Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC

Description

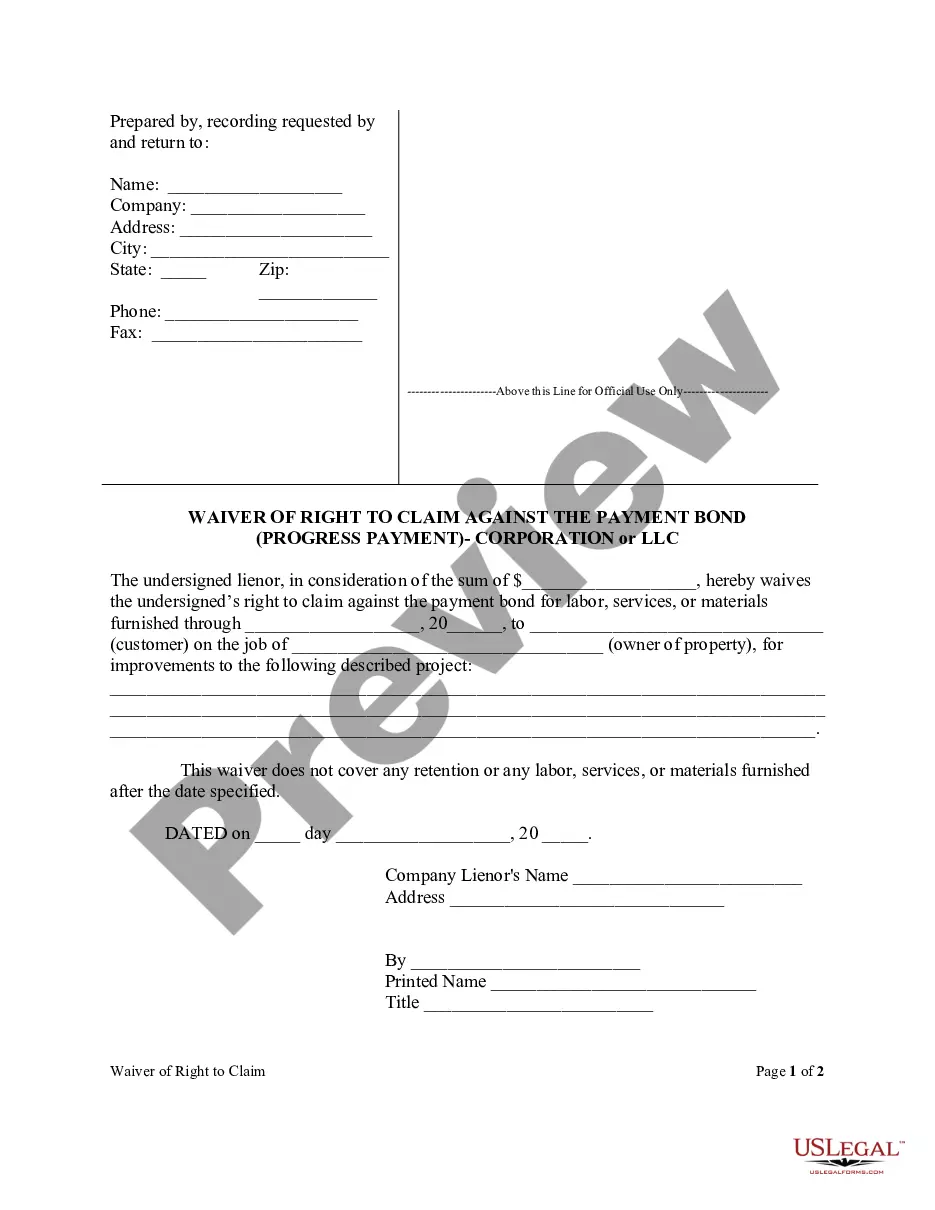

How to fill out Florida Waiver Of Right To Claim Against The Payment Bond (Progress Payment) - Corporation Or LLC?

