Florida Summary Administration Package - Small Estates - Under $75,000

Description

How to fill out Florida Summary Administration Package - Small Estates - Under $75,000?

Obtain the most extensive collection of legal documents.

US Legal Forms is truly a means to locate any state-specific document in just a few clicks, such as Florida Summary Administration Package - Small Estates - Under 75,000 samples.

No need to squander hours searching for an admissible court example.

After selecting a pricing plan, set up your account. Pay using a credit card or PayPal. Save the document to your device by clicking Download. That's it! You should complete the Florida Summary Administration Package - Small Estates - Under 75,000 form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and conveniently browse over 85,000 valuable forms.

- To utilize the forms library, select a subscription and create your account.

- If you have already completed this, simply Log In and click Download.

- The Florida Summary Administration Package - Small Estates - Under 75,000 template will be promptly stored in the My documents tab (a section for each form you save on US Legal Forms).

- To create a new profile, follow the brief instructions listed below.

- If you intend to use a state-specific example, ensure you select the correct state.

- If possible, review the description to understand all the details of the form.

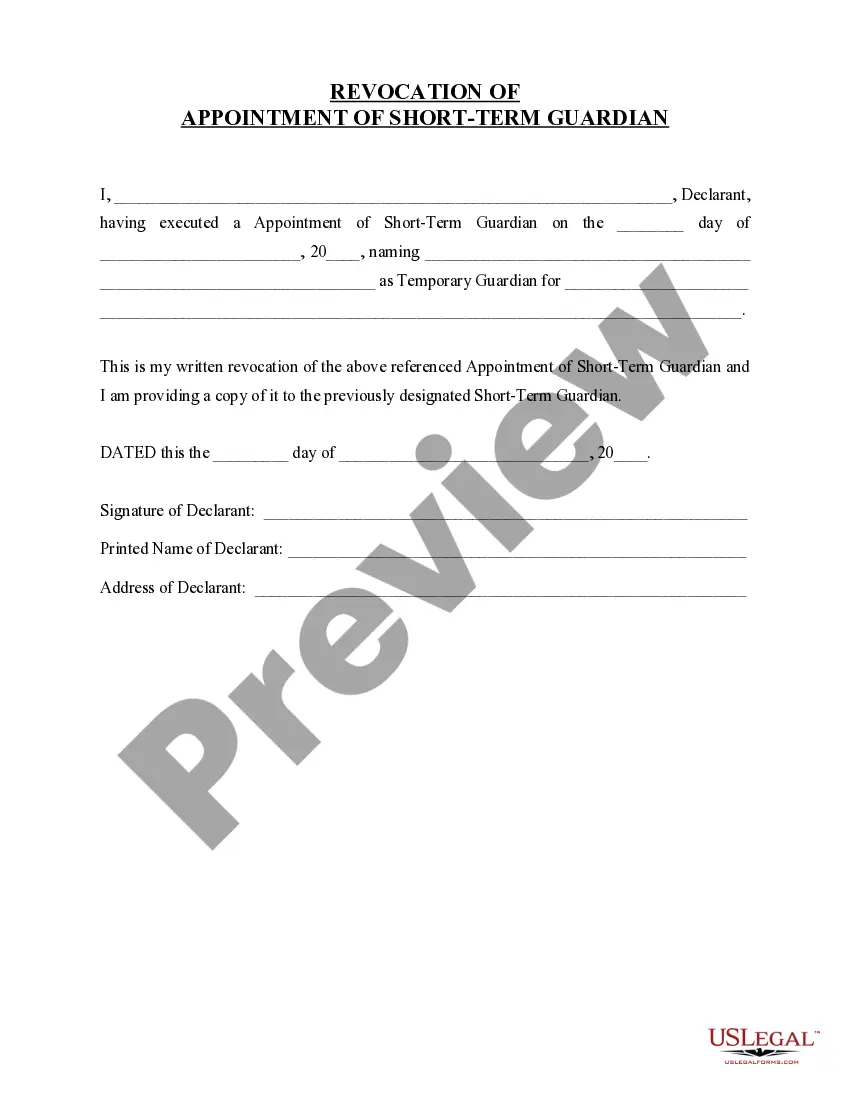

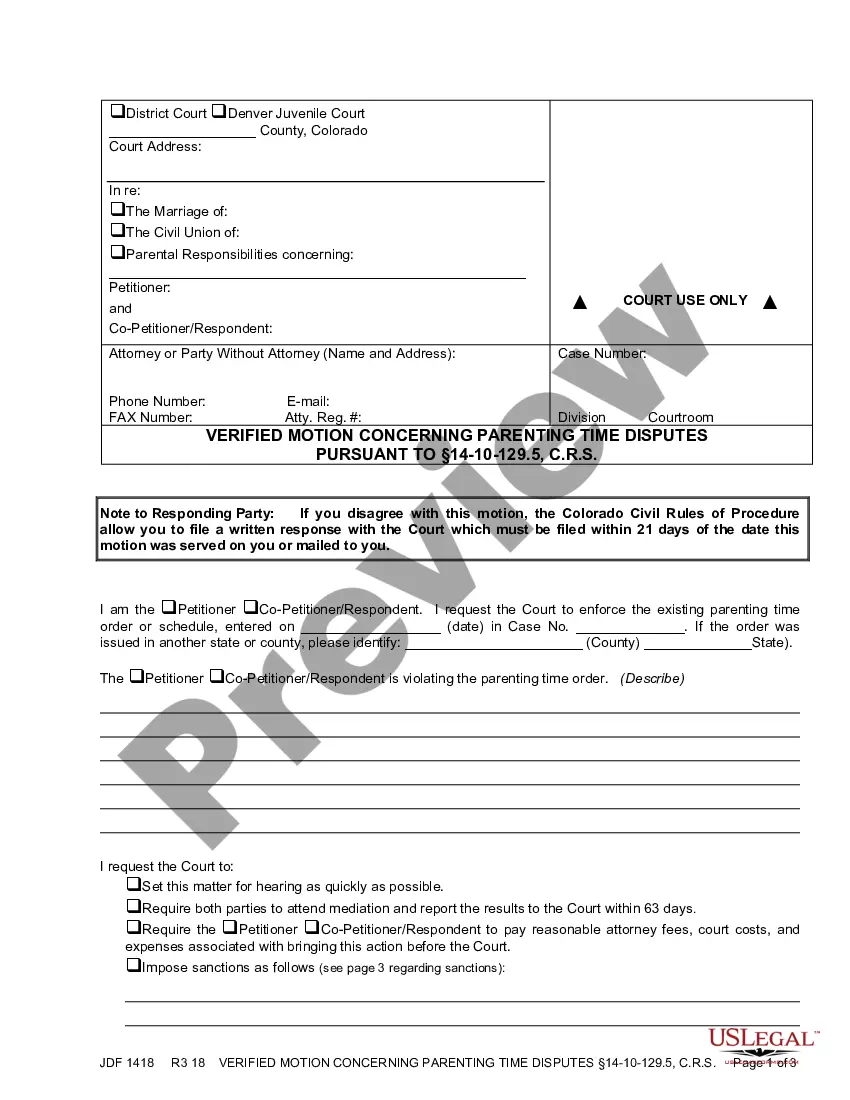

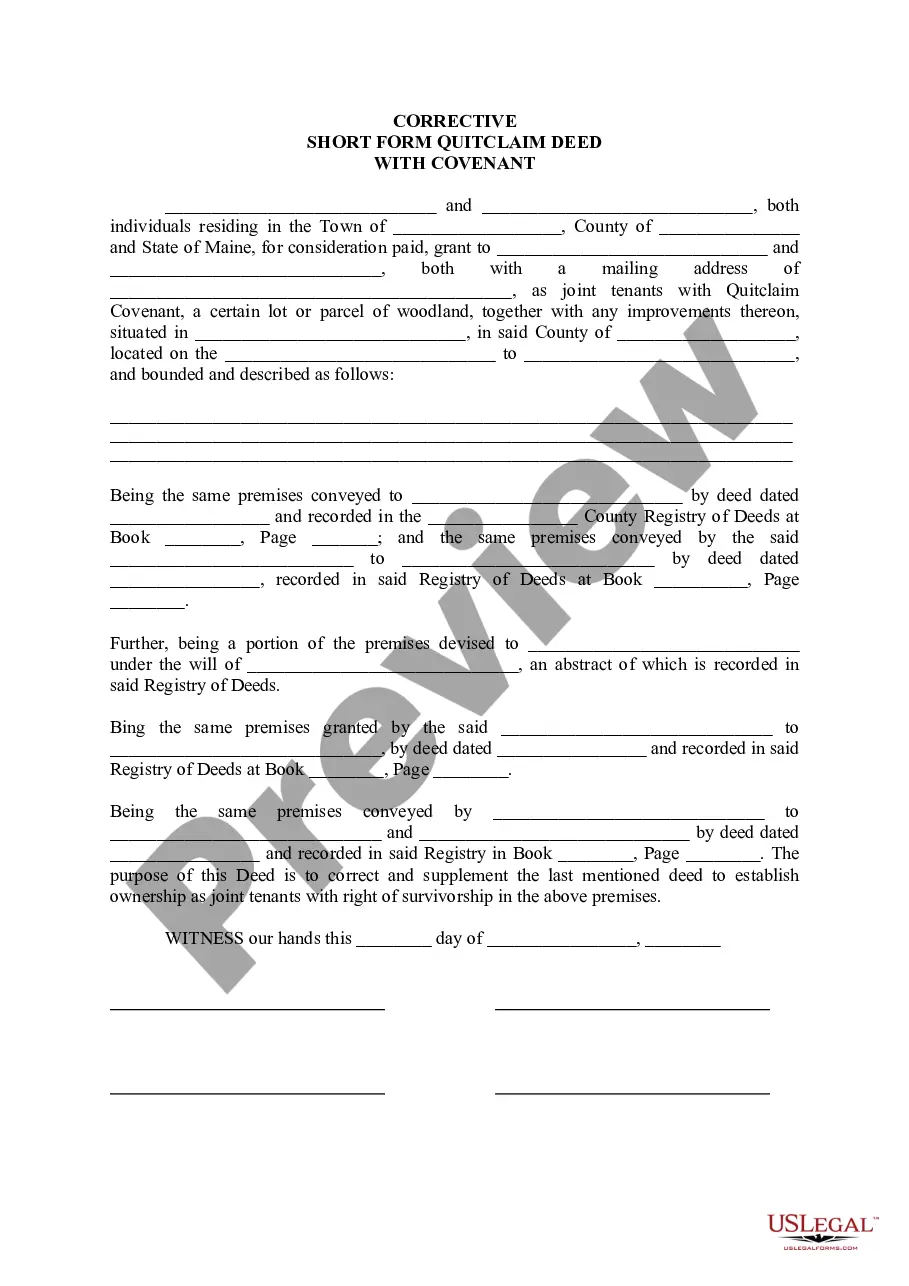

- Utilize the Preview option if it’s available to examine the content of the document.

- If everything appears correct, click on the Buy Now button.

