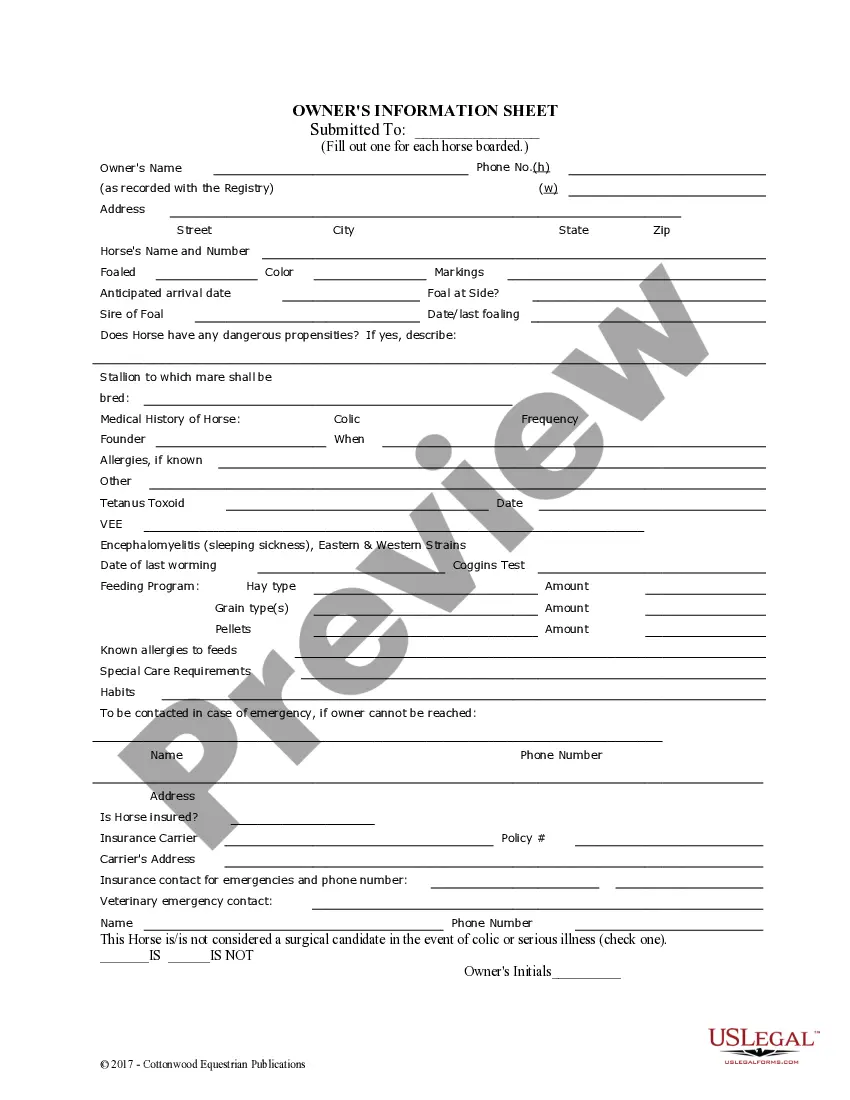

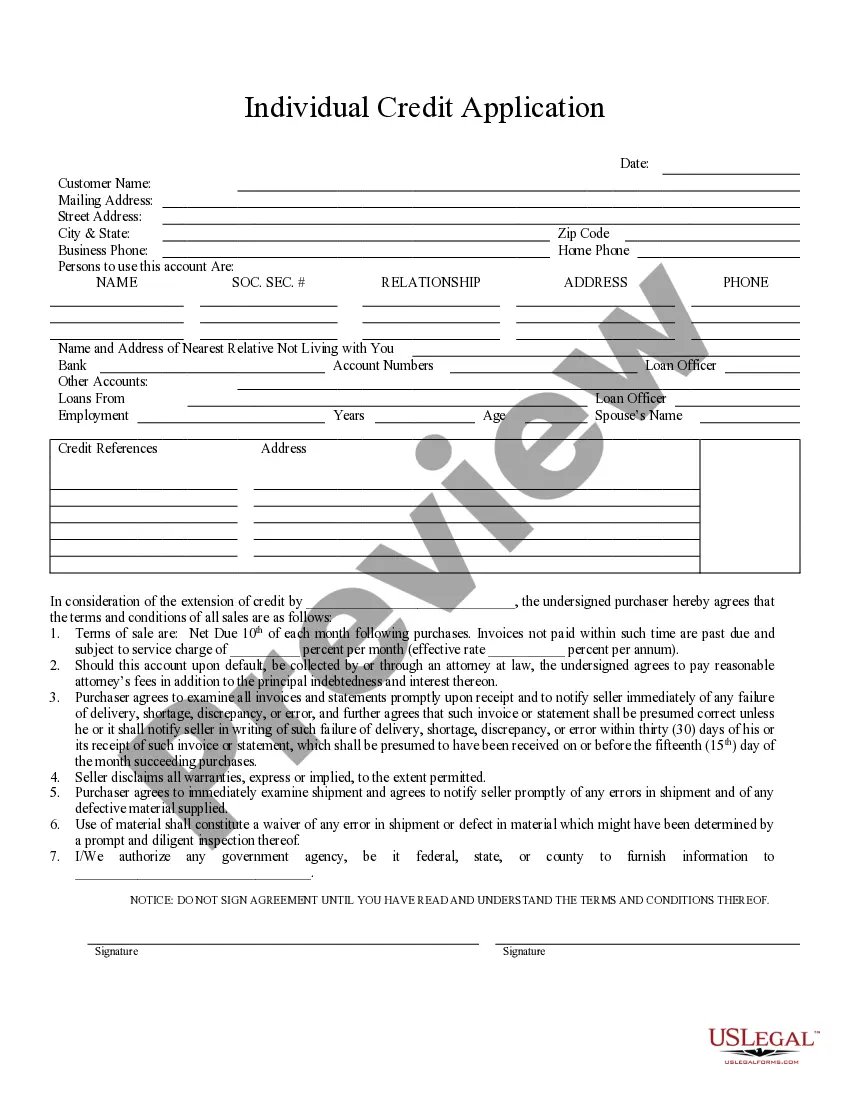

Florida Individual Credit Application

Description

How to fill out Florida Individual Credit Application?

Acquire the most extensive collection of legal documents.

US Legal Forms serves as a platform where you can locate any state-specific file in just a few clicks, including Florida Individual Credit Application templates.

There's no need to squander several hours attempting to find a court-acceptable example.

If everything looks right, click on the Buy Now button. After selecting a pricing plan, register an account. Make payment via credit card or PayPal. Download the document to your device by clicking Download. That's it! You should fill out the Florida Individual Credit Application template and verify it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and easily navigate over 85,000 valuable templates.

- To access the document library, select a subscription and create an account.

- If you have already set it up, simply Log In and hit the Download button.

- The Florida Individual Credit Application template will be automatically saved in the My documents section (a section for all forms you save on US Legal Forms).

- To establish a new account, adhere to the straightforward instructions outlined below.

- If you plan to use a state-specific document, ensure you specify the correct state.

- If possible, review the description to comprehend all the intricacies of the document.

