Florida Living Trust for Husband and Wife with No Children

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

Obtain entry to the most extensive collection of sanctioned documents.

US Legal Forms serves as a platform to locate any state-specific paperwork in just a few clicks, including samples of the Florida Living Trust for Couples without Children.

There’s no need to squander hours in search of a court-recognized form. Our certified experts guarantee that you receive current samples consistently.

After choosing a pricing plan, establish your account. Pay via credit card or PayPal. Download the sample to your device by clicking Download. That’s it! You should file the Florida Living Trust for Husband and Wife without Children form and verify it. To confirm that all details are correct, consult your local legal advisor for assistance. Register and easily browse more than 85,000 useful forms.

- To utilize the forms library, choose a subscription and set up your account.

- If this has been completed, simply Log In and select Download.

- The sample of the Florida Living Trust for Husband and Wife without Children will be instantly saved in the My documents section (which includes all documents you store on US Legal Forms).

- To establish a new profile, adhere to the brief guidelines presented below.

- If you're required to use a state-specific sample, make sure to specify the correct state.

- If possible, examine the description to understand all of the details of the document.

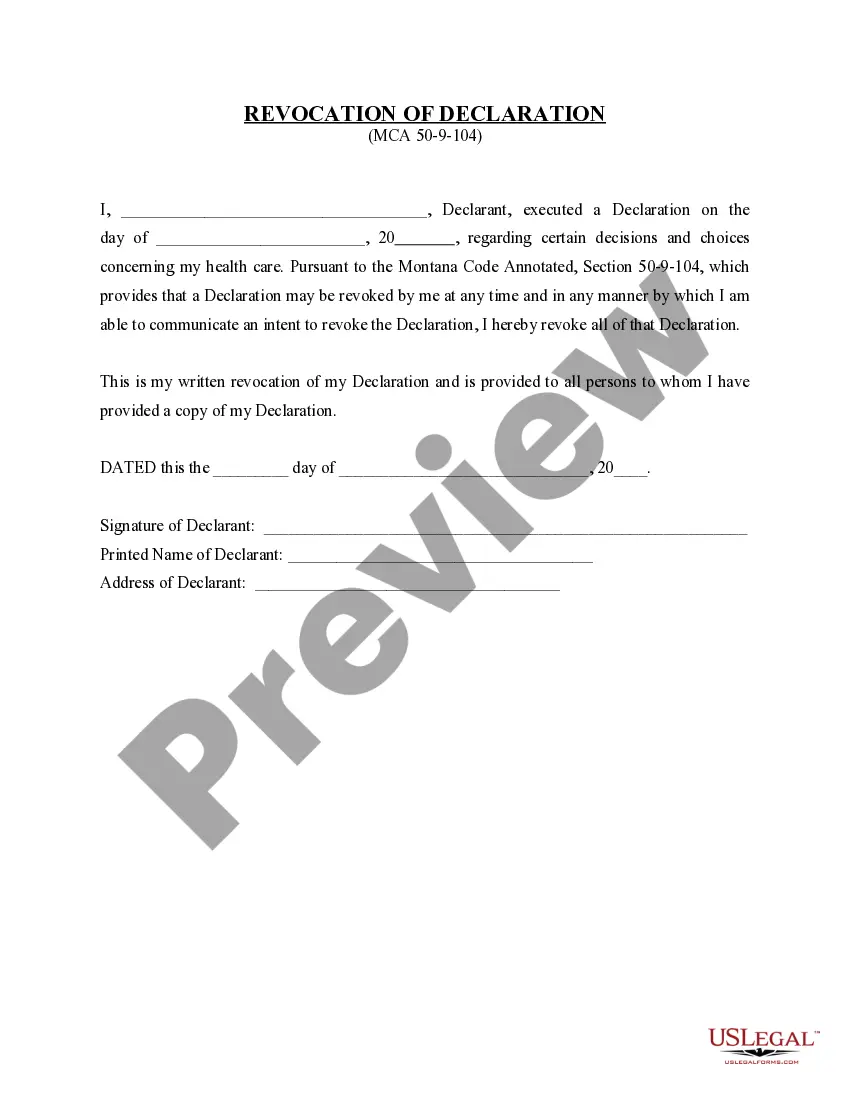

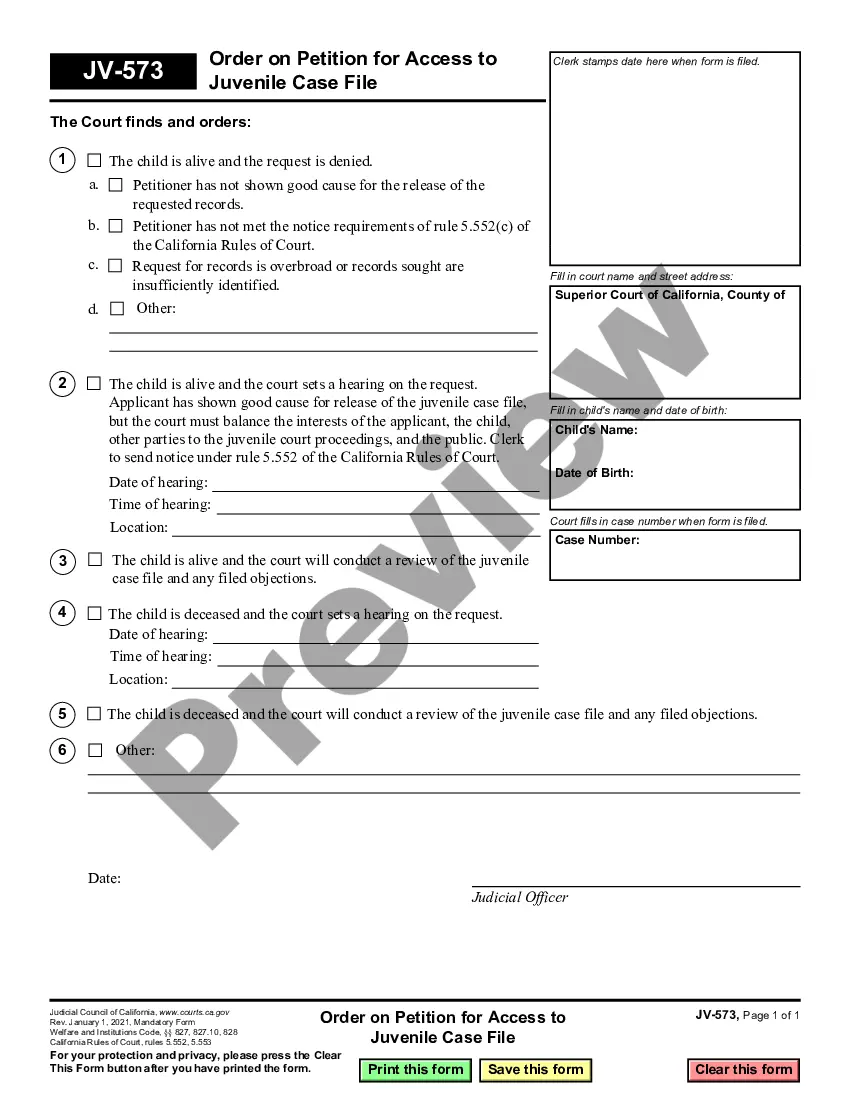

- Utilize the Preview feature if it’s accessible to review the document's contents.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

Many couples wonder if they should establish separate living trusts. A Florida Living Trust for Husband and Wife with No Children can simplify the estate planning process. By creating one joint trust, both partners can manage their assets together, and it can ease the distribution of property after one spouse passes away. Using a shared trust can often save time, reduce costs, and provide clarity in your estate planning.

While there are many advantages to using a Florida Living Trust for Husband and Wife with No Children, some disadvantages exist as well. For instance, transferring your house into a trust may incur fees and require additional paperwork. Furthermore, you may lose certain tax advantages depending on your situation. It’s vital to weigh these factors carefully and consult with a professional if you have concerns about the implications of putting your home in a trust.