Form popularity

FAQ

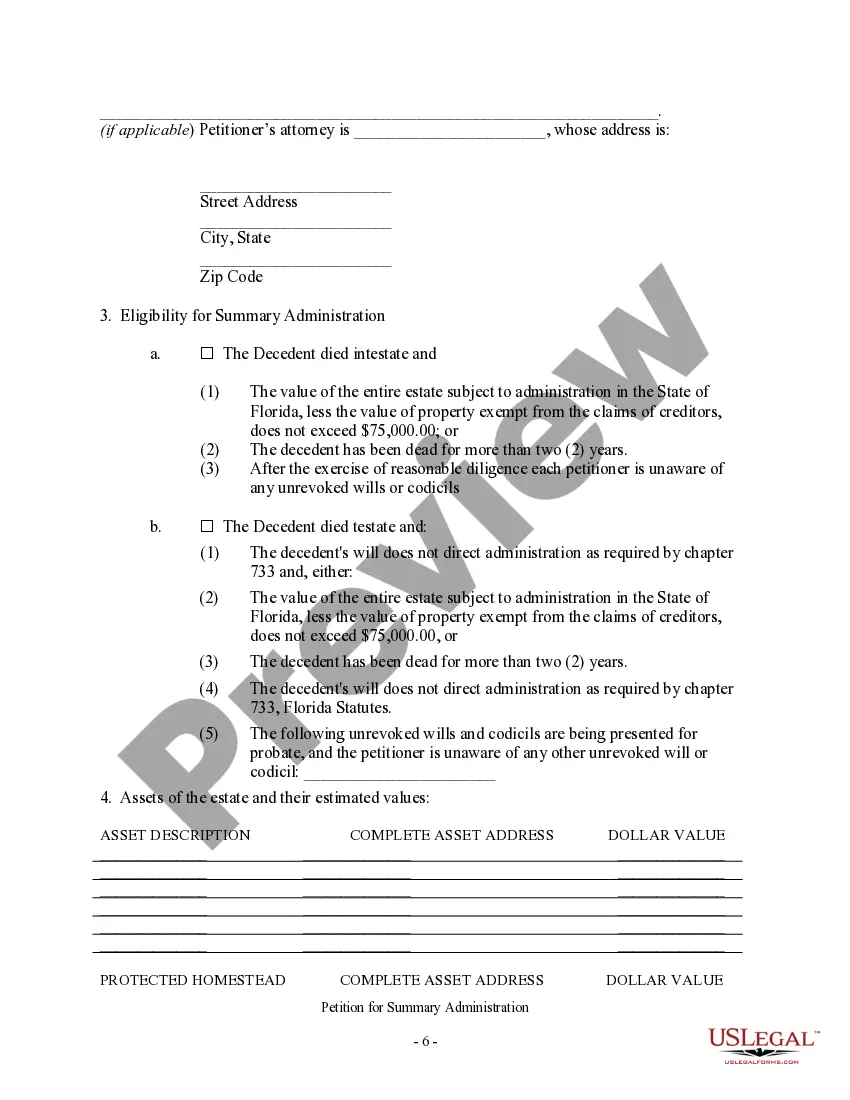

In Florida, a small estate is generally defined as one that has a total value of less than $75,000, excluding certain assets like homestead property. This classification allows for a streamlined process using the Florida Summary Administration Package - Small Estates - Under $75,000. By opting for this package, you can facilitate a quicker resolution of the estate, allowing heirs to receive their inheritances with minimal delay. If you believe your estate qualifies, explore our services to guide you through the process.

In Florida, the estate tax limit is set at a threshold of $11.7 million, which means that estates valued below this amount do not incur estate taxes. However, if you are dealing with a small estate valued at under $75,000, the Florida Summary Administration Package - Small Estates - Under $75,000 can simplify the process. Utilizing this package can help you efficiently navigate the necessary legal procedures without the burden of estate taxes. Always consider consulting a professional to ensure you meet all legal requirements.

In Florida, the single audit threshold is a federal guideline that mandates audits when federal funds exceed a specific monetary limit, which is $750,000 for non-profit organizations and governmental entities. For estates using the Florida Summary Administration Package - Small Estates - Under $75,000, this threshold usually does not impact the summary administration process directly. However, having a clear financial overview can support compliance and give you peace of mind.

The summary administration limit in Florida refers to the maximum estate value that can qualify for a simplified probate process. Currently, this limit stands at $75,000, allowing smaller estates to bypass standard probate requirements. By opting for the Florida Summary Administration Package - Small Estates - Under $75,000, you can significantly reduce the workload and expedite distribution of assets to heirs.

The 5.530 rule in Florida refers to the stipulation that allows a small estate to qualify for summary administration if the estate's value is less than $75,000. By adhering to this rule, you can efficiently navigate the summary administration process, avoiding the complexities of regular probate. Utilizing the Florida Summary Administration Package - Small Estates - Under $75,000 can streamline this experience for beneficiaries.