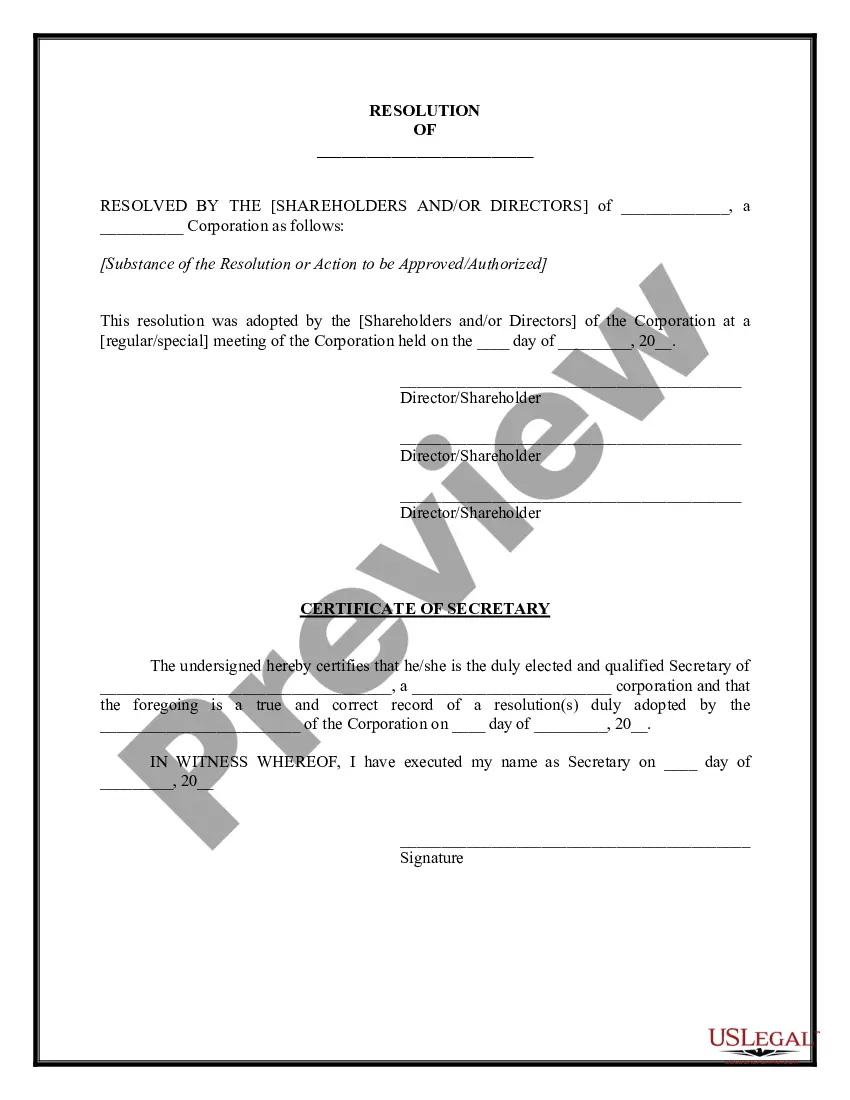

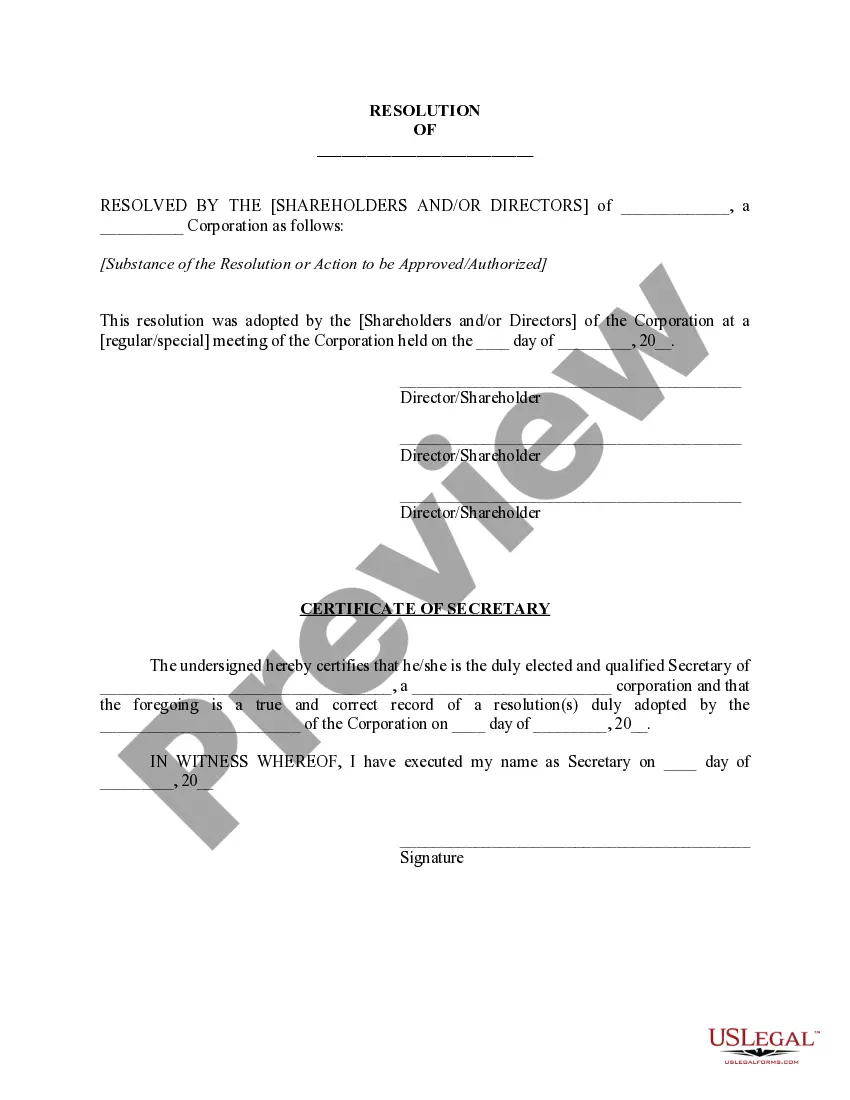

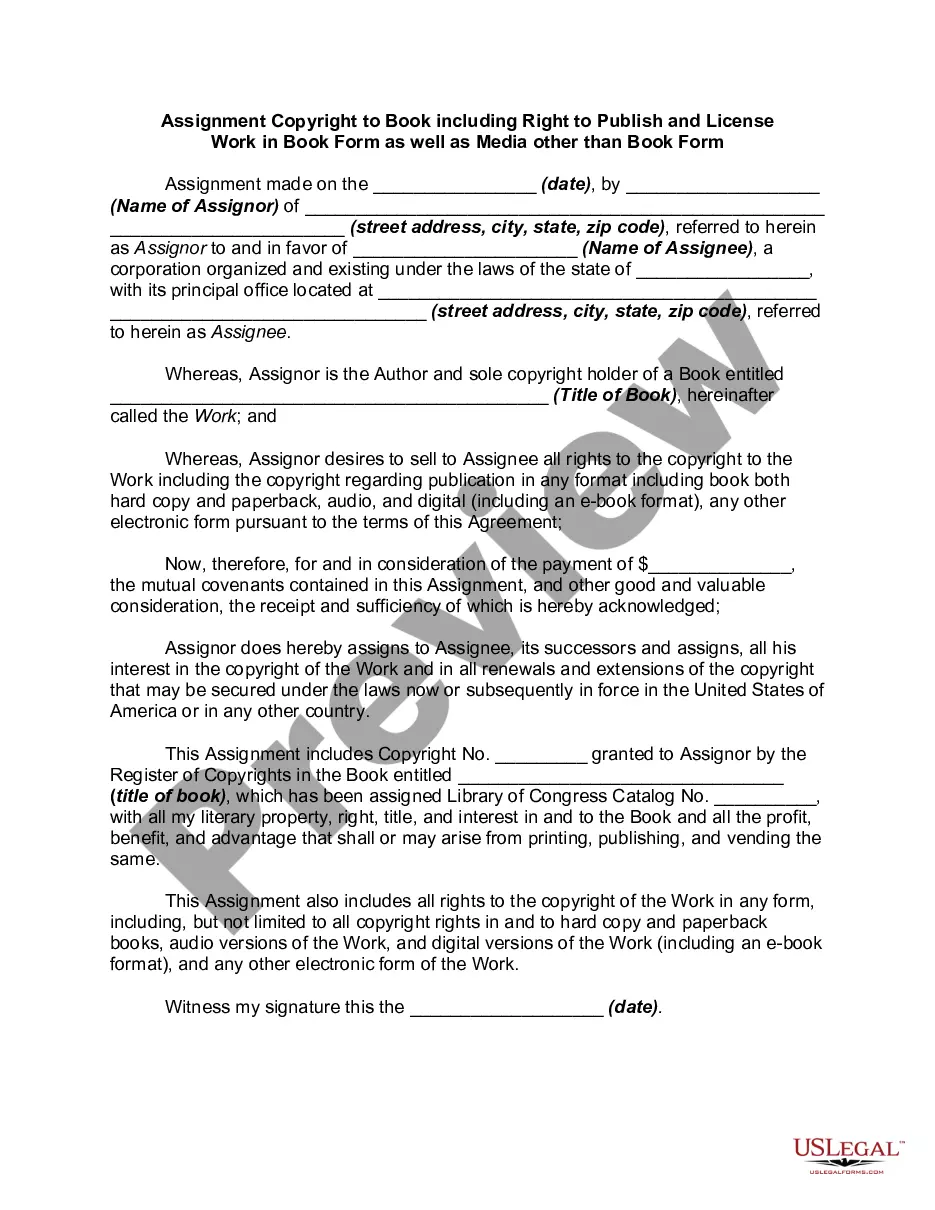

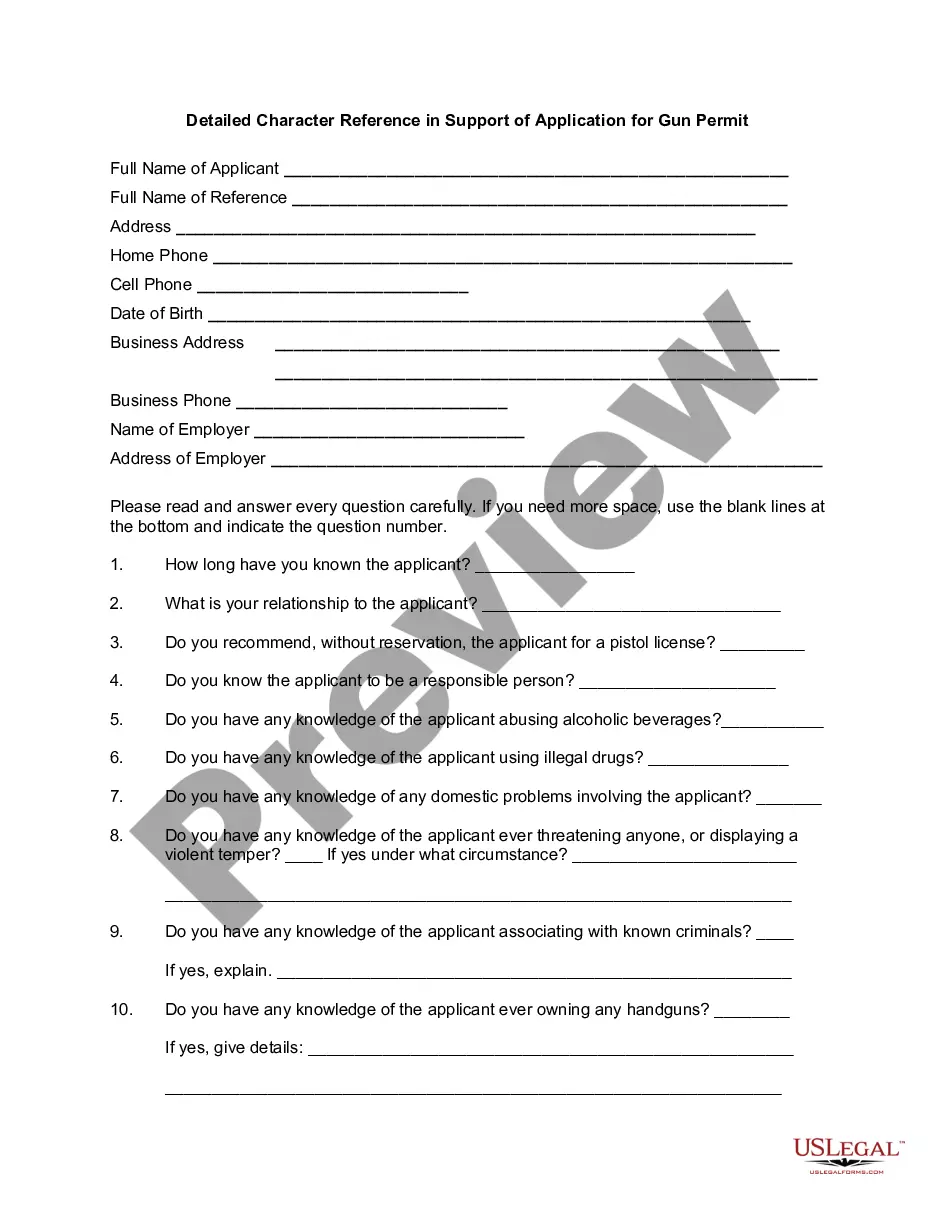

- Employ the Preview feature if it’s available to examine the document's content.

Form popularity

FAQ

In Florida, you do not have to file a state tax return because there is no state income tax. However, you might still need to file with the federal government based on your income level and types of earnings. Keep in mind that utilizing the Florida Individual Credit Application can help you take advantage of possible tax benefits at the state level.

Florida does not have a state income tax, which means there is no minimum income requirement for state tax filing. However, you still need to file a federal tax return if your income exceeds the federal thresholds. Make sure to review any credits you may be eligible for, such as those offered in the Florida Individual Credit Application, to maximize your tax benefits.