Yes, you can write your own Florida Living Trust for Husband and Wife with No Children, but it is essential to follow the state's requirements for it to be valid. While many find this DIY approach appealing, legal assistance can ensure that your trust meets all necessary regulations and accurately reflects your intentions. Using a platform like US Legal Forms can simplify this process, guiding you through the complexities of trust creation. This way, you can avoid potential pitfalls and have a robust estate plan.

Yes, placing your home in a Florida Living Trust for Husband and Wife with No Children can be a wise choice. This action provides protection and simplifies the transfer of property upon death. Additionally, it can help manage assets if one partner becomes incapacitated. By placing your house within a trust, you ensure that your home remains secure and your wishes are honored.

Creating a Florida Living Trust for Husband and Wife with No Children can provide significant benefits. A trust allows couples to manage their assets and ensures that their wishes are followed upon their passing. It can simplify the estate planning process, avoid probate, and protect your assets for the future. With a trust, you gain peace of mind knowing your loved ones are cared for according to your intentions.

A notable downside to a living trust in Florida is the complexity it can introduce into your estate planning. While a Florida Living Trust for Husband and Wife with No Children can help manage your assets, it requires diligent management, including transferring assets into the trust. This ongoing responsibility can be burdensome if not handled properly, possibly leading to unintended consequences and added stress during times of grief.

One of the biggest mistakes parents make when establishing a trust fund, such as a Florida Living Trust for Husband and Wife with No Children, is failing to clearly define the purpose and terms of the trust. This can lead to confusion and disputes down the line. Additionally, neglecting to update the trust as circumstances change—like acquiring new assets—can also create complications. For those looking to set up a Florida Living Trust for Husband and Wife with No Children, utilizing platforms like US Legal Forms can simplify the process and help ensure all important details are covered.