review the form description or utilize the Preview option.

- If your legal template does not fulfill your needs, search for another one using the search bar located at the top of the page.

- If you are already a member of our service, Log In and download the Florida Satisfaction of Mortgage. If not, follow the next steps.

- Click Buy now when you locate the appropriate document. Select the subscription plan that best fits your needs to access the full range of our library’s offerings.

- Register for an account and complete the payment for your subscription. You can pay using your credit card or via PayPal - our service is entirely secure for those transactions.

- Download your Florida Satisfaction of Mortgage onto your device and fill it out on a physical hard copy or electronically.

Form popularity

FAQ

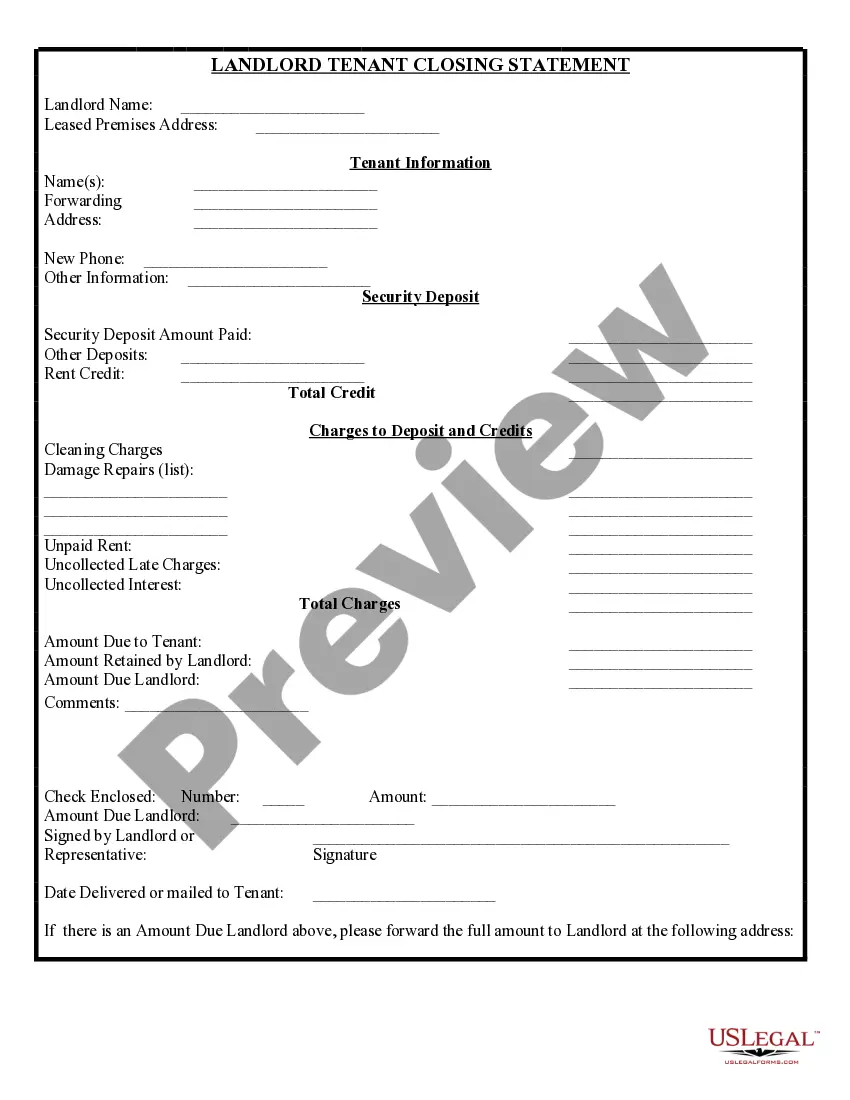

To fill out a satisfaction of mortgage form, start by gathering relevant information such as the mortgage details, borrower information, and lender identification. Ensure that the form includes a statement indicating that the mortgage is satisfied, along with signatures from authorized individuals. After completion, file the form with the county clerk’s office for official recording. Platforms like US Legal Forms provide helpful templates and guidance to make this process easy.

You can determine if your mortgage is satisfied by checking your records for a satisfaction document from your lender. This document is often filed with the county clerk's office. Additionally, if you’ve received a release or satisfaction letter, you can confirm that your Florida Satisfaction of Mortgage has been processed. If you have any doubts, consider using US Legal Forms to track the status of your mortgage.

An example of satisfaction of mortgage is when a homeowner pays off their mortgage balance. Upon completion of payments, the lender issues a satisfaction document, signaling that the debt obligation has been met. This document is crucial for clearing the title of the property, indicating no further claims exist. Essentially, it serves as proof that your Florida Satisfaction of Mortgage is officially resolved.

Yes, Florida is classified as a mortgage state, rather than a deed of trust state. This means that mortgages in Florida create a lien on the property, allowing the lender to secure their interest. Homeowners in Florida must understand this distinction when managing their mortgage obligations. For guidance on mortgages, the US Legal Forms platform offers resources and templates tailored for Florida residents.

Florida law mandates that certain documents, like mortgages, must have witness signatures. Specifically, two witnesses are required during the execution of the mortgage document. However, other documents, like a satisfaction of mortgage, may not have the same requirement. This differentiation highlights the importance of knowing the specific requirements for each document to ensure compliance.

In Florida, a mortgage does require witnesses for the document to be valid. Specifically, two witnesses must sign the mortgage document at the time of signing. This requirement ensures that there is proof of the authenticity of the signatures, which can be critical during legal disputes. Be sure to follow this guideline closely when securing your mortgage to guarantee a smooth process.

Yes, in Florida, a satisfaction of mortgage must be notarized to be valid and enforceable. A notary public's signature adds an essential layer of authenticity to the document, ensuring that it is properly executed. This notarization helps lenders and county officials recognize the document during the filing process. If you need templates for this, US Legal Forms can provide the necessary forms to simplify the notarization process.

In Florida, a satisfaction of mortgage does not require witnesses to be legally valid. The document must be signed by the mortgagee, but the presence of witnesses is not mandated. However, having witnesses can help secure the document's acceptance, especially in certain situations. Ensuring proper execution can lead to fewer complications when filing your Florida Satisfaction of Mortgage.

To find the satisfaction of a mortgage in Florida, you can check the local county clerk's office, where records of satisfied mortgages are filed. These records are public and can usually be accessed online or in person. Additionally, you may locate the information through the lender who issued the mortgage, as they are responsible for filing the satisfaction documentation. Utilizing platforms like US Legal Forms can also streamline the process by providing the necessary forms and guidance.

In Florida, a Satisfaction of Mortgage does not usually require notarization to be legally effective. However, having it notarized can add an extra layer of authenticity to the document. It's important to check with your local county office to understand specific requirements in your area. Utilizing resources from USLegalForms can help ensure that you have the right documentation for your Florida Satisfaction of Mortgage.