To calculate the collection allowance in Florida sales tax, you first determine your taxable sales. The collection allowance is a percentage of the taxable sales which you can deduct from the amount of sales tax you owe. This consideration is important when managing your business finances, and utilizing the correct figures is crucial. If you have further questions, the Florida Individual Credit Application may provide tax credits that complement your sales tax management.

To file your tax return in Florida, you typically start by gathering necessary documents such as W-2s, 1099s, and any other relevant income statements. Then, you can choose to file online using tax software like TurboTax or paper forms available on the Florida Department of Revenue website. Additionally, if you consider applying for the Florida Individual Credit Application, this may provide benefits that help reduce any tax liability.

The requirements for CLE in the Florida Bar include 30 total credits, with five dedicated to ethics and professionalism. Lawyers must submit their compliance using the Florida Individual Credit Application. Utilizing resources like USLegalForms can streamline the documentation process, ensuring you meet all obligations effectively.

To qualify for The Florida Bar, candidates must earn a Juris Doctor from an ABA-accredited law school. Additionally, they must pass the Florida Bar Exam and complete the required CLE credits. A strong grasp of the Florida Individual Credit Application will enhance your success in this process.

In Florida, lawyers are required to complete 30 CLE credits every three years. This includes a minimum of five credits in ethics, professionalism, or interpersonal skills. Planning your education and keeping track of your credits through the Florida Individual Credit Application can simplify your compliance.

Florida is a 50-minute CLE state. This means that one hour of Continuing Legal Education generally equates to 50 minutes of actual instruction time. It is important to keep this in mind while planning your courses to ensure compliance with the Florida Individual Credit Application requirements.

To submit CLE credits in Florida, attorneys must log into the Florida Bar's website and use their online system for reporting education hours. Ensure you keep records of your courses attended and the certificates of completion. Utilizing a Florida Individual Credit Application makes tracking and submitting your credits more manageable, helping you meet your compliance requirements.

Filling out a credit card form involves providing your personal information, such as your Social Security number, income, and address. It’s vital to review the terms and conditions before signing to ensure you understand the agreement. Many people find a Florida Individual Credit Application helpful for gathering necessary details when applying for credit cards.