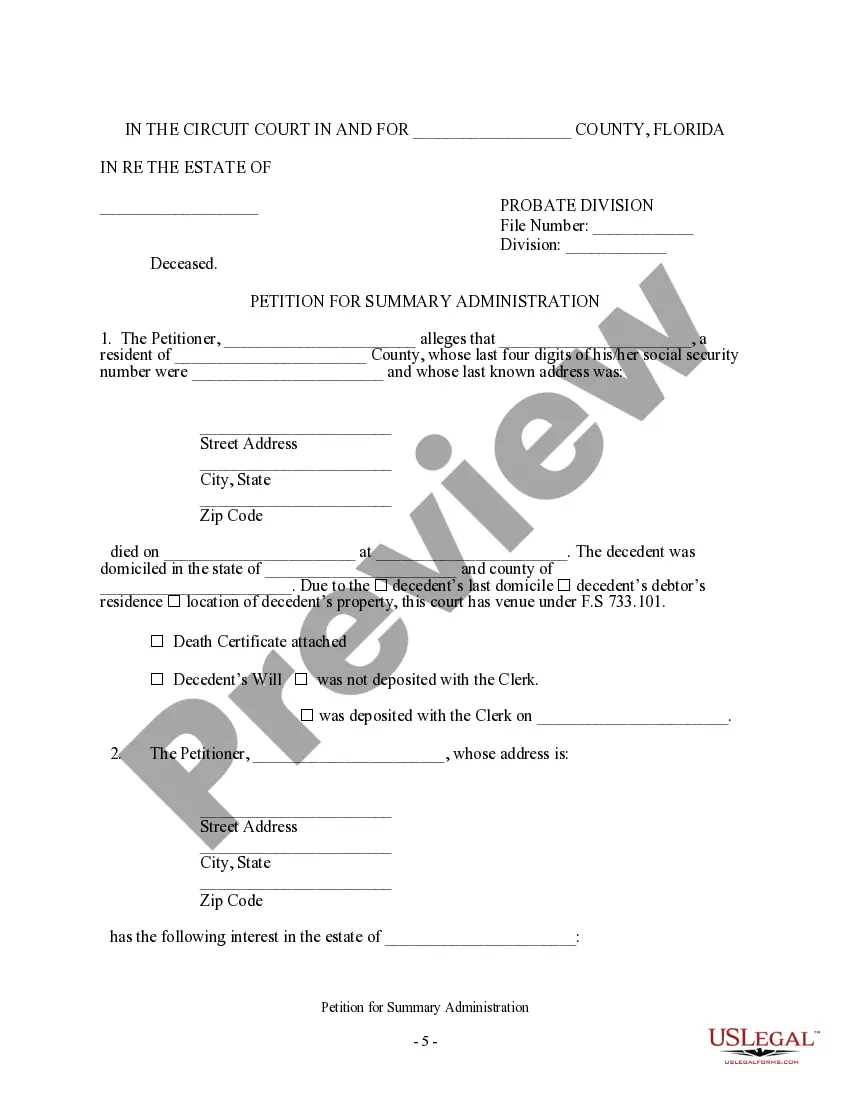

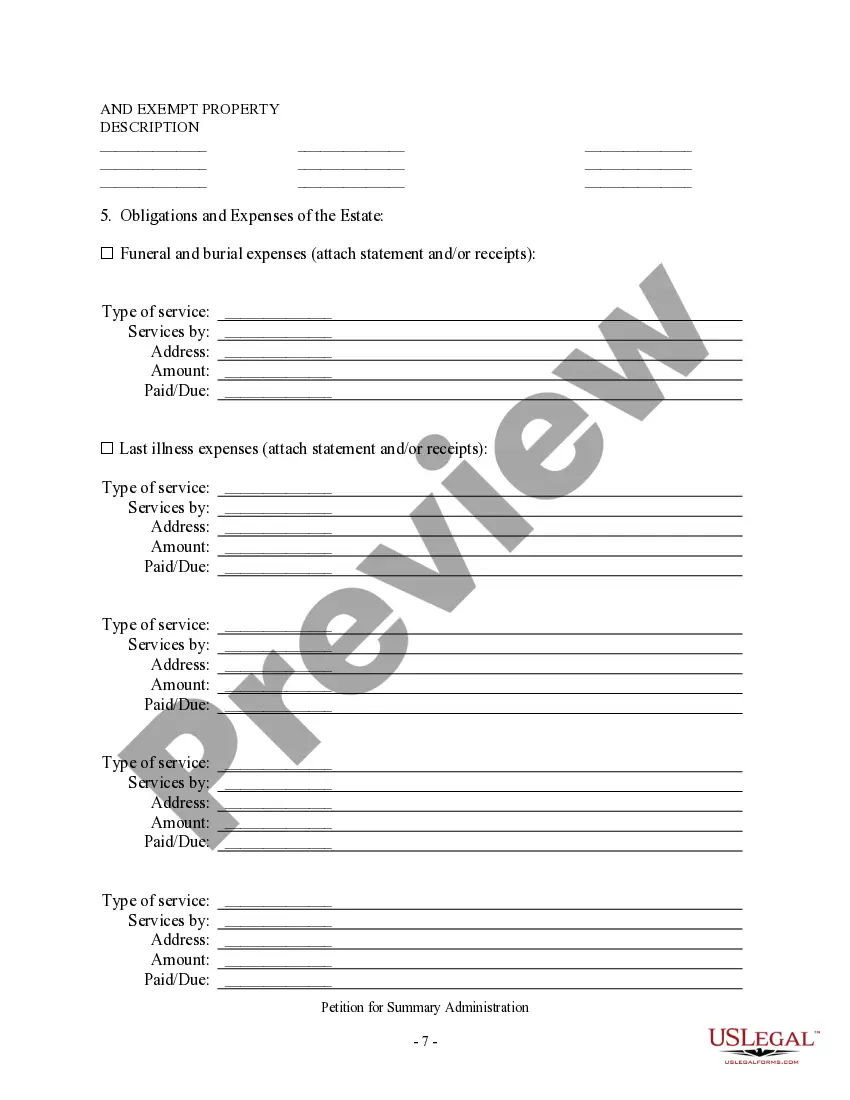

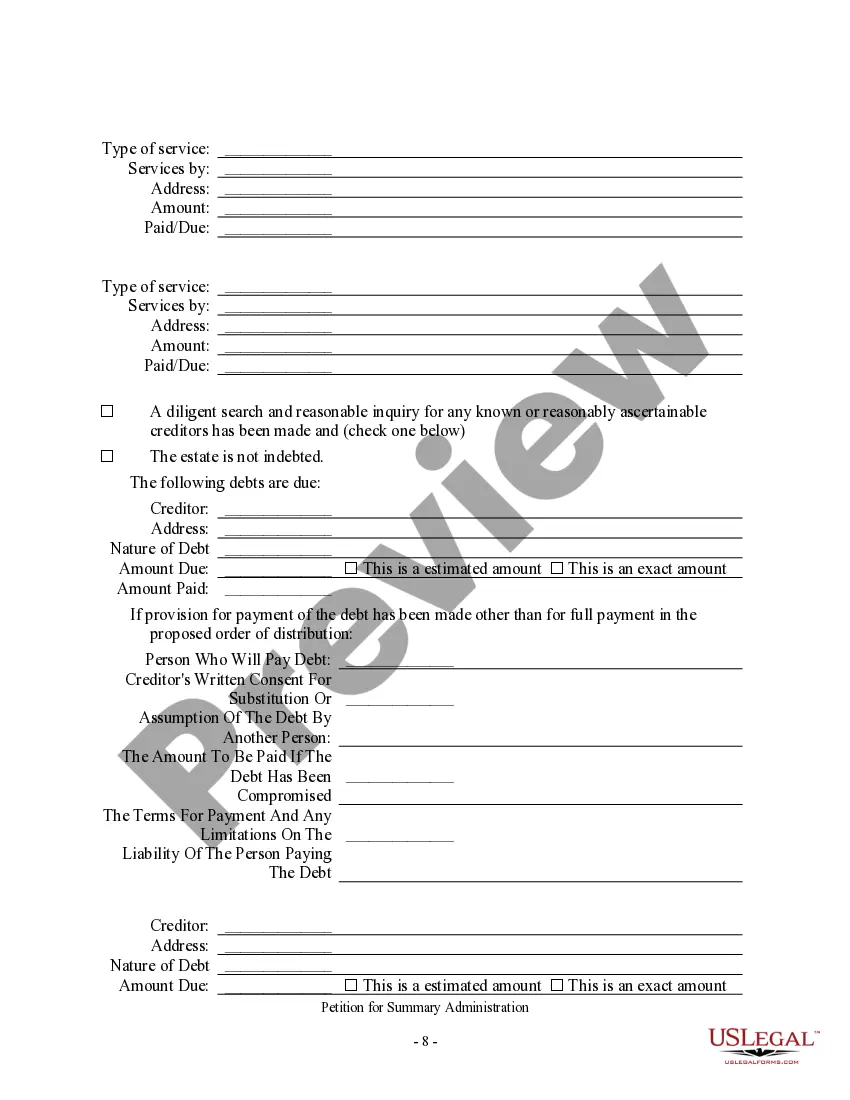

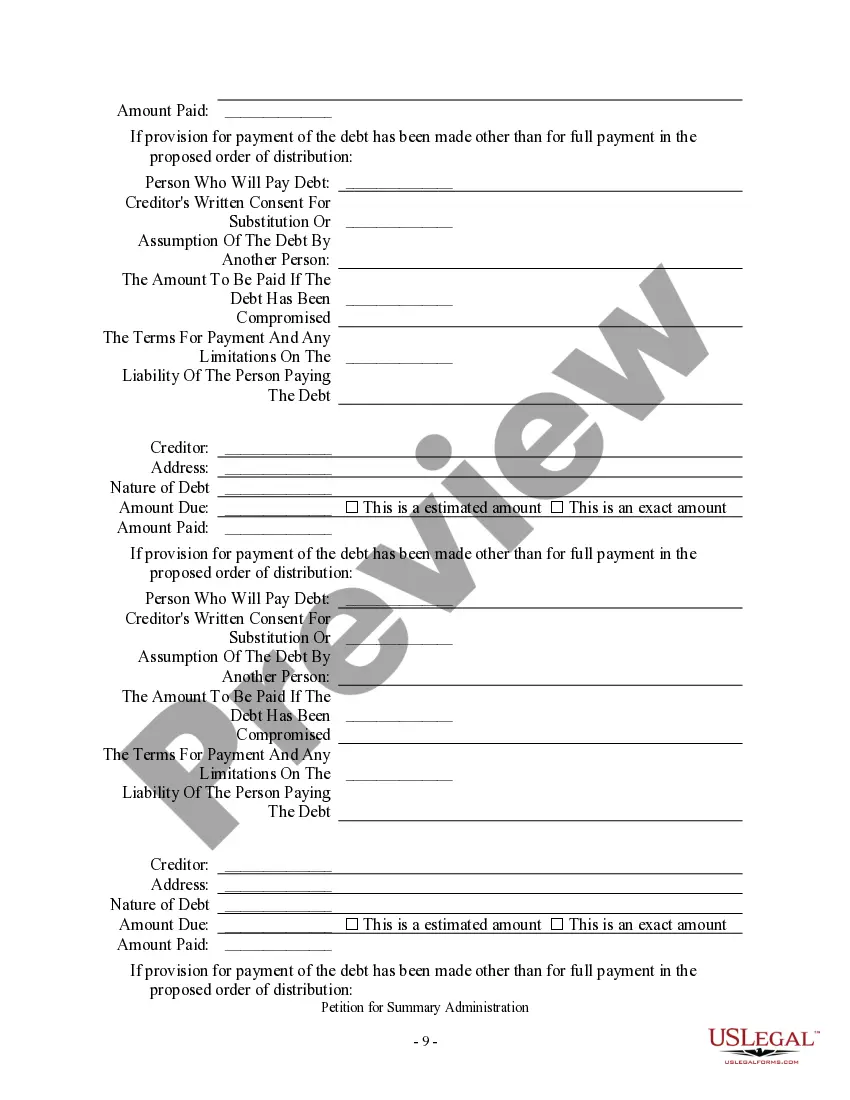

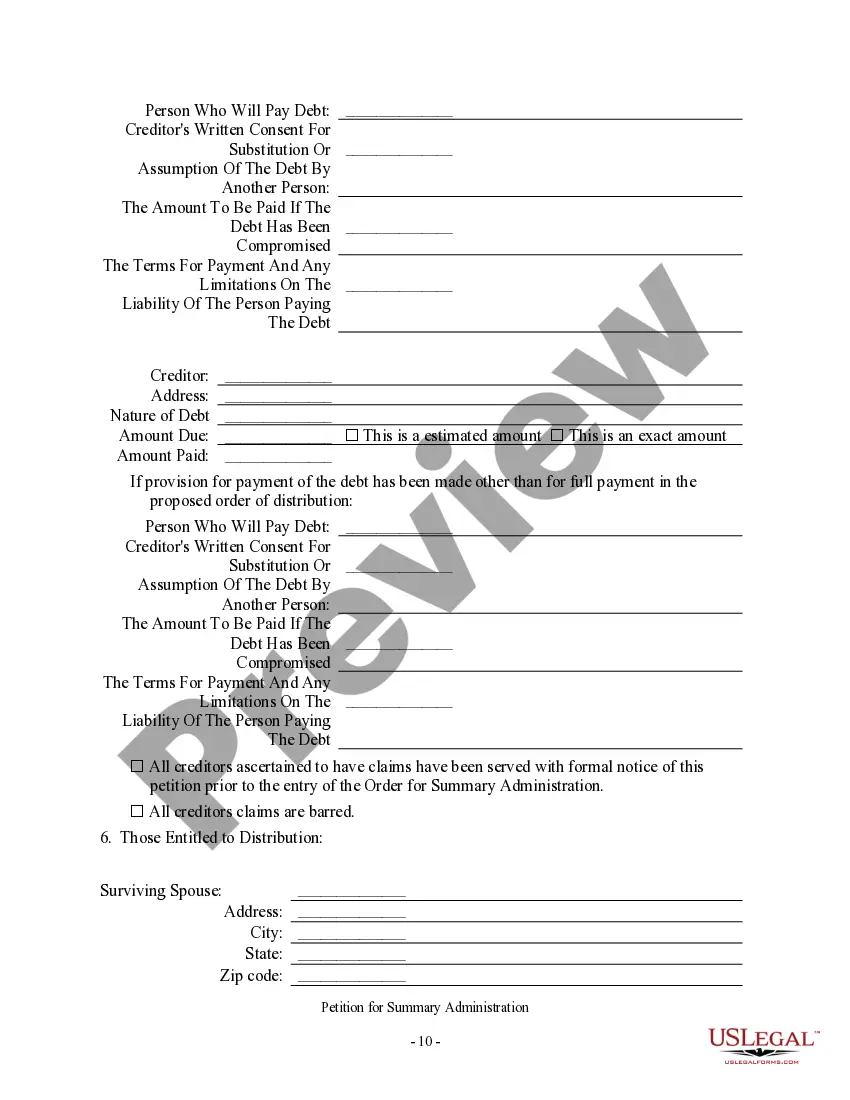

To get an order of summary administration in Florida, start by preparing a petition that fits the criteria for small estates under $75,000. This petition must be submitted to the probate court along with required documents, which generally include evidence of the assets and a death certificate. After filing, you will attend a court hearing where the judge will review your submission. Using the Florida Summary Administration Package - Small Estates - Under $75,000 can streamline this process by providing you with essential resources and guidance.

The duration of summary administration probate in Florida generally varies based on the specific details of the case. However, in most instances, it can be completed within a few months if there are no disputes among heirs or creditors. By leveraging the Florida Summary Administration Package - Small Estates - Under $75,000, you can ensure that you have all the necessary forms and instructions, potentially speeding up the process.

While it is not a legal requirement to have an attorney when filing a summary administration in Florida, having professional assistance can make the process smoother. An attorney can help you understand the necessary documents and ensure that your filing complies with all legal requirements. Moreover, using the Florida Summary Administration Package - Small Estates - Under $75,000 can provide you with templates and guidance, making it easier to proceed without legal representation if you choose.

To obtain an order for summary administration in Florida, you will need to file a petition with the probate court. This petition should include necessary documentation, such as the death certificate and an inventory of the estate's assets under $75,000. Once filed, you will then need to attend a court hearing where the judge will review your petition. Utilizing the Florida Summary Administration Package - Small Estates - Under $75,000 can simplify this process significantly.

Yes, a small estate affidavit must be filed with the appropriate court in Florida. This step verifies the eligibility of the estate for summary administration, particularly when the estate's value is under $75,000. Utilizing the Florida Summary Administration Package - Small Estates - Under $75,000 can help you understand the filing process and the documentation needed. This ensures compliance with local regulations and aids in the smooth transfer of assets.