The larger the quantity of documents you need to prepare - the more anxious you feel.

You can discover countless Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC templates online, but you're unsure which ones to rely on.

Eliminate the inconvenience of identifying examples with US Legal Forms.

Proceed by clicking Buy Now to initiate the registration process and select a pricing plan that suits your needs. Enter the required information to create your account and pay for the order using PayPal or a credit card. Choose a suitable file format and download your copy. Access each sample you receive in the My documents section. Simply navigate there to create a new version of your Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Even when using professionally prepared forms, it remains crucial to consider consulting a local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- Receive professionally crafted documents that meet state requirements.

- If you already have a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the page for the Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC.

- If you have not utilized our website before, complete the registration process with these steps.

- Ensure that the Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC is valid in your state.

- Verify your choice by reviewing the description or using the Preview option if available for the chosen file.

Form popularity

FAQ

To file a bond claim in Florida, start by gathering necessary documents such as your contract, invoices, and any correspondence related to the bond. Next, draft a formal notice of claim that outlines the specifics of your claim against the bond. It's crucial to ensure your claim is submitted within the statutory time limits to maintain validity. You may also want to consider using platforms like US Legal Forms to access templates and guidance tailored for the Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC.

In Florida, a lien waiver qualifies typically when the contractor or subcontractor receives a payment for the work done or materials provided. To be effective, the waiver must clearly express the intent to relinquish rights to claim against the payment bond for that progress payment. For accurate guidance and templates, US Legal Forms can serve as your go-to resource.

While lien waivers do not typically require notarization, certain parties may prefer notarized documents for extra security. It is always wise to check any specific project requirements to determine if notarization is necessary. Using US Legal Forms can clarify these details and help you prepare the appropriate documents.

In Florida, lien waivers do not need to be notarized to be legally binding unless specific conditions or project requirements state otherwise. However, having a notarized document can offer additional legal protection. To ensure compliance and understand your obligations better, consider using US Legal Forms to access ready-to-use templates.

To file a bond claim in Florida, gather relevant information such as the bond number, contract details, and the nature of your claim. Submit a formal claim to the bond company outlining your rights and the reasons you believe you deserve compensation. Engaging with US Legal Forms can provide you with necessary resources to navigate the filing process effectively.

Filling out a conditional waiver and release on progress payment requires you to specify the payment amount and the conditions under which the waiver is valid. Essentially, this waiver acknowledges that you will relinquish your right to claim against the payment bond once you receive the stated payment. US Legal Forms provides several tools to assist you in properly drafting this document.

To fill out a waiver of lien in Florida, you need to provide essential details such as the property owner's name, job address, and the amount of payment received. Ensure you clearly state that you are waiving your right to claim against the payment bond for the specified progress payment. Utilizing platforms like US Legal Forms can help you find the correct templates and guides to simplify this process.

A lien waiver indicates that a contractor or supplier agrees to give up their right to file a lien, typically after receiving a payment, while a lien release formally cancels an existing lien on the property. Understanding this distinction is important because a lien waiver is proactive, preventing future claims, while a lien release rectifies a situation where a lien has already been filed. To navigate these processes seamlessly, resources like USLegalForms can provide critical assistance and templates tailored for the Florida legal landscape.

The purpose of a final lien waiver is to provide a clear and definitive statement that a contractor or supplier has been fully compensated for their work on a project. By eliminating any potential for claims against the payment bond, it protects property owners and assures that all parties involved understand the financial closure of the project. Implementing this process efficiently can prevent disputes and foster trust in contractual relationships.

A waiver and release of liability in Florida allows one party to relinquish their right to pursue legal claims against another party, usually in situations involving potential risk. This document is crucial in circumstances where parties need to protect themselves from potential lawsuits resulting from accidents or negligence claims. Incorporating a Florida waiver of right to claim against the payment bond (progress payment) - corporation or LLC can further clarify terms in a contractual agreement, enhancing legal